The Finance Bill 2023 was passed in the Parliament in the last week of March. It had some new tax provision changes, sneaked in the last minute. Debt Funds and REITs got a further tax burden with additional tax compliance. Benjamin Franklin has been known to say, “there are only 2 certainties in life – […]

[FAQs] Taxation on Debt Funds from April 2023

In the Finance Bill 2023, a new provision was sneaked in which impacts taxation on debt funds. It takes away one of the selling points of these funds against Bank FDs – long term capital gains tax along with indexation benefits. This has led to a flutter in the minds of investors and several questions […]

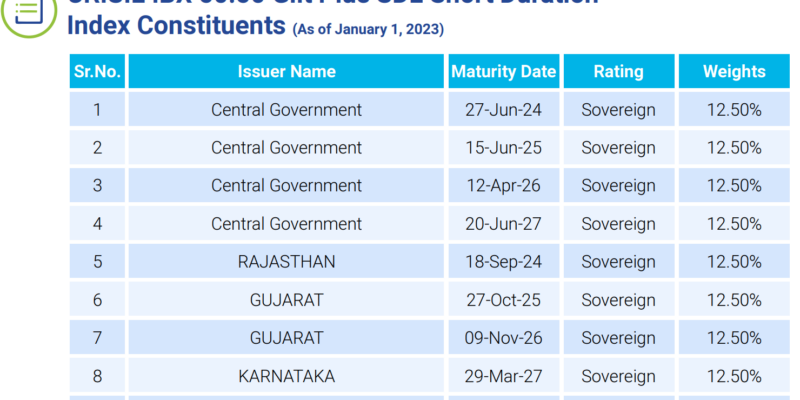

NFO: Edelweiss Short Duration Index Fund

Well, the actual name is Edelweiss CIBIL IBX 50:50 Gilt Plus SDL Short Duration Index Fund. That’s a pretty big name for a short duration fund. And it promises to offer a lot. Beyond the marketing buzz, let’s find out what the fund has to really offer. The fund is categorised “Short Duration Fund” under […]

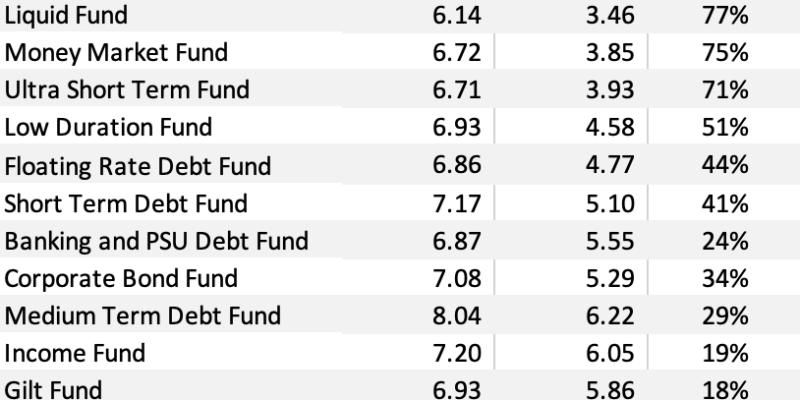

How have debt fund yields changed over the past year

As interest rates change, there is an impact on the yield too. Here’s a comparison of how debt fund yields have changed over the past year. The yield at the lower end of the duration (Liquid, Ultra Short, Low Duration) is quite attractive now. Overall, there might still be some way up for the debt […]

The FMP mess – Should you invest in a Fixed Maturity Plan?

If you have come across an FMP sales pitch, it almost always is that “it is as safe as a Bank FD”, yet, “it will give higher returns than an FD.” An easy lure for most investors since ‘safe returns’ is a primary criteria. You don’t like that FMP word any more. Do you? In […]

Should you be adventurous with bonds or debt funds? – Insights for 2019 with Arvind Chari

The year 2018 was one year when investors had a rude realisation that debt funds are not always safe and linear as they are made out to be. The IL&FS default, NBFC issues, oil prices, inflation contributed to a fairly volatile scenario for bonds. Investors now wonder, what is in store for 2019? Will things […]