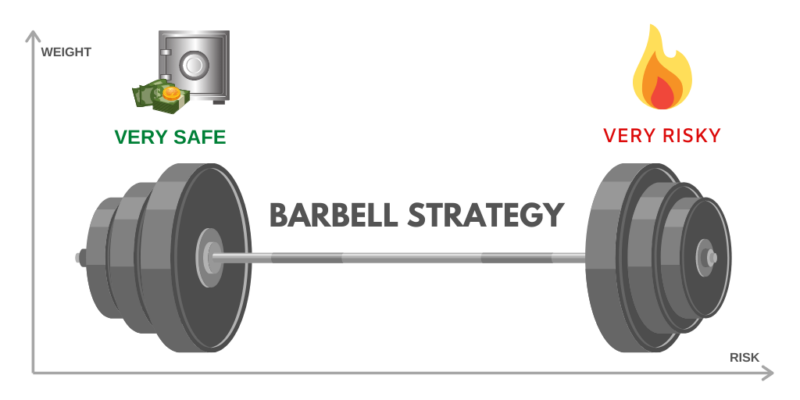

A barbell portfolio has 2 simple components. Absolutely no risk with one part of the portfolio. All the risk is taken with the other part. Typically, a barbell portfolio’s safe part is in govt securities, bonds or Bank Fixed Deposits, anything that has no default risk. The other part is exposed to a risk that […]

Budget 2021: How EPF, VPF & ULIPs will be taxable?

So, the once in a century budget is out. If you have been in touch and wondering what is ‘once in a century’ about it, let me share with you the popular humour. There were no new taxes! Ah! Perhaps, that is a little stretched. It may be true for a large section of the […]

2020: How much returns to expect from Mutual Funds?

As an investor, you choose mutual funds to earn a higher return than your other traditional investments. You expectation is based on the past returns of these funds and you hope to get the same result for yourself. Is that the right way to go about it? Let’s try and use a data based approach to […]

Retirement Planning – Who cares?

We are living in an age where very few of us want to think about retirement leave alone retirement planning. This is an age where jobs are not fixed or assured and you are likely to change jobs multiple times. In fact sometimes we change careers wholesale. I know of a software engineer who now runs an adventure travel […]

The Power of Search

We live in the Google world, our default go-to-platform for any question on our mind. As you make that search, more often than not you end up finding the necessary fact or information right on the first page. It almost feels like magic. Entire information of the world at your fingertips. I bet that is […]

5 Tax Changes in FY 2020-21 you should know

April 1, 2020 marked the onset of a new financial year. It also brought into action the new tax changes as proposed in the Budget 2020. Let’s look at the 5 key changes that you need to be aware of as well as plan for. #1 Are you salaried? Time to make your tax slab […]