How should I track mutual fund portfolio – across schemes and AMCs – in one place? This has been a common problem expressed by many investors.

If you happen to have investments in just 4 mutual funds, that is, HDFC, Quantum, Sundaram and Franklin Templeton, you are going to have an interesting time tracking all these investments with multiple folios in one single place.

Add to that investments in the name of family members and you have got a multiplication of your tracking problems.

Is there a solution?

Of course, there is.

All you need to ensure is that your email id is registered with your mutual fund investments.

Here is a step by step process of how you can do this.

Step 1: Download the consolidated account statement from CAMS

If you have registered an email address in your folios across funds serviced by CAMS, Karvy, FTAMIL (Franklin) and SBFS (Sundaram BNP), you can use the CAMS Mailback Service to obtain a consolidated PDF Account Statement at your registered email address.

Please note that only the CAMS consolidated statement PDF can be used to make this work.

Visit the following link: http://www.camsonline.com/InvestorServices/COL_ISAccountStatementCKF.aspx

If the link doesn’t work, see the following video for an alternative path to download the statement.

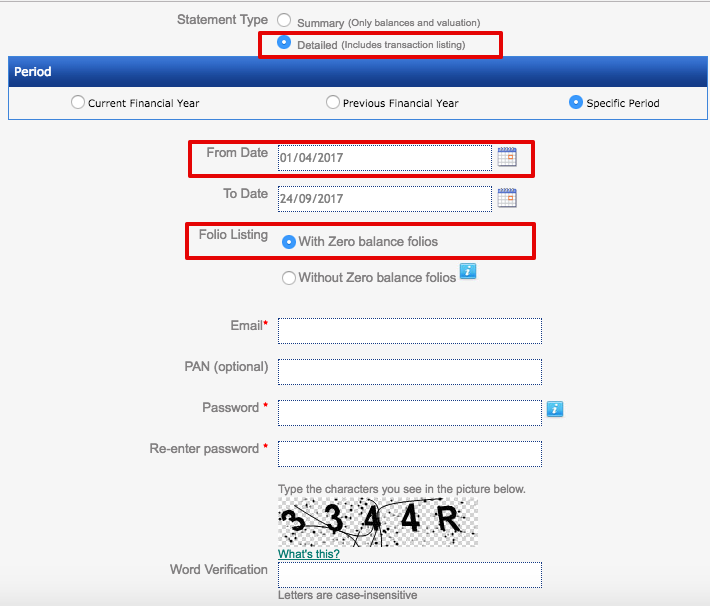

You will see a screen like this.

Select the various fields as suggested in the image and press submit.

You will receive a consolidated account statement in your email.

Please note: For reasons of security the statement will be encrypted using the password provided by you, and emailed only to the address provided earlier in your application form.

This service is linked to your email id. If you do not have your email id registered in your mutual funds, those transactions will not appear.

If you do not have an email registered with your mutual fund, here’s how to do it.

In case you registered multiple email ids for different mutual funds, then you have to download separate statements using each of the email ids.

Step 2: Upload and track mutual fund portfolio

Now, you can use several mutual fund platforms (new age fintechs) to upload this statement and see reports of performance, transactions and capital gains.

Another alternative that has emerged recently is that of MFCentral.com. It is an initiative of the 2 mutual fund registrars – CAMS and KFintech.

Actually, it is much easier to see all your holdings there. Read this note to know the details.

Did you add the feature of letting people manually add entries for investments that are not mutual funds? FD, bank account, cash, gold, etc.

No Kartick. Not yet. However, a consolidated figure of such investments can be added under My Goals for the purpose of Goal tracking. Thanks.

Hi Vipin,

If a person is not having any exposure to Mutual funds and if like to start Mutual funds in Direct Mutual Funds platforms like Unovest ,what are the things to be done in below cases.

case 1 : Resident Indian

case 2 : NonResidentIndian

Dear Vijay

Thanks for writing. In either cases, there are a couple of things that need to be done.

1. You should have a valid KYC with you or for the person who wants to invest in mutual funds.

2. You should have a CAN (Common Account Number). This is required to transact online through Unovest.

Both are 1 time actions and are highly useful.

To do your KYC, you will have to submit a form for individual KYC along with necessary proofs. The form is available on this link. https://www.cvlindia.com/downloads01.html It has the necessary instructions too.

For CAN, you may create an account with Unovest and then fill your CAN application online. You can then print it and send with the necessary documents attached.

To know more about CAN, you may read the post on this link: http://unovest.co/2015/12/mutual-funds-you-can-common-account-number-do-it/

Let me know if you have further questions.

Regards, Vipin

Hi,

How can i upload folios which serviced by karvy since reliance mutual funds investment made by me not shown in mycams application.

Regards

Srinivasan.k

Dear Srinivasan,

This probably means that your email-id is not registered in your reliance folios. You should raise a request with reliance to update your email id.

Once it is done, you can then download the statement again and upload.

Hope this helps.

sir

thank u for the suggestion given.

one more doubt.

i did ekyc using aadhaar based otp.

I got my CAN no now after registration using CAMSKRA.

Through unovest ,can i invest more than 50,000 limit .

regards

Srinivasan K

ph:9842092575

Srinivasan, the limit of Rs. 50,000 will be applicable for Unovest too. You should probably get your regular KYC done. In fact you can do it online through AMCs such as Quantum. Visit this link – ekyc.quantumamc.com.

Thanks

SIR,

I PURCHASED Franklin India Smaller Companies Fund – Direct-GROWTH UNITS THROUGH FRANKLIN TEMPTON WEBSITE ONLINE. BUT SITE SAYS REDEMPTION BANK ACCOUNT & NOMINATION DETAILS CAN ONLY BE SENT PHYSICALLY THROUGH POST.

NOW I MAPPED MY CAN NO WITH THAT FUND.

WHETHER THE BANK ACCOUNT & NOMINATION DETAILS UPDATED THERE WITH THE CAN DEFAULT BANK ACCOUNT AND NOMINATION DETAILS GIVEN BY ME.how to verify that one.

KINDLY CLARIFY THIS ONE.

REGARDS

DEVAKI K

PAN NO:EHMPK3308A

PH:9842092575

To verify, you can request an account statement from Franklin and see if the details are reflecting there. Thanks

I already have CAN and payeezz facility with MF Utility.

1) If I use your service to purchase some Funds ….how do I make the consolidated payment ?

2) Do I make a payment through your platform?

3) Does the payment get routed through you, or directly to MF Utility OR AMC?

4) If I am making payment through your platform , can I use Netbanking to transfer funds from my account?

5) Do I receive a physical MF certificate from AMC or will it be a virtual online statement?

Dear George

The transaction backend at Unovest is integrated with MFU. The final consolidated payment is made to MFU escrow account which then transfers the money to the respective AMCs. Unovest is only a facilitator in the process.

Hope this clarifies.

Thank you

I was previously investing in ‘Axis Long Term Equity Fund – Regular (Growth)’ through ‘NJ India’. This SIP was active from April 2015 to June 2016. Then I stopped that SIP and started a SIP in the Direct Plan through the Axis Mutual Website. When I downloaded the CAS from CAMS, the folio number of the SIP done through NJ India is not being shown in the statement. NJ India is holding the mutual fund units in DEMAT form. As per CAMS, mutual fund units held in DEMAT form is not shown in the CAS. Please guide as I want to map both these folios with Unovest and start investing through Unovest at the earliest.

Hi Jose

You cannot do direct plans with a demat account / units. For this you have to first remat them to Statement of Account.

Here is the process:

For reconversion to physical mode as SOA

Ø Obtain REMAT/Re-statementization Request Form (RRF) from your DP.

Ø Fill-up the RRF completely and sign by all holders.

Ø Submit the RRF with your DP.

Ø After due verification, the DP would register the request at his end and send the RRF to the AMC / RTA.

Ø The AMC / RTA after due verification will confirm the conversion request to your DP for extinguishment of such units from your DMAT account.

Ø AMC/RTA will issue normal mutual fund statement of account confirming reconversion to physical mode for your record.

Once the conversion is complete, you can download your CAMS statement again and upload on Unovest.

Hope this helps.

Thank you for the prompt reply. Alternately, can I hold the units for 3 years since every installment will be locked in for 3 years anyway? Once the lock-in period gets over, I will gradually redeem the free units through SWP option and then invest in the direct plan through Unovest. Request your view on the same.

I still have to apply for CAN. I have few questions as below.

1. Will any number of transactions (lumpsum, SIP, redemption, SWP, STP) in direct plans of all mutual funds be free for life?

2. Is it ok if I convert the bank account registered with Payezz to a joint account sometime later in future? Will this have any implications with regards to transactions through Unovest?

3. Is printout of CDSL (CVL-KRA) KYC acknowledgment letter PDF copy valid as proof of KYC? If not, please inform which document is valid.

4. For proof of bank account, how many months statement is required? Is printout of PDF copy of the bank statement valid?

5. How many CAN’s can be registered with a single account?

6. For someone opting for the free service, is there any monthly / yearly flat fees or any other charges for account maintenance?

Warm regards,

Jose.

Yes Jose, that too can be done.

1. Yes, any and all transactions will be free for life.

2. If you convert your bank account, it will be advisable to update your details to the CAN too.

3. Yes, the CDSL copy is valid as KYC proof.

4.The latest statement even for a month would be fine for bank proof. Yes, PDF print is also valid.

5. With a free account / Uno, you can have 1 CAN for transaction. With a Plus account, 3 CANs can be registered.

6. Free means free. No charges at all.

Hope this helps. 🙂

Ok. In case I convert my bank account registered for SIP with my existing folios into a joint bank account, do both account holders need to be KYC compliant? Or compliance of the primary holder is sufficient?

The KYC compliance is applicable for the CAN holders and not the Bank account holders.

Sir lets take a example, i have sip in 4 MF Houses, i uploaded the statement on unovest, what about the future translations, is the website will automatic add all the continue transaction or i have to again upload the statement for next month scheduled translations

Ajay, Unovest will have no way to track if the future instalments of your SiPs went through or not. There is no linking to Unovest of the transactions by the AMC.

Hence, you will need to updated the statement every time new transactions take place.

While uploading the external portfolio pdf , I am getting pan not found.

However I am providing pan details while generating pdf.

Also my pan details is upto dated to all portfolio.

Try without putting PAN, just the email.

I had not used UNOVEST for a long period. Now I want to subscribe But I am unable to , since the screen does not move

Are we to provide our password which we use to open our gmail account or any other password can be created for this.

Please reply.

Any password can be created.

Hi. Unable use this track mutual fund portfolio feature and getting the message “This site can’t be reached”. May I know whether this feature is currently available or no more.

Also, not sure whether this is done in a secured login or simply and if it is without a login, may you please explain how the data uploaded is secured?

I had used your portfolio report facility sometime back ; but I am not able to log in , now; I would like to upload CAMS statement and get the portfolio report.

Is there a payment to be made ?

Can you please re-activate my log-in,

Unfortunately, that service doesn’t exist anymore. There are several platforms out there that can be used for the same. In fact, the MF industry has come up with mfcentral.com where you can see your entire portfolio together without needing to upload anything.

MF central gives absolute returns. I would like to calculate xirr based on consolidated statement which I am not finding anywhere. Can you help?

You can find several online tools where you can upload your CAS statement and see detailed reports including XIRR. Valueresearch has such a tool. If you can list all your transactions in a spreadsheet, then you can set up a XIRR formula to see the annualised return.