In personal finance management or financial planning, insurance is the most important item that needs your attention.

Yet, I have seen a common tendency to ignore insurance and instead focus on the investments. But that is a deadly mistake.

While investments are for the future goals, insurance takes care of your current risks.

Investments will build up over time and that too based on your contributions, but what would you do if an emergency arises today?

You may argue that you will use your existing investments but that could be too high a cost. Why burn a hole in your investments when only a relatively smaller insurance premium can do the job for you?

Insurance is the financial way to deal with life’s emergencies.

Hence, it is important to assess the right amount of insurance cover that you need and protect your family and yourself from those emergencies that can lead to financial headaches.

Let us discuss about one of the most important insurance requirements – life insurance.

How much life insurance do you need?

The Rule of Thumb – 10x

If you go by the rule of thumb, your should take an insurance cover 10 times your current annual income. So, if you earn Rs. 12 lacs in a year, your insurance cover or Sum Assured should be Rs. 1.2 crores.

What this means that if you buy an insurance policy for a Sum Assured of Rs. 1.2 crores and God called you tomorrow to be a part of his team, your dependents would receive Rs. 1.2 crores.

Fair enough. But there is a problem. We do not know whether this amount is going to be enough to pay for all the expenses for the rest of the life of your dependents.

As an individual, you may have very different needs and goals than another individual. Your life insurance cover should account for those needs and goals.

And that’s the limitation of the thumb rule. It is a good point to start but not the one to reach a conclusion with.

Two real methods to calculate your insurance cover

Given the limitation of the thumb rule, we need far better estimates of what should your life insurance cover be. Here we introduce you to 2 methods that you can use to calculate your insurance requirements.

The 2 methods are:

Income replacement approach

Expense and Liability replacement approach

The Income replacement approach takes into account the fact that if you lived all your productive years right upto your retirement, what is the total income you would have generated? The current value of all that income is the total insurance cover you should take.

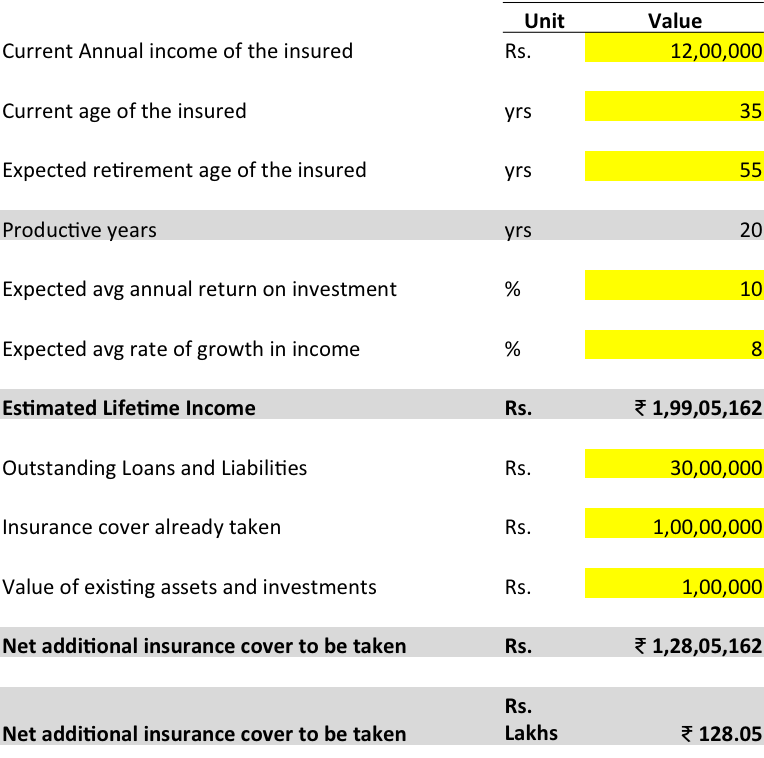

See this example below:

With this approach, we have taken the annual income of the insured and used it as a basis to calculate the required insurance cover which in this case is Rs. 199 lakhs.

However, you need to add any outstanding liabilities like that of your car loan or home loan and subtract any insurance cover plus the current value of other existing investments that you have to arrive at the extra cover you might need.

In the example we have taken, the net insurance cover required is only Rs. 128 lakhs.

A word on assumptions:

- The average annual expected return has been kept at 10% compounded per annum. It is assumed that this return will be delivered by using a healthy mix of equity and debt investments. You may use one that is suitable to your risk capacity. However, it is recommended that you do not exceed this number. You can take a lower return if you so wish.

- The average annual growth rate in income is the rate at which you would expect your income to grow per year.

Let’s take up the next one.

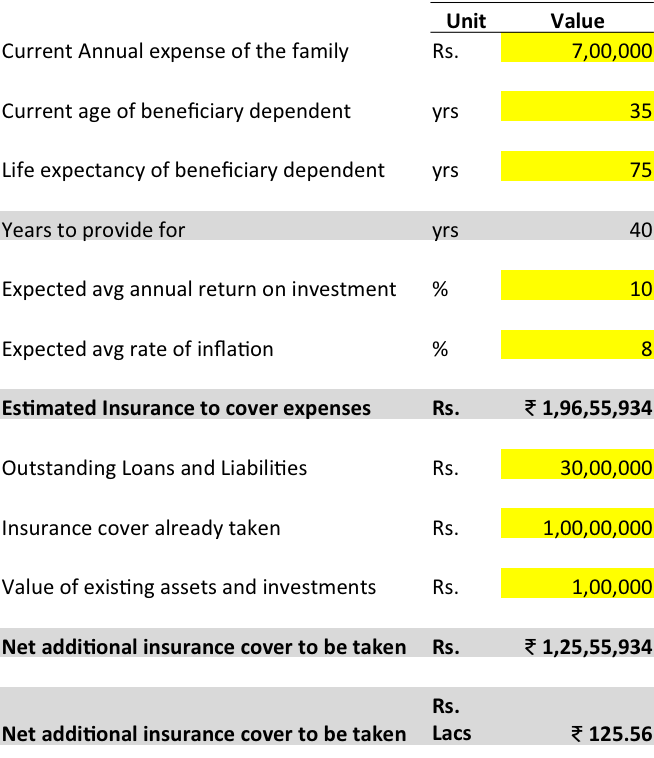

With the Expense and Liability replacement approach, you take into consideration all the expenses and liabilities that your dependents will have to take care of, in case something happens to your life.

Let’s look at the example below:

With this approach, we have taken into account the expenses and the liabilities of the insured and used it as a basis to calculate the required insurance cover which in this case is Rs. 196 lakhs.

However, you need to add any outstanding liabilities such as your car loan or home loan and subtract any insurance cover plus the current value of other existing investments to arrive at the additional cover that you might need. In this case, the net insurance cover required is Rs. 125.56 lakhs.

While the other assumptions are the same, the one different assumption here is about theinflation rate or the rate at which prices increase. We have taken a rate of 8% that is true for my lifestyle. But you can take a rate that is suitable to your lifestyle. As a guidance, choose a rate between 6% to 12%.

Confusion – which number to rely on?

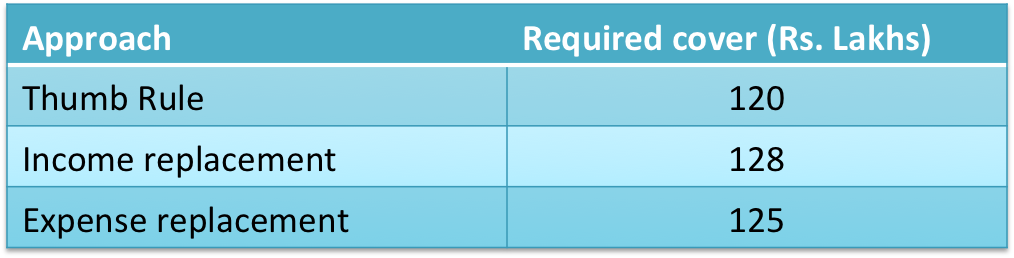

We understand it totally. First, lets quickly make a comparison of all the approaches.

Comparison table of insurance cover for all the approaches

As you can see, all 3 approaches give a value in a range. The thumb rule gives us the lowest amount. In case of Expense and Liability the amount is lower since the it does not seek to replace the entire income but to only provide for the expenses and liabilities.

You can never really be sure of the exact amount you need. As long as you have a decent estimate, you can work with it. Just review it regularly and see that you remain adequately covered all the time.

As for which number to take, I would go with the highest amount of life insurance cover estimate, that is, Rs. 128 lacs. It is better to err on the side of caution. In any case, we are talking insurance, that is protection against risk, right?

Insurance Calculators that you can use

So, which method are you going to use? What is your insurance requirement? That is where the calculators come for your help.

Click here to download the Life Insurance Calculator Files in MS Excel.

In this excel file, you will see two sheets, Life Insurance – Income replacement and Life Insurance – Expense Replacement. Play around with the numbers in the sheets and see what is the life insurance cover requirement that you get.

Note: Make your inputs only in the yellow coloured cells. Please do not change the others as it may distort the calculations.

We now have the web version too of the life insurance calculator. Here’s the link to the web version.

Time for action

To repeat Benjamin Franklin, “There are only two certainties in life – death and taxes.”

There could be no bigger a pain to see that after you, your dependents have to compromise on their needs and their lifestyle for the lack of money.

Nothing would give you more joy to know that even when you are not there your family and its financial needs are being taken care of.

Now that you know how much cover you need, go and buy that term insurance immediately. It is the most important thing that you can do for your loved ones.

A word of caution: Avoid any other life insurance product except for a term plan. You have to get your insurance cover right first before you look at anything else.

This note is a part of the free course – Investing 101. Want to subscribe to the full course on email?