To all alpha chasers – “Don’t risk what you have and what you need for what you don’t have and don’t need.” I am sure you have been in a situation on the road, when you see vehicles in the other lane moving faster, manoeuvre yourself to get there, only to realise that the lane […]

Revisiting NPS in 2022

Pension payments are a huge burden for Governments around the world. As populations age, this burden continues to grow. In the past, India (like several other nations) followed a defined benefit cum assured pension plan. Once you retired, a predefined pension was made available regularly for your post retirement needs. Over time, the realisation dawned […]

[Funny Money] Index Funds are safe

Go out on Quora and you will find DIY investors asking – “I want to invest in safe index funds. Can I put all my money there?” In fact, I recently had a first hand experience. A new investor was speaking with me. “See I am afraid of the stock markets – stocks or mutual […]

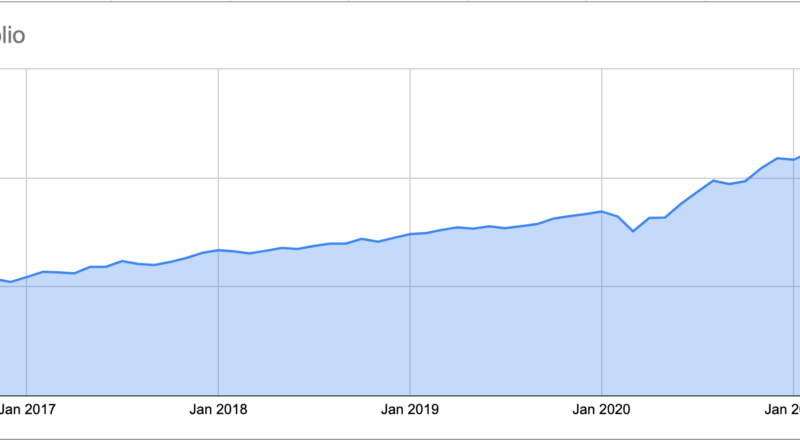

The 60-40 Portfolio is not dead

The 60-40 portfolio is one of the most popular portfolio asset allocation for long term investors. Even for those who want to start out with equity investing. The popular old version of the 60-40 portfolio is that you invest 60% of money into equity for capital appreciation and 40% in fixed income for reducing volatility […]

A Smart Asset Allocation that works more!

What If I told you that there is a portfolio that may have NOT lost anything during the March 2020 fall even when markets fell 30% or more during that time? That’s a bold statement! Well, this is what I am talking about. (Notice the period of 2020) Now, you are smart and would say something […]

There are no permanent winners – a chart

See this image/chart posted on Twitter by Neil Borate of LiveMint. They call it the Asset Allocation Quilt. What I am taking out of here? No permanent winners in investing except Asset Allocation and Rebalancing. You can focus on picking the winning investments (easier said than done). Or, you can focus on allocating the right […]