Choosing mutual fund on the basis of returns only is deadly. Here’s how

LightHouse and 2 ideas

Firstly, have you downloaded your free copy of my latest newsletter – The LightHouse. It is one of the most important pieces I have written and there is a lot of positive feedback about it. I assure you, it is going to improve with time. There is no payment. Just put in your email and […]

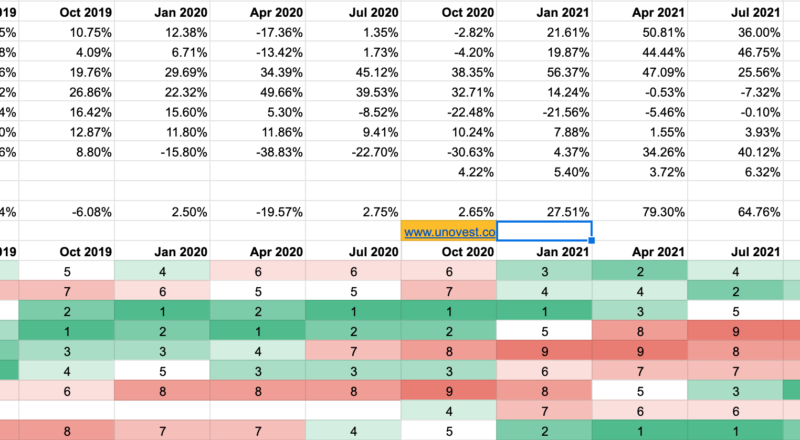

Build wealth with mutual funds and asset allocation

The one topic you have read me going on and on and on about is “asset allocation”. It is not without reason. The more I experience it, the more potent it feels. A simple idea with an extraordinary power. I found it imperative that every investor masters and uses this power and to make that […]

State of the Markets – July 2022 – Asset Allocation Update

The pain doesn’t seem to go away. The world is still at a precipice. Inflation is a monster now with food prices going up XX. Loan rates are increasing faster than fixed deposit rates. The Pain. Now, as an investor, remember, the markets want you to experience this pain. In fact, they want you to […]

Can InvITs be a source of regular income?

Infrastructure Investment Trusts or more popularly known as InvITs have emerged as alternative investment in the last few years. The provision of distributing most of their surplus to the unitholders adds to the appeal for income seeking investors. What are InvITs? As mentioned on NSEIndia.com, an Infrastructure Investment Trust (InvITs) is Collective Investment Scheme quite […]

RBI Bonds vs Tax Free Bonds vs Target Maturity Funds

In the current market volatility, investors are looking for options to earn a safe rate of interest and protect their capital. Here’s a quick overview of RBI Bonds vs Tax Free Bonds vs Target Maturity Funds. This should help you pick one of these if you need to. A comparison – RBI Bonds vs Tax […]