What do you think it takes to getting rich?

Lottery!

What do you think it takes to getting rich in 31 days?

Convinced – It can only be the Lottery!

No, not really. You need something better.

Here’s a challenge for you. We give you 1 paisa, yes just 1 paisa.

If you double the money every day for 31 days, what will be the final value?

Come on, take a shot. You can use an excel sheet or a calculator if you want. Give it a try before you move forward.

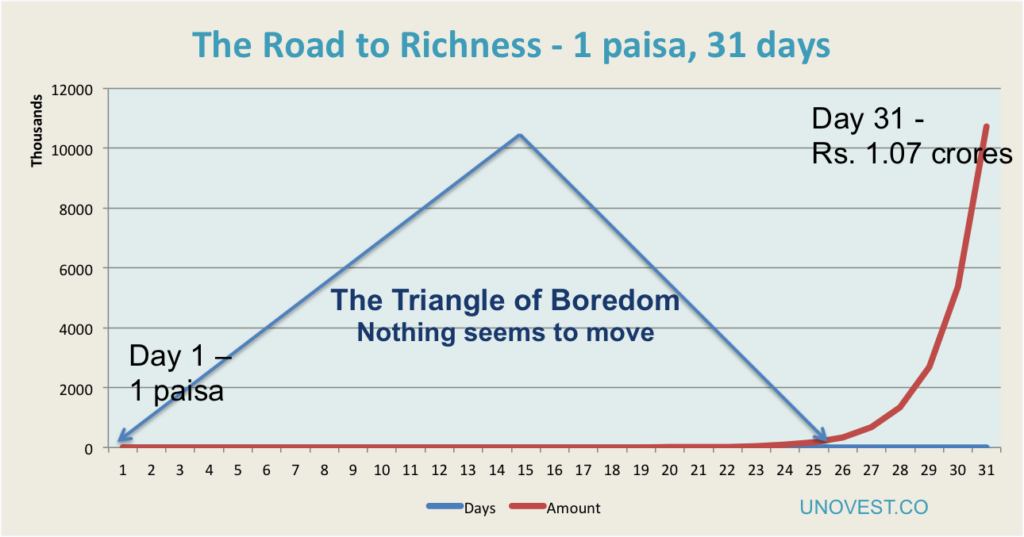

Well, to give a visual impression of the idea, here is a chart plotted with the values with the days. If you start with 1 paisa on Day 1 then on Day 31 you will have…

At the end of 31 days, you will have Rs. 1.07 crores.

Unbelievable!

All you did was double the money every day. Something like this –

Day 1 – Rs. 0.01

Day 2 – Rs. 0.02

Day 3 – Rs. 0.04

Day 10 – Rs. 5.12

Day 20 – Rs. 5,242.99

Day 25 – Rs. 1.67 lacs

Day 31 – 1.07 crores

You don’t want to trust this. But that’s how it is.

The formula for getting rich

All you do is double your money. This sounds so simple. But it hasn’t been easy. Getting rich isn’t easy.

There is tremendous short term pain. As you can see in the chart above, for the first 25 days out of 31, absolutely nothing seems to move. That’s 81% of the time.

This time period constitutes the “great age of boredom“.

That’s where most investors give up. It needs lots of patience and discipline to go through this phase.

But you stick on and see how the magic works. You see the first lac only on Day 21. Starting day 26, the movement becomes visible on the chart. And in the next 5 days, we have a skyscraper coming up leading all the way to over Rs. 1 crore.

While patience and discipline is required in the journey of “getting rich” journey, another important lesson for us is to Start early.

Look at it this way. Suppose you start with Rs. 1,000 at age 21.

Can you double it every year? How? By using a combination of investment returns as well higher savings.

You know what will be the result?

At age 51, you will have Rs. 107 crores.

It does sound like a fairy tale. In reality, money is unlikely to double every day. But we hope the lesson is not lost.

It is not just the tricks of the trade or chasing some moonshot that you need to be rich. Discipline, patience and willingness to go the whole hog is what will actually make you rich.

All the best!

It’s unrealistic to expect one to double their money every year, even including both investment lessons and savings. In your example, at age 50, one would have 53 crores, and if it grew 20%, one would be left with 64 crores. So, by your logic, one must invest 107 – 64 = 43 crores IN A SINGLE YEAR! If one is able to do that, one wouldn’t need all these financial calculators!

Your basic point is right, but it would be better to illustrate it with a realistic example. For example, according to http://sipcalculator.in if you invest a thousand rupees a month, assuming 18% annual returns, after 30 years, you’ll have 35 lac, but after 40 years you’ll have 1.2 crores. See how your net worth increased by 35 lac over 3 decades, but suddenly increased by 85 lac in just the last decade? This is a realistic example to illustrate the same point you made.

Yes, you are right. Typically, lot more savings will happen in the initial years the positive effect will be felt in the later years.

I hope this moves people into thinking and acting on savings. I hope at least one person, sets up a goal like this 🙂

great message for investors i like “patience and discipline” approach and you are very right

Surely, you caught on to the right words. 🙂

Your example misguiding & did not understanding as how 1 paisa is becoming 1 cr in 31 days. Explain in details otherwise its making wrong message as a consultant.how can we understand money is double ever years?

Dear Rajesh

Don’t be upset please.

The example is for understanding the power of compounding. It no where suggests that you will double your money because of the markets. The money can be doubled by growth in the market or by adding more savings to the portfolio.

I think the last part of the post did not come out clearly and hence this confusion.

10 5.12

11 10.24

12 20.48

13 40.96

14 81.92

15 163.84

16 327.68

17 655.36

18 1310.72

19 2621.44

20 5242.88

21 10485.76

22 20971.52

23 41943.04

24 83886.08

25 167772.16

26 335544.32

27 671088.64

28 1342177.28

29 2684354.56

30 5368709.12

31 10737418.24

How can possible to earn double money every year? Not average more than 12 % return available in market. Please explain

Getting reach is a gradual process. You have to invest a considerable amount of your income apart from savings. The best way to grow wealth is investing in the stock market. Though risky, a proper plan can help you gain the best returns that most of the options available.

good