The Budget 2020 proposed a new tax slab system, which it deems to be easier, convenient and helpful to a majority of the tax filing population. As I chewed upon the notes, I realised that the new tax slabs can actually make a lot of sense to a certain section of the tax paying population.

The retirees, an individual just starting off and needs more disposable income or for that matter anyone who wants to exit the maze of deductions and keeping it simple can make use of the new tax slabs.

To find out if it really does make sense, I have created a simple tax calculator. All you have to do is enter in your actual income numbers and then see the difference for yourself.

If you don’t have MS Excel, you can open the file directly in Google Sheets as well.

Let’s find out how does the calculator help you with an example.

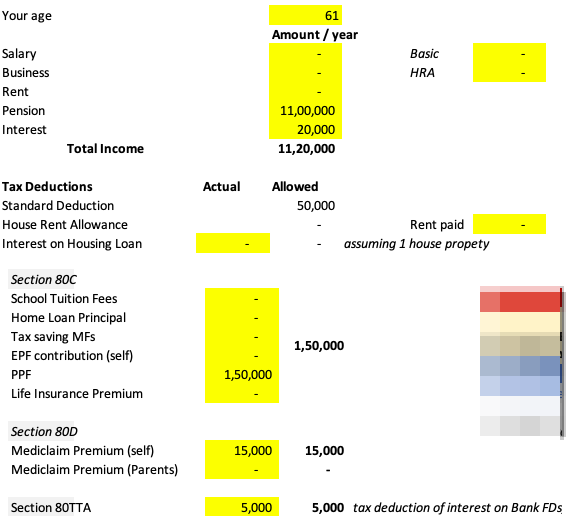

Case 1 – Tax Slabs for a just retired individual

A just retired individual who is receiving pension and some interest income. He lives in his own house and has no need for further investments.

Here’s how the numbers stack up.

So, what is the likely difference in tax for this retired individual? Rs. 6,500 extra tax if he chooses the new tax slabs.

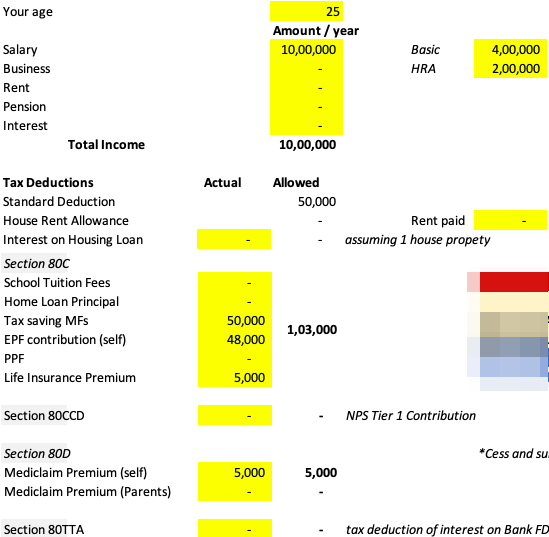

Case 2 – A young individual’s confusion about tax slabs

What about a young 25 year old, who is just getting started on a salary and is looking for more disposable income. She lives with her parents and hence no rent is paid.

This is how the numbers look like.

So, which tax slab works for this young one? There is a difference of almost Rs. 6,000, that is, with the new tax slab the tax liability goes down by Rs. 6,000.

Great, isn’t it! Not to mention the zero hassle of not having to track any tax deductions.

New Tax slabs are for everyone not using tax deductions

As you can see, the big weightage in the choice of old vs new tax slab is on you using various tax deductions available under the Income Tax Act. If you are not claiming most of them, for any reason, you are better off with the new tax slabs.

Anyways, the best way is to find out for yourself. So, download the file below and run the numbers for yourself.

If you don’t have MS Excel, you can open the file directly in Google Sheets as well.

Between you and me: Are you planning to shift to the new tax slabs? What is your reasoning to stay or to shift? Do share in the comments.

Vipin,

A young earner living with her parents in their house can also claim HRA tax benefit as paying rent to her parents. Now please do not say it is very complex. If someone is paid 10L a year,they are good enough to claim HRA benefit.

As for senior citizen, I will be over the moon if some insurance company offers medical insurance for just 15000 premium at that age for a reasonable sum assured.

We all have to laud the amount of effort and hardwork the FM has put to come up with this new regime to benefit certain group of taxpayers which can only be identified by some complex algorithm running on a supercomputer.

Let us not try to solve this trivia, its beyond human capabilities.

Pradeep, I understand your point.

But like it or not, as pragmatists, we have what we have and got to work with it.

The examples taken in the notes are real. The young chap has parents in the 30% tax bracket so no point doing that rental merry go round.

Good on her, parents in 30% slab she is not exactly struggling for her next meal, is she?

A smart brain in her should be telling her to invest her surplus into PPF, VPF, ELSS, etc for her future and claim tax deductions fully.

Someone with 70k for herself to spend every month, what difference will an additional 500 Rs in her hands will make?

Is this govt trying stimulate consumption by putting 500 more Rupees into the hands of someone who has 70k in her hands?

I am wondering whether to laugh or cry

Can the calculator also incorporate NPS employer contribution as well?

You may add it to one of the deductions items in the sheet, subject to maximum applicable as per new rules. (Employer contribution max of 7.5 lakhs in a finanail year for EPF, NPS, Superannuation combined). Thanks

good article