Time and again, Rahul is confused about his investment choices. He is not really sure what can he do about it. He now has a bloated portfolio with all kinds of instruments scattered around. At last he came visiting.

“What do you want your money to do for you?” I asked.

There was a pause. He somewhere knew that any random answer would not cut it.

He spoke. “I know what you are getting to. But I am not really sure about this whole goals and planning bit. I am earning enough, saving quite a bit. I just need help with investments.”

Cliche alert! “That’s like saying, I have fever, give me a paracetamol. You are putting the cart (investments) before the horse (goal and plan).”

“Hmm. Today, I am willing to listen to you. So, how does it work?” He leaned forward this time. He was curious.

“See. It’s clear that you are earning well and saving quite a bit too. But to what ends. How will your money help you fulfil them? Have you made a list about what should your money do for you and how much?”

“I have a list in the mind.”

“That does not help much, unfortunately! You need to write down your goals. Make them real with numbers. With this you get targets to works towards. It helps you build commitment and channelise your resources both mental and financial to achieve your goals.”

“Make it more specific for me.”

“Sure. Ira, your daughter, how old is she now?”

“3”

“OK. Let’s assume she would need a big chunk of money for her grad/post grad starting age 18 for 4 to 5 years there after. That’s 15 years from now.”

“Yes.”

“How prepared are you to fund her education?” Rahul sat back to make some calculations.

“Well, I have saved Rs. 3 lakhs already for her and I am taken an insurance policy. There is a PPF account in her name. Last year I started an SIP of Rs. 10,000 too, just for her education.”

“Is it enough?”

“I don’t know.”

“OK. Let’s work this out.

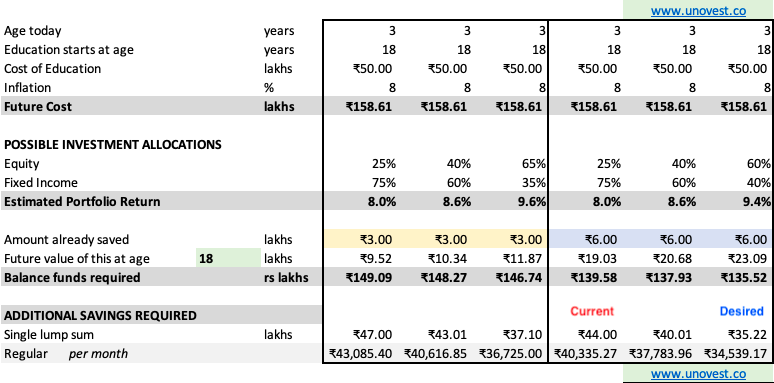

Today’s cost of her education is about Rs 50 lakhs. Say, you want to provide for the full amount and not depend on a loan. Loan can be a last resort, if at all.We will work with 8% inflation per year. With this, the future cost of her education is going to be almost Rs. 1.6 crores.”

“Holy S**t! How the hell am I supposed to save so much?” Rahul exclaimed.

“We will come to that. Let’s quickly run some scenarios. But first let’s take stock of what you have done.

You already have some investments that you want to mark for her education

- an endowment insurance policy (current value is 2 lakhs, premium of Rs. 22,000 per year)

- a PPF account (current value is approx. Rs. 2.5 lakh, annual contribution of Rs. 50k)

- Equity MFs (current value Rs. 1.5 lakhs, SIP of Rs. 10,000 per month in 8 different schemes)

The above set of investments amount to 4.5 lakhs of fixed income (or debt investments) and Rs. 1.5 lakhs of equity. The ratio turns out to be 25:75, equity:debt.

If you continue with this ratio, your expected returns are likely to be 8%, just about matching inflation. Interestingly, the return is least of the issues here.”

See the right hand side box in the image below.

There are 2 scenarios, one where Rahul has already saved Rs. 6 lakhs (right hand side) and another on the left hand side, assuming the current investments for education are at Rs. 3 lakhs only.

“At this rate and time period of 15 years, you need to save Rs. 44 lakhs one time now. If you allocate better, this can be done with just Rs. 35 lakhs.

OR

Rs. 40,335 per month for the next 15 years. With better allocation of money to investments, it can drop to Rs. 34,539 per month. ”

“I am getting the shock of my life.” Rahul had an agitation in his voice.

“I know the numbers look scary. But don’t be. See the good side.

- you are already saving

- your regular investing allocation is fine

You only have to deal with

- current savings which are less than required (Rs. 16k current vs Rs. 40k required / month)

- equity allocation in current portfolio can go up

This is the beauty of goal based investing. You now have a good view of where you want to go and what will it take to reach there. Yes, we are making certain assumptions about the future but then it gives us a fair idea of the steps we need to take.

In your case, the first most important step is to allocate more savings to your daughter’s education. This by itself will make a significant impact.”

“How? I am already stretched.”

“Of course, that is going to be a little bit of a stretch. But you know your target now. Align your cash flows to provide for these. This may not happen immediately which is fine.” Rahul was not happy to hear this.

“The next thing to do is to align your asset allocation and move more towards equity. Within that, you first need to correct your existing allocation and then ensure that you are investing regularly in line with the allocation.”

“And how do I do that?”

“For the next couple of years, you continue to invest more money into Equity through mutual funds. Review yearly to see how your allocations look and make your investing decisions accordingly.When the allocation is corrected, then start investing in the desired allocation break up.”

Rahul was wondering what to say. After a few minutes:

“You make me feel stupid. Actually, I think now I realise what you were trying to say all this time about goal based investing and financial planning. All this while I had thought I had an investment problem, but the bigger problem I have is a savings problem. Frankly, I am glad that this realisation happened. ”

“I am glad too, Rahul. By the way, the investment problem exists but let’s deal with this one first.”

“Done. I want to give this a honest try. And I am going to need your help to be able to make this happen specially in the initial years.”

“I am always there.”

—

Read More: The tricky aspect of saving for your child’s education

Rahul and I then worked on a detailed plan for his entire money needs. He had some questions the answers to which I summarise below. Hope they help you too.

As you work towards the goal , these are the things to remember:

a) When the goal starts approaching, say 3 years to go, you should start pushing your money towards fixed income. At that time, certainty of having the money is more important than the few extra bucks. Actually, planning it now, will ensure that you have enough to not run for extra points in return.

b) If at any time, you think you can save and allocate more to a goal (without hampering other goals), then do that. This will reduce the burden on the portfolio to produce more. You can work with a lower allocation to equity. In fact, in the final years, almost all the new savings should be in fixed income with no equity.

c) During the course of preparing for the goal, some of the investments such as your insurance policy or PPF account may mature. Those can ideally be kept in fixed income instruments only. Debt funds or Bank FDs based on your taxation bracket can work fine. Any other instruments available then can be evaluated.

d) Review and rebalance on a regular basis. You don’t know in advance about the sequence of returns that you will get. At some times, your equity portfolio will zoom up in no time and at other times, crash down. You also don’t know if it will happen in the initial years, middle years or later years. Don’t get greedy when portfolio outperforms and fearful when there is a lag. Just review calmly and rebalance your portfolio to your required allocation.

So, are you doing random transactions hoping it will all come together in some way or definitive goal based investing?

Excellent Article on Goal based investing . I was doing it all randomly, trying to invest first and then make goals. But now I can see where I am going wrong. Those four pointers at the end are also worthy to remember always.

Glad it helped, Prasanjit.

Vipin,

This education goal for kids is the most trickiest thing for all Indian parents. These days every Indian parent has a goal to send their kids to US for higher education and aggressively saving for it. Rahul is one of them too.

If you consider 15 years from now, there will be an army of Indian parents like 15-20 Lac of them every year will be ready with 2-3 crores to send their kids abroad.

Will the US have enough infrastructure to take them all in?

Will the US provide work visas to all of them after studies? If they dont, then studying there is not attractive. Recent events saw many students return after studies.

Will there be enough opportunities to get a job there?

Will the money saved be enough?

What if rupee depreciates quite a lot? That would double or triple the costs.

Already there are so many Indians in US who will take up the opportunities as well.

I guess you need to advice your clients regarding these unknowns for this particular goal. This is not like retirement where many assumptions will not go wrong.

Pradeep, Thanks for the detailed comment and raising the concerns. There are indeed a lot of unknowns. The biggest unknown is the way education will be structured in the times to come. Careers to will undergo a massive change in a couple of decades. However, there is little clarity of what it would look like. So the safe thing to do for now is to plan for what we already know. Most likely, these parents will use the money for their own needs. 🙂

Yeah that last point is funny but very true, what if the kid doesn’t want to do higher studies or not want to go abroad 🙂

Parents can’t force the issue…

The parents might as well use that money to setup a business or something which they can look after during their retirement and allow the kids to inherit.

Hi Vipin,

Excellent reading, Thanks a lot. Can you please share the excel sheet(from the screenshot) I would love to input my numbers and check if I am doing Ok.

Thanks

Rajeshsn

THanks Rajesh. Sure.