In an earlier post, we discussed about how much returns to expect from your mutual fund investments. In this post, we use an example of retirement planning and how returns expectation and your investment mix can impact your strategy.

Chances are that you are not adequately prepared for retirement. Let’s use the numbers to know where do you stand today and what will it take to reach your retirement goal.

So, Abhishek has opted in to analyse his case. We can all learn the lessons with him.

About Abhishek:

Abhishek is 35 years old today and plans to retire by age 50. He needs sufficient funds in his hands by then to take care of his day to day expenses.

He works as a software engineer and takes home a salary of Rs. 1.5 lakh a month. After paying for regular expenses, he is left with about Rs. 50,000 a month.

Out of this, he invests Rs. 5,000 a month in PPF and Rs. 30,000 a month as SIPs in equity mutual funds. Rs. 5,000 a month goes towards an ULIP that he had bought early in his career. Another Rs. 5,000 goes towards NPS. The balance is parked in Fixed Deposits for emergency needs.

He also contributes Rs. 10,000 a month towards his EPF which is matched by his employer too. In total, Rs. 20,000 a month goes towards EPF investments.

So far, so good.

Coming back to the key goal, he wants to retire by age 50. The question is – can he?

Retirement Planning for Abhishek – Can he retire at 50?

For the purpose of his retirement planning, we use an excel based calculator.

Download the retirement planning calculator by clicking here.

Now, we need to make some assumptions to know whether Abhishek will realise his dream of early retirement or not.

Here is the list:

- Post retirement income: For a basic standard of living, he would still need about Rs. 50,000 a month. Apart from that, he would also need an additional Rs. 2 lakhs a year for travel, medical, etc. expenses.

- Other income (post retirement): There is no other source of income such as rental or pension.

- Life expectancy: A key aspect of retirement planning is the post retirement phase, how long do you expect to live. An ideal number to plan for is 100. However, we will work with 85 to begin with.

- Inflation (pre retirement): Abhishek thinks that for his living standard, an average 9% inflation is expected.

- Inflation (post retirement): Post retirement, the average inflation is to be assumed at 8%.

- Growth in savings per year: He will increase his savings for retirement by 5% every year, till he retires.

- Investment return (pre-retirement): Assuming an average mix of equity and fixed income investments, he is ready to work with a 10% compounded average return on his investments.

- Investment return (post-retirement): This is the rate of return he would expect to earn post retirement to generate an income from the funds. We will keep it similar to the inflation rate.

- Existing Savings: Abhishek has a current investment portfolio of Rs. 10 lakhs divided almost equally between fixed income and equity.

Note: A change in any of the above assumptions can significantly change the outcome.

We now use the calculator and input the numbers. What do the numbers tell us?

The retirement planning numbers

To reach his goal of retirement at 50, Abhishek needs a total fund of Rs. 10.20 crores by age 50. While he already has Rs. 10 lakhs today, he needs to save Rs. 1.85 lakhs per month additionally in the first year itself. This savings needs to grow by 5% every year.

That is certainly not possible with the current income/savings. What can be done?

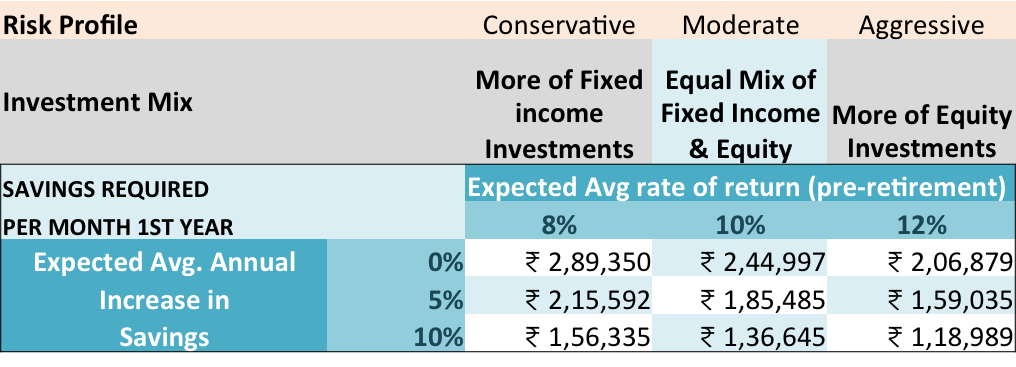

Have a look at the matrix below.

The above matrix tells us, for various investment mix and rate of growth of annual savings, what savings are required to reach the retirement goal.

Even if Abhishek decides to change his allocation to more of equity investments and thus reach an expected return of 12%, he needs to save Rs. 1.59 lakhs per month.

If he were to push it further with an increase in savings by 10% every year as also a higher allocation to equity, he still needs to save Rs. 1.18 lakhs per month. This number is way outside of his current savings.

Currently, his total savings amount is Rs. 70,000 a month, distributed as:

- EPF – Rs. 20,000 per month

- ULIP – Rs. 5,000 per month

- NPS – Rs. 5,000 per month

- Equity Mutual Funds (via SIPs) – Rs. 30,000 per month

- PPF – Rs. 5,000 per month

- FDs – Rs. 5,000 per month

With a roughly 50:50 ratio between fixed income and equity, this is expected to earn a return of about 10%.

It is clear that retirement at age 50 is an aggressive target.

So, what should he do now?

What if he changes his retirement age to 55?

When he does that, the retirement fund requirement changes to Rs. 13.45 crores. Yes, it is higher than what he needed for retirement at age 50, courtesy inflation, but he also gets more time to save resulting in a lower savings number.

With the current investment portfolio at Rs. 10 lacs, he needs to now build the balance of Rs. 12.78 crores.

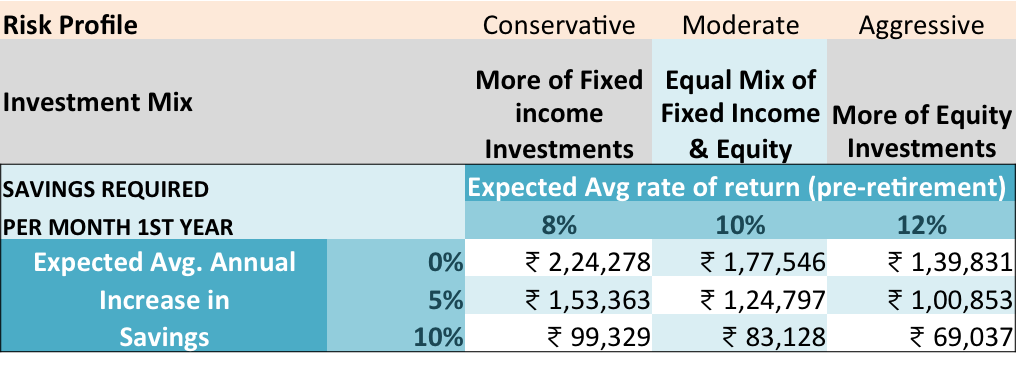

How much does he need to save now? Let’s look at the matrix again.

As clear in the above matrix, with a 5% annual increase in savings and a 10% average return, this goal is still far from reach. The required savings is at Rs. 1.25 lakhs a month.

However, with a 10% return with a 10% increase in annual savings, Abhishek needs to save Rs. 83,000 a month to reach the goal of retirement at 55. This seems to work better for Abhishek. He needs to push up his savings to get to the goal.

Alternatively, he can change his asset allocation or investment mix towards ‘more of equity‘. Here, with 10% annual increase in savings and an average return of 12%, he would need to save Rs. 69,000 a month to reach the goal of retirement at age 55.

Of course, he has to take into account the additional risk / volatility he will have to bear for the same. He also has to plan the additional savings.

Abhishek is now more aware. He knows what will it take to reach his retirement goal.

It’s your turn

While our minds are not tuned to think of such large numbers, using a retirement calculation like this one can help you assess your goal in proper light. Just like Abhishek did.

You can then adjust your goal or your investment strategy accordingly. It could be increase in savings or changing the investment mix or both.

What story are your numbers telling for your retirement planning? Do share with us.

Click here to download your copy of the retirement planning calculator

Now, you can also set your retirement planning goal on Unovest and track it along with your investments there. Here’s how.

Not sure if I agree to this. You are suggesting to build a corpus of Rs 10+ crores for retirement. This seem too high for an average Indian. We can look at many examples around us who are just drawing pension of Rs 25,000 per month and living happily.

Also, when we are talking about 35+ years of retirement then why do not one put her money into 100% equities (Mutual funds) and keep withdrawing it as 35 years long SWP plan. In such case you are not required such a big corpus. You will do well if you just have 1.15 crores in equity MF with 5% inflation adjusted returns for next 40 years. Keep withdrawing Rs 6,00,000 (+ inflation) per year.

Please help with your views.

Thanks for the comment. I am sure for some the strategy as identified by you could work.

The way to adjust this in the calculator is to change the post retirement expected return.

Currently, it is assumed to be all fixed income investments, since safety and assured return are taken as key requirements.

Anyone wanting to chart a different course is welcome.

Agree. In my opinion, such a high amount of retirement corpus limits most of Indians to not think about retirement as they believe that they cannot achieve such a Hugh corpus. A more realistic achievable calculation would help. However, many thanks to you for posting such an eye opener blog. Thanks!

Well, Can’t disagree with you about a high goal leading to inaction. However, the idea is to get people to think and act well in time. The calculator is only a tool.

Thanks for the comment again.

Vipin, Thanks for creating the Excel sheet. Its great to have an easy to use calculator handy. You are doing a great work by posting such blogs and providing these excel sheet tool. Keep up the good work.

Thanks for the encouragement Rupesh.