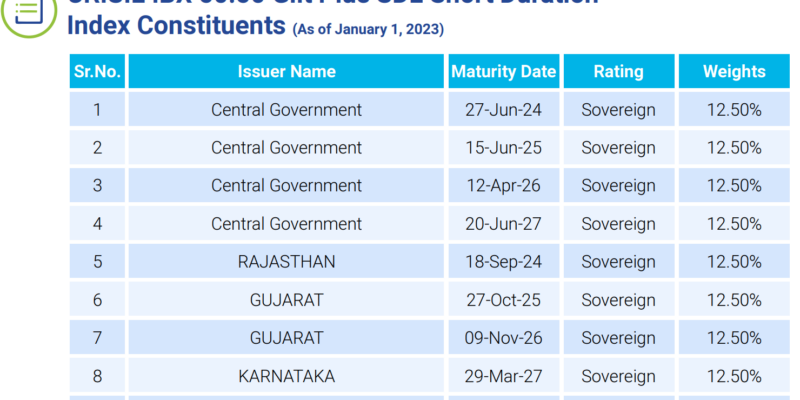

Well, the actual name is Edelweiss CIBIL IBX 50:50 Gilt Plus SDL Short Duration Index Fund. That’s a pretty big name for a short duration fund. And it promises to offer a lot. Beyond the marketing buzz, let’s find out what the fund has to really offer. The fund is categorised “Short Duration Fund” under […]

Is Motilal Oswal S&P 500 Index Fund a good fit for international diversification?

Motilal Oswal S&P 500 Index fund is the upcoming new fund offer from Motilal Oswal AMC with the theme of providing international diversification to investment portfolios. Why International Diversification? There is an important reason for it. As per World Bank, India has a roughly 3% share of world GDP. It means international diversification is an […]

Nifty Next 50 – Is this the Gold for passive investors?

You believe active investing is overdone. That fund managers are overrated. They use ill-structured index benchmarks to show alpha where none exists. In the garb of this false alpha, they rip investors off with the exorbitant fees. For you, index funds and ETFs are the God’s gift to investors and his Avatar is none other than […]

Primer – Active vs Passive fund management

If you are new to the jargon, an actively managed fund is the one where the fund manager takes call based on research and analysis on what should the portfolio be, how much and when. The fund managers call the shots based on several parameters that they have outlined as a part of the investing process. […]

Why choose passive funds and not index for performance comparison?

As an investor, how do you know if your fund is working for you or not? This is specially relevant to the actively managed funds where a fund manager makes investment decision of how much to invest and where. You can evaluate your mutual fund’s performance by finding out if your fund outperformed its stated benchmark […]