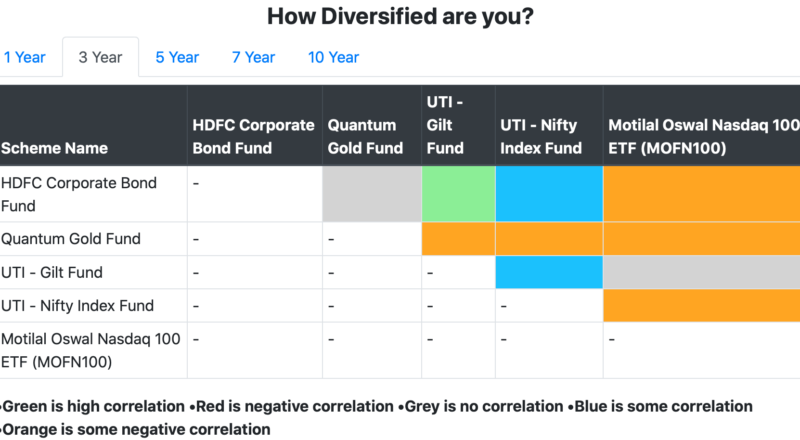

Invest in assets that behave differently at a different times and you have a well diversified portfolio. This dictum is the bedrock of the practice of asset allocation and all the benefits it brings to you. However, is the choice of your investments really adding to your diversification or just adding more noise? Let’s find […]

It’s the World Financial Planning Day!

Money can be cause of stress and anxiety for many. Planning can help us get over that uneasy feeling and make more informed decisions and save a lot of pain. Better decisions also lead to outcomes that align with our version of ourselves. At least, that is how I see it. On this World Financial […]

How to save 9x tax?

Saving TAX occupies a significant part of our mind space, specially if we are in the 30% or higher tax bracket. Along with inflation, high taxes lead to a double whammy. Today, let’s discuss and understand a way to save 9x tax on our investments by shifting our tax liability from “income” to “capital gains”. […]

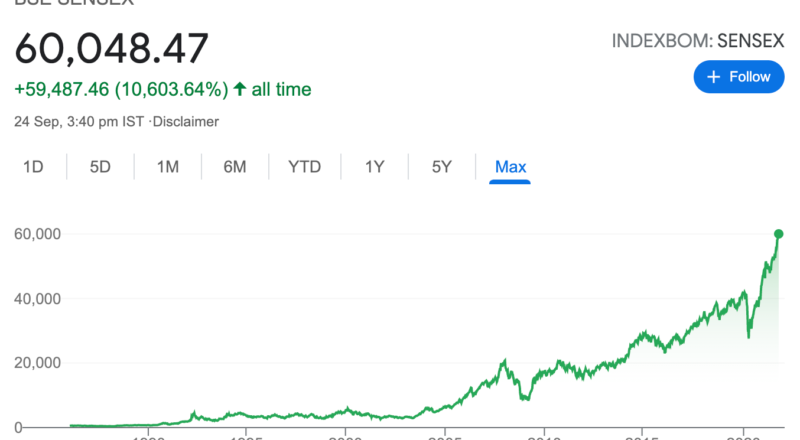

Sensex at 60000 – The AAA Manifesto

Yes, the BSE Sensitive Index, popularly known as the Sensex, closed at an all time high of above 60,000 points. This is a moment to revel for investors as well as to reflect. Question: Who do you think benefited the most in this journey? Answer: The one who stuck around, stayed in the game. I […]

Is Parag Parikh Flexicap an overrated fund?

Parag Parikh Flexicap fund is highly overrated fund. In fact, one can save on expenses and get similar or better results by using different parts to create their own whole. “What do you mean?” I asked in disbelief. — Parag Parikh Flexicap fund has been a shining example of fund management with its open communication, […]

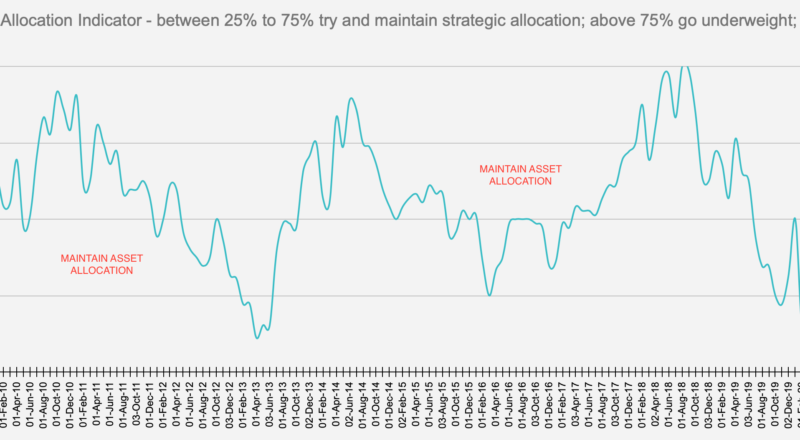

Should I stop my SIPs?

The stock markets are making all time highs. Many think – too fast, too soon! All those questions are back – Should I stop my SIPs? Should I pull out money invested in my funds? Is this the right time to add more money to stocks? Should I buy gold/real estate? Well, if you are […]