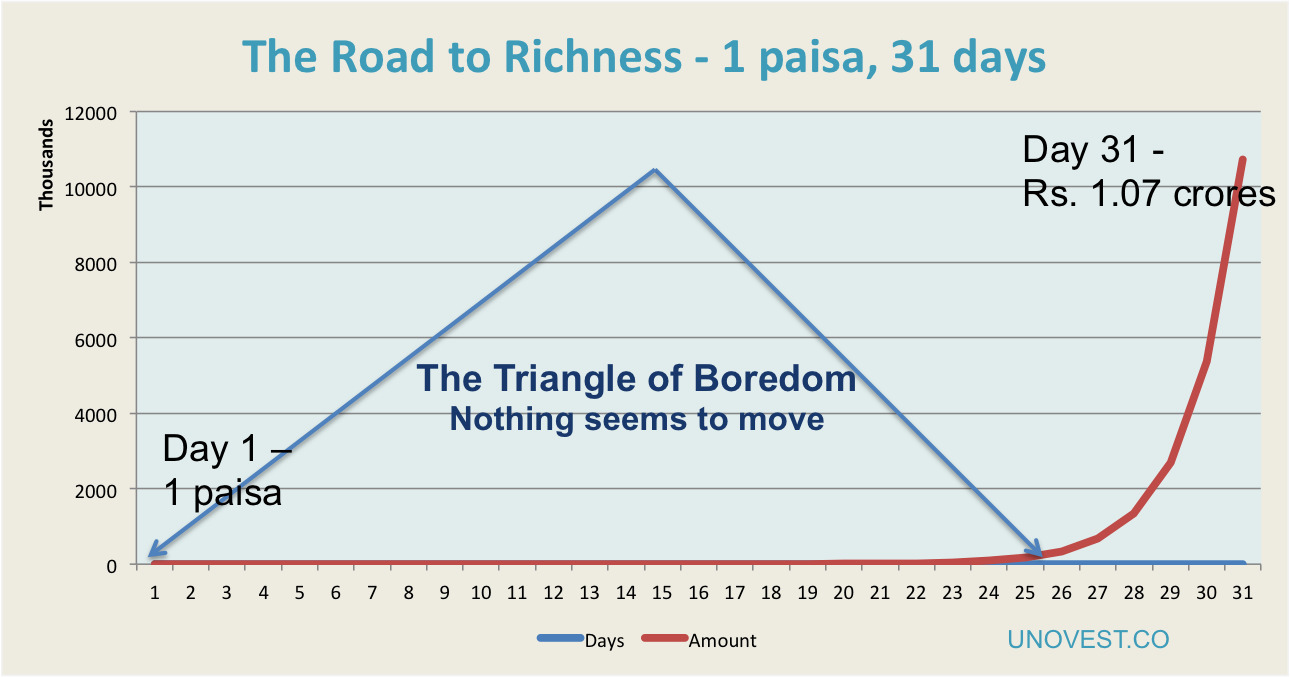

What do you think it takes to getting rich? Lottery! What do you think it takes to getting rich in 31 days? Convinced – It can only be the Lottery! No, not really. You need something better. Here’s a challenge for you. We give you 1 paisa, yes just 1 paisa. If you double the money every day for […]

- « Go to Previous Page

- Page 1

- Interim pages omitted …

- Page 32

- Page 33

- Page 34