Protection is an important aspect of every financial plan. This happened primarily via insurance products including term, health, accident & disability, etc. The one aspect that needs to be touched upon is the Health Insurance.

Now, I thought investing in mutual funds was a huge problem for you and me. Turns out I was so wrong. Buying Health Insurance is a much bigger pain. I don’t know which planet did the creators of health insurance products come from but they have succeeded in scaring the hell out of us.

When the plans are presented to common janta like you and me, all I can feel is my head spinning.

Room rent capping, disease wise sub limits, waiting period for specific diseases and pre-existing diseases, co-payments, domiciliary hospitalisation, organ donor, emergency ambulance, renewals, no-claim bonus, refills, super top ups, top ups, vaccination, ….(stop for breathing…), how many things one needs to look at before deciding what makes sense?

I agree that there is a ton of useful material out there that already details what you should look for in buying health insurance. Even after going through those super helpful guides the evaluation of health insurance plans is simply no fun.

Anyways, after much dilly dallying, I decided to first take the bull by the horns in early 2017. I am now presenting the updated list.

What was I looking for when buying health insurance?

I already hold a family floater policy (covers 2 of us) with a sum insured of Rs. 5 lakhs from a PSU. The policy has been in force since 2007. But it has several limitations with respect to what you can do with it and how you can use it.

I am now looking for a health insurance policy that would give me similar cover without binding me with unnecessary terms and conditions of sub-limits, room rent capping, co-payment, etc.

One may not be able to escape all the jargon and the Terms & Conditions, but the fewer they can be, the better it is.

I had to look at various companies and their offerings. I got in touch with a few of them. The people I spoke to, I must admit, were good. I was more informed after my conversations.

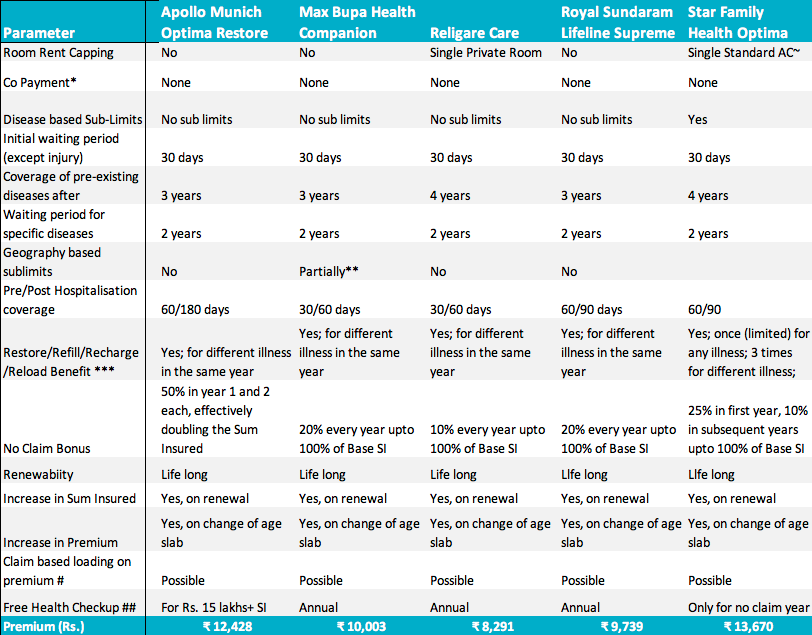

I used all the chats and the literature I read to prepare a comparison of 5 of those plans. In the table below, you can see their comparison against some critical parameters.

Buying Health Insurance – Comparison of 5 plans

The parameters are applicable for Rs. 5 lakh floater policy for 2 people of age – 38 years. You can go for a higher cover too, but this in my opinion, is the minimum you should have.

*In Religare and Star, if you take a policy after 61 years of age, 20% co-payment is applicable.

**In Max, 20% co-payment has to be made by Zone 2 customers (basically those living in non metro cities). You get a 10% discount on premium for this.

***Restore is for Apollo, Refill is for Max, Auto Recharge is for Religare, Reload is for Royal Sundaram – functionally all are almost the same. Except for Apollo, the Restore option gets triggered only after the Sum Insured and the Bonus is exhausted.

#The insurance companies say that there is claim based loading of premium, that is, if you make a claim or develope a disease, the company may not increase premium for that reason. But the policy terms and conditions clearly specify that they could do risk based loading and the user has the choice to continue or not.

~In case of Star, the single standard room is available only for covers of Rs. 5 lakhs and above

In case of Royal Sundaram, 15% discount on premium is available for customers in Zone 2 (as defined by the company).

Note: The premium would change for change in sum insured, no. of people covered, age of the insured, other benefits sought, etc.

Here are some pointers to make sense of the table:

- All the policies have practically no capping or sub limits on room rents or specific diseases. This removes the biggest hassle. I need not look at the hospital’s menu card every time and decide what I want to have or not. When it comes to medical attention, I want no compromises. None at all.

- There is no co-payment required to be done ever. My claim would be fully reimbursed. Only in Max’s case, it you are not from a zone that they have specified, there could be a 20% co-payment.

- One of the most important features of all the 3 policies is the Restore/Refill/Recharge. What it means is that if I exhaust my Sum Insured in any year in a claim, the insurance company will restore/refill/recharge the policy for the full Sum Insured again. But it cannot be claimed for the same illness by the same person again in the same year. It can only be used for a new illness or by the other insured person.

- The No Claim Bonus is earned at the end of a year if you have not made any claims on the policy. It is very attractive in the case of Apollo. In case of Religare, they have an option of Super No Claim Bonus which can take your cover higher by 150% over 5 years. This comes at a slightly higher premium. Royal Sundaram in its Lifeline Supreme option offers 20% NCB every year (till 100% of Sum Insured).

- Renewability is assured life-long by law. So, that is not the concern.

- You can port your existing policy to any of these insurance plans and also carry forward any benefits that you have accrued so far. Porting can happen only before 45 days of the next premium due date.

- The biggest difference is in the premium, with Star coming across as the most expensive and Religare the cheapest. However, if you are from Zone 2 as defined by Royal Sundaram you get a 15% discount on the premium which could make it close to Religare’s. .

- As you can see I have not included coverage of network hospitals in the comparison. Most policies have a wide network of hospitals. In this case all the 3 claimed to have over 4000 hospitals, pan India, in their network. However, it would be great if you could find out which hospitals closer to your area are part of the company’s network. They are what you will likely use the most.

- There are other parameters like organ donation, emergency ambulance, vaccination against animal bites, etc. but again I would not consider them critical inputs to make a selection for buying health insurance.

So, which policy should you go for?

Given all the features and differences, I tend to gravitate towards the Royal Sundaram Lifeline Supreme Option. It fulfils almost all the criteria I am looking for with a reasonable premium.

By the way, which of the above 5 policies works for you the most?

Do share your feedback and inputs including your experience with the insurance claims process.

Here are web links on the 5 health insurance plans compared above. Click for more information.

- Apollo Munich Optima Restore

- Max Bupa Health Companion

- Religare Care

- Royal Sundaram Lifeline Supreme

- Star Family Health Optima

Disclaimer: The above comparison is done for study and analysis purposes. This is not to be taken as a recommendation. Consult your advisor and communicate your specific needs and then select a policy best suited to such needs. The author is not registered with IRDA or any insurance company.

Dear Vipin

We had opted for ICICI Lombard complete health insurance, I would really like for it to be included in your analysis and then see the the results

We had a hospitalisation last year in our family and I am happy to say that the whole process worked out quite painless for us and no issues at all. I had ported into ICICI just last year and it was simply good for us

Before I receive any feedback on the above, let me clarify I am not affiliated with any insurance company in any form

Good to know your experience Varun. I am sure readers will consider this plan too.

In my (heavy) research before buying 2 years back, ICICI Lombard (which is the number 1 private player) came out on top followed by Royal Sundaram. I’m now on Royal Sundaram Supreme because ICICI underwriting rejected my application on a minor concern.

Royal Sundaram is good at lower ages but their premium increases substantially more as you grow older compared to other players. I plan to port, if allowed, some years down the line (am 35 now) to ICICI. Royal Sundaram otherwise matches ICICI on most parameters except premium (current and future), claim %age and reach (they use a TPA, not in-house processing, a major difference).

Highly recommend to include ICICI in your research for the benefit of all.

Hello Vijay, good to note your feedback and experience. I am more keen on reliability and timely claims payment than the premium (of course shouldn’t be too off).

Sir,How is HDFC ERGO health insurance?Kindly suggest.

It might be okay but not at par with the ones compared.

Hi Vipin,

Thanks for the comparison. I have a family floater Lifeline Classic policy from Royal Sundaram. Please do let us know the difference between classic and supreme plans. My health policy renewal is due in November, should i renew it or look for a better option?

The difference is that of Sum Assured. 5 lakh + policies become Supreme. Supreme also has lower waiting period for coverage of Pre Existing Diseases and certain other medical conditions. You should definitely look for an adequate cover for yourself and family.

Why you didn’t have the claim percentage as on of the data for decision?

Is there a significant difference to make it a decision point? Any good business will focus on improving it, in may view.

I have a couple of questions –

1) I currently have insurance provided by my employer (say 5 Lakh), in case of hospitalization, can I share the bills between the two?

2) I have also heard about top up plans with much cheaper premium (eg, above 7Lakh to 25Lakh) etc. Do you have any similar comparisons, and does it make sense to have a normal plan and a top up plan.

i was covered by new india assurance for last couple of yrs however last yr since my agent recommendation I moved to Star because of various benefits since cost of premium was working out almost same with 500 rs difference.

However we had a recent admission of family relative and was shocked for various deduction by star health, absolutely bad and pathetic

Would recommend to go with govt companies than these private.

They may cost less now and more attractive with features however eventually once a customer base it built they will be no less to spare with higher premiums and less benefits.

Dear All,

I had ICICI lombard health insurance initially

but ported to STAR health after they increased the premium

but again STAR has increased the premium

and now I am planning to port it.

Can you suggest where to port?

Thanks for sharing your insights & knowledge!

Would this list still hold strong in 2020! Also do they cover the current Co-vid crisis.

FYI, I’m looking to buy a new individual policy for myself (38 years; no pre-existing condition). Please advise!

Thanks in advance!

Well, FYI, Apollo Munich is now HDFC Ergo. I don’t think the features have changed. Others remain the same and hence comparison is still valid. Some more policies have come up on the radar including from Star Health. There is also one Aditya Birla Capital + PolicyBazaar. I have done a review of it on this blog itself.

As for CoVid Coverage, the govt has made it mandatory (almost) for all insurance companies to include CovID treatment related expenses in existing policies. You may want to check when buying.

Thank you for the prompt response!

Do any of these plans have an option of including OPD expenses at an additional fee?

Thanks for the informative post. This post helped me to know some new things about insurance. Keep posting. Please let me know for the upcoming posts.