This is that time in the investment world when you as an investor are jumping in hoping to make it big. It’s a time when you say – “what can go wrong now?”

You are probably pulling money out of Fixed Deposits and conservative options and invest in equity.

Why not?

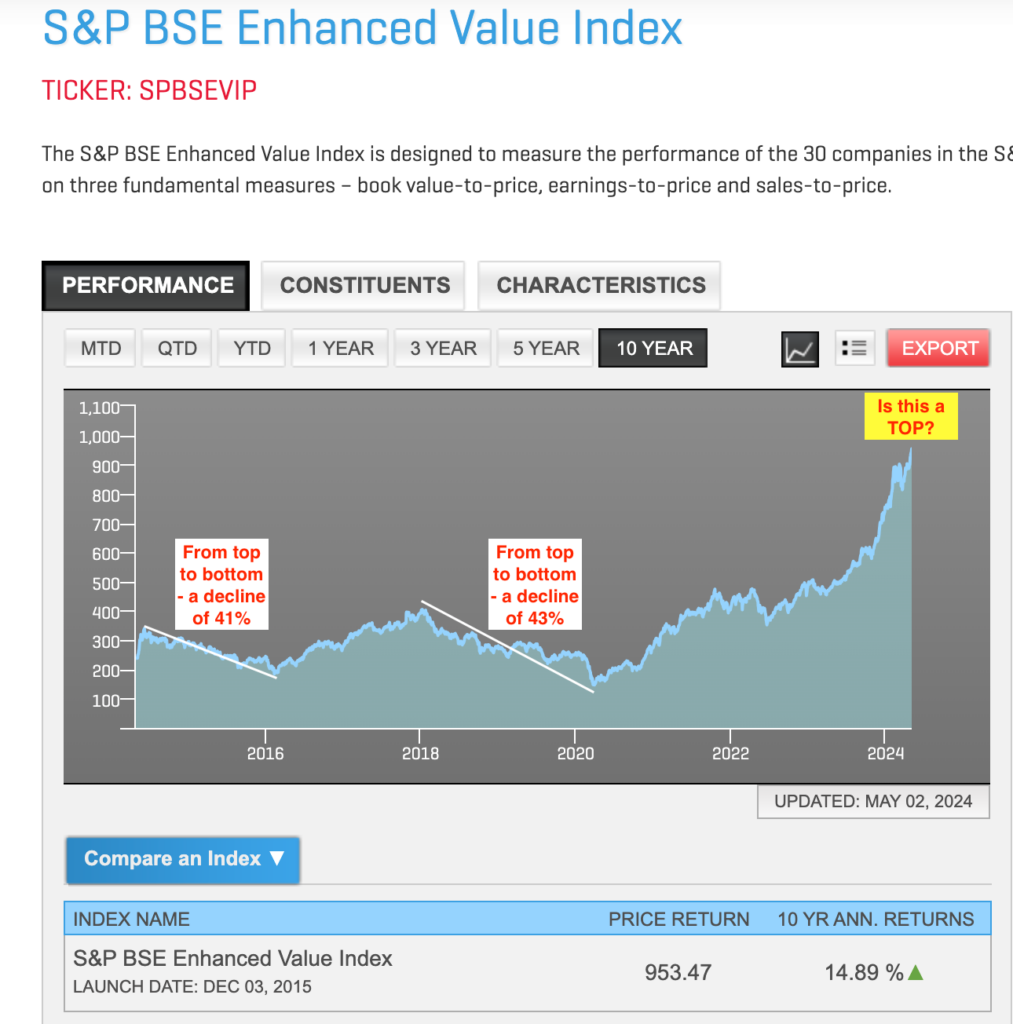

Here’s an example. In the last 1 year, BSE S&P Enhanced Value Index has grown by 90.45% (as on May 2, 2024). The CAGR for the last 5 years is an impressive 27.37%.

If you go to Value Research and sort (descending order) the funds for last 1 year performance, Motilal Oswal BSE S&P Enhanced Value Index fund (a 30 stock portfolio which replicates the above index) ranks #1 with an astounding return of 95.46%.

Enough to make anyone’s mouth water! And if you are NOT an investor here, makes you punch yourself to have missed out on this performer extraordinaire’.

The best of times, the worst of times

As in the example above, these are times when even value investing, which is the not considered an exciting way to invest in the markets, is roaring.

Martin Currie of Franklin Templeton Investments has written a post “Is value investing set to roar back in the 2020s?

JP Morgan asset management published a similar view too.

I am not sure if you have heard of the Quantum Long Term Equity Value Fund, a predominantly large cap fund which swears on its value orientation. Even this fund finally seems worthy – again. The funds’ 10 year CAGR is at 14.45% and 15 year CAGR is at 17.39% (as of May 2, 2024).

Its one year return along and of other value oriented funds is now in the 40s and 50s.

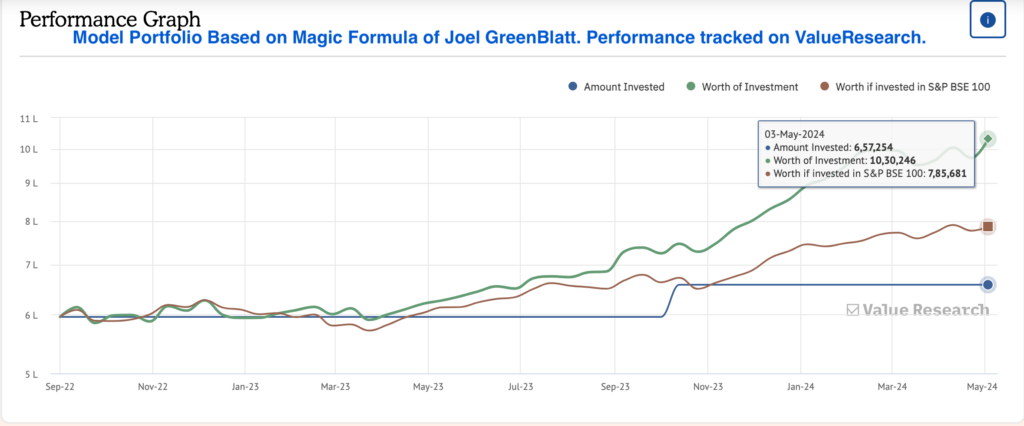

I too track a model portfolio based on Joel GreenBlatt’s Magic Formula using a mix of quality and value.

The last year return of 66% is a hit out of the stadium.

Now, are you getting get carried away with these superlative numbers?

Let me show you the other side of the story.

You see, value investing is not an easy operation to run. Quantum’s Long Term Equity Value fund underwent a very difficult period.

If you look at the BSE S&P Enhanced Value Index, the historical ten year CAGR of the index is 14.89%. A far cry from the last year’s 90%.

In the last ten years, it also had two periods of great decline – down by 40%+. See image below.

Equities are volatile. They go up and then they come down in value.

Take a good look again at the image above and see what happens once the fund makes sort of a top. What’s next?

It looks scary not just for value investing but for anyone who is throwing caution to the winds.

Simply put, don’t try to invest in what looks good now or what is topping the charts now. You may be in for a rude surprise.

—

And, don’t forget Asset Allocation

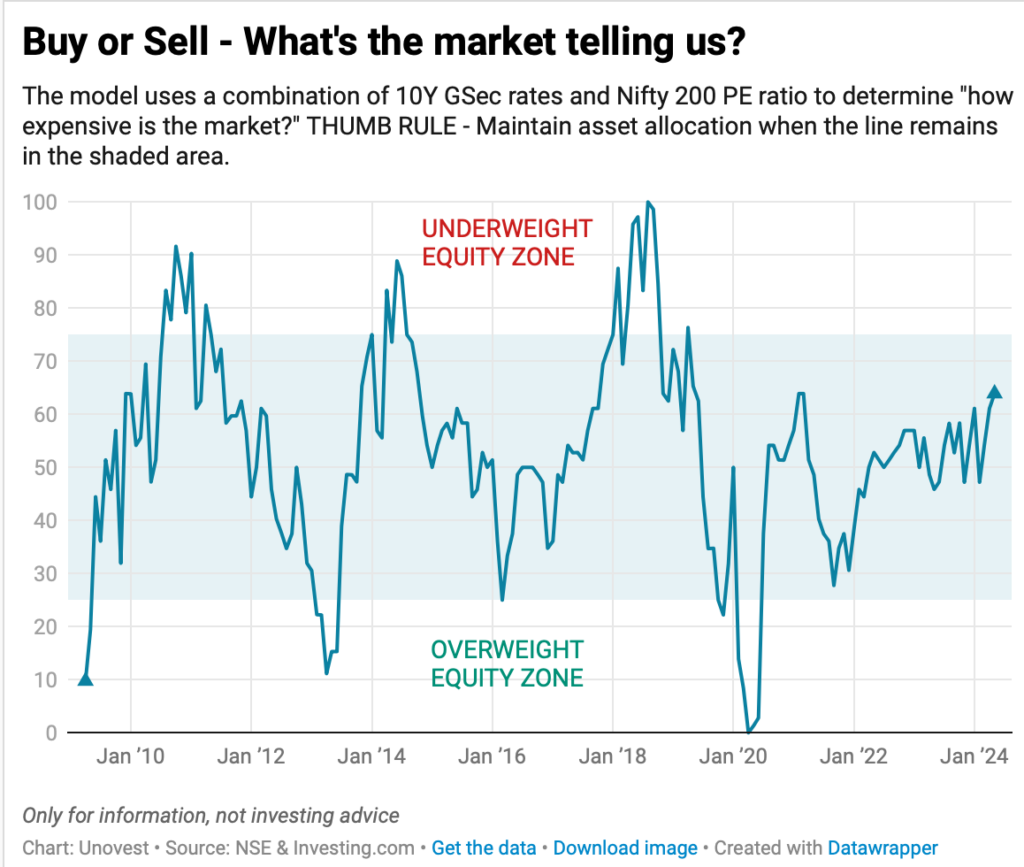

Value investing has arrived or not, the safest and the sanest way to ride the vagaries of the market is “asset allocation“.

Let’s also take a look at what our in house asset allocation model is telling us now?

The message is simple. Stick to your allocations.

I repeat, don’t get greedy. Rebalance your investments as per your plan, your asset allocation.

If you don’t have one, then discuss with your advisor and make one.

Bengaluru folks: If you would like to meet up on May 18 or May 19 in Bengaluru city, do write back to me.

Leave a Reply