The word ‘guaranteed’ has a strange aura to it and it can suspend all our logical senses to consider and even buy. Dr Sharma has been approached by an insurance agent with a guaranteed income plan.

Dr Sharma is 48 years old and has sufficient cash flows to take care of his expenses. He doesn’t see himself retiring for the next 20 years and hence doesn’t need to tap the portfolio for income for at least that period.

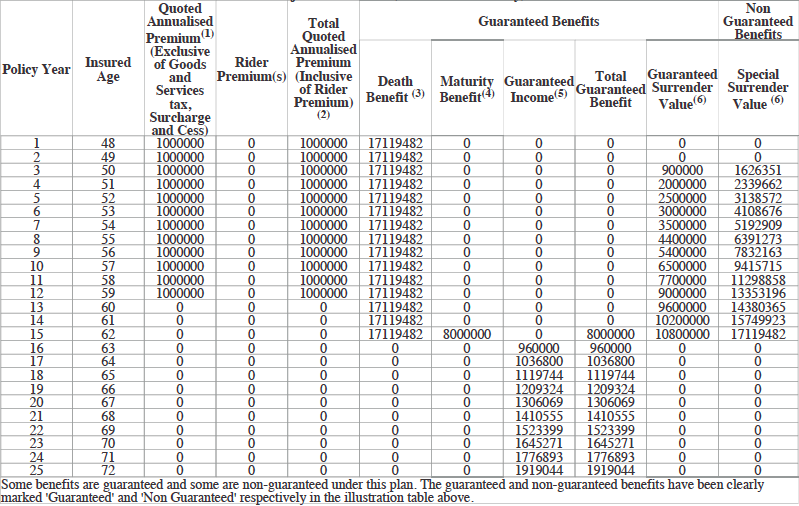

The plan on offer is the TATA AIA Insurance Gold Income Plan. While it is available in multiple combinations, here’s the proposal that Dr Sharma has received.

- Base Sum Assured – Rs. 80 lakhs

- Premium – Rs. 10 lakh / year + GST

- Policy Term – 15 years

- Premium paying term – 12 years

- Income Term – 10 years (starts from the 16th year)

- Death Benefit – Rs. 1.71 crores (calculations later in the post)

- Guaranteed Maturity Benefit – Rs. 80 lakhs, at the end of year 15

- Guaranteed Income Benefit – starts at 12% of Base Sum Assured, from year 16 to 25. Beginning amount is Rs. 9.6 lakhs in the 16th year

- Guaranteed increase in income – 8% per year

Surrender Value – The policy also acquires a surrender value after payment of 3 premiums (since it is a 15 year policy). It offers a guaranteed surrender value, along with a possibility of a non guaranteed option. (See the illustration image below)

Dr Sharma has come to believe this is a very good investment option, which offers guaranteed and tax free returns. (As per Section 10(10D) of the Income Tax Act, receipts from certain insurance policies are tax free in the hands of the investor.)

Debt funds, in which he invests currently, may offer similar returns but don’t guarantee them.

He is okay with with illiquidity or lock in as he doesn’t need the money right away.

Additionally, he gets an insurance cover of Rs. 1.71 crores, which will be paid to his family in case of a death during the first 15 years of the policy.

Now, the fact that the offering is an investment based insurance policy is usually sufficient ground to reject this option. Yet, let’s give it a fair chance and do an analysis.

An analysis of the TATA AIA Insurance Gold Income Plan

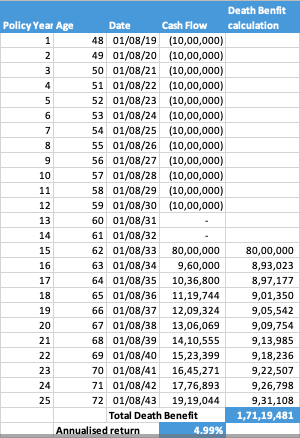

Well, thankfully, the construct of the policy is not very complex, yet it deserves a round of excel analysis. So, I put all the stated numbers in an excel workbook in the format given below.

How much is the guaranteed return on the Gold Income Plan?

The construct of the policy is this. Pay Rs. 10 lakh per year as premium for 12 years. In the 15th year, you will get the Base Sum Assured, Rs. 80 lakh tax free. From the 16th year, you will get an income starting at Rs. 9.6 lakhs a year, increasing by 8% every year.

While you read it, this sounds like a fantastic product with 8% increase income. However, there are a few things you must note.

- In terms of annualised return, we used the XIRR method to find out the return number of the cash flows in this policy. It turns out to be a 4.99% annualised return. Yes, it is guaranteed and tax free (as per existing tax laws. Taxes may change in the future.)

- The maturity benefit and the income is the total cash flow from the policy. There is no lump sum payment at the end of the income period. At 25 years of policy, the final income instalment is paid and the policy is terminated.

Specifically, for Dr Sharma, there are certain points of note.

- The policy offers a death cover of Rs. 1.71 crores. But Dr Sharma’s assets / investments provide enough for his dependents. He doesn’t need insurance. In fact, there will be a deduction of mortality charges from his premium to provide this death cover.

- He needs to stay with the policy for 25 years to realise the 4.99% returns.

- For a 25 year time horizon, he deserves a better compensation.

You may argue, that future interest rates will be much lower and hence this guaranteed option makes sense. However, you need to take into account the fact that over a 25 year period, using the right allocation methods and a diversified portfolio, you can do better, on a post tax basis.

As for the tax benefit under the policy, benefits accrue under Section 10 (10D), only if the Sum Assured is at least 10 times of the annualised Premium. In this case, the Base Sum Assured at Rs. 80 lakhs is only 8 times. It is not particularly clear if they are using the Death Benefit as a Sum Assured here. Little complicated, in my view.

Final word: Don’t mix investment and insurance. Most investment based insurance policies exist to take away your returns, not to add to them.

Calculation of Death Benefit as per illustration

In the illustration, the death benefit is mentioned as R. 1.71 crores. In the analysis, we have shown how the death benefit has been derived.

As per the policy illustration, Death Benefit is defined Death Benefit is the Sum Assured on death which shall be the highest of

- 11 times Annualised Premium,

- 105% of all the Premiums paid, (excluding the underwriting extra premiums and modal loading), as on the date of death,

- Guaranteed Sum Assured on Maturity,

- Absolute amount assured to be paid on death

Where, “Guaranteed Sum Assured on Maturity” shall be equal to 100% of the Basic Sum Assured plus the commuted value of all future Guaranteed Income payments payable during the Income Term, discounted at 7.5% p.a.

The calculation of Death Benefit in the above illustration is based on the above logic of “Guaranteed Sum Assured on Maturity”.

The Gold Income Plan policy is available in various combinations. If you are interested, you can read further details at – http://tataaia.com/life-insurance-plans/savings-plans/gold-income-plan.html

Good point

Most investment based insurance policies exist to take away your returns, not to add to them

fully agreed. It is better to keep money in fixed deposit.