The top question on any investor’s mind is “what’s the return I can get?”

I wasn’t surprised when recently an investor told me that his investment strategy was looking at past 3 year and 5 year returns of a fund and invest in the top ones.

Now, you WILL look at past returns, there is no doubt about that. The latest 1 year, 3 year or 5 year returns play a significant role in determining which fund will get your money.

But can we do this past performance evaluation in a better way?

Because the numbers you are looking at – the past 1 year, 3 year or 5 year and available on most websites including the fund house website are trailing returns. They are anchored to the date on which you are looking.

The question is if trailing returns is the most relevant measure to evaluate a mutual fund’s performance?

Should it be the basis on which you invest your money?

Let’s examine these questions.

The world of Trailing Returns

So, with trailing returns you will get to see a 1 year, 3 year, 5 year, 10 year or since inception returns of a mutual fund. If you had invested exactly 1 year, 3 year or 5 year or at the inception of the fund, trailing returns would tell your annualised return over that time period, anchored to the current date.

For example, if today is June 1, 2021 and you are looking at 3 year return, it would be calculated as a difference between the NAV as on June 1, 2018 and June 1, 2021. The result would be annualised to get the average yearly return.

A quick illustration:

| Date | 31-May-2021 |

| NAV | 94.444 |

| Past Ref date | 31-May-2018 |

| NAV | 64.41 |

| Return (Annualised) | 13.6% |

However, trailing returns measure performance for just one block of time and in that sense they suffer from a recency bias. If there has been a recent great performance of the fund, say in the last 1 year, it can skew the overall annualised results.

In fact, if you were to move your anchor date 1 month here or there, you could see a completely different picture for a fund.

With trailing returns, you can see a super 1 year performance but a not so good 3 year or 5 year performance. As an exercise, look up the past returns for any of your favourite funds.

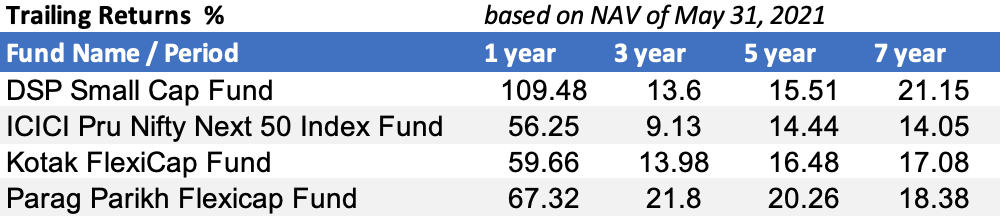

Here are some examples:

What do their trailing returns tell you?

While you figure that out, let me share what they don’t tell you.

The problem with trailing returns is that it gives you a very straight line view of the past. If you invested 3 years ago, your returns today would be x or y or z%?

The reality is quite different. Equities are volatile which leads to the risk of prices going up and own affecting your portfolio value. See this actual NAV movement for our example fund

To earn that 13.6% annualised return over 3 years, this is the journey your investment would have made.

When you looked at that return number, you didn’t see that, did you?

Another thing is that you are unlikely to be someone who has invested just once – a lump sum. You are likely to invest over a period of time, as cash flows become available and not just one time.

Your mutual fund performance measure should take this fact into account too. No?

So, yes trailing returns are not perfect.

How to overcome these shortcomings of trailing returns?

Enter the world of Rolling Returns

That is where Rolling Returns come into picture.

The idea behind calculating rolling returns is to measure not just one block of 3 or 5 or 7 year period but to take several such blocks of 3 or 5 or 7 year periods at various intervals and see how the fund performed over those periods.

So, while with trailing returns you would take just a 3 year period ending today. With rolling returns, you would take many such 3 year periods over the history of the funds.

So you keep shifting the end date by say 1 day and you will have, say for a 10 year old fund, about over 2500 3-year data points. Now you will see a better picture of how the fund performed across these 3-year periods.

You get the point of rolling? It is the interval or frequency for which you calculate the returns.

You could calculate rolling returns for 1 year, 3 year, 5 year, 10 year, 15 years with rolling intervals or frequency of 1 week, 1 month, 3 months, 6 months, 1 year, 3 year, 5 year, so on and so forth.

When you do this you would measure the consistency of performance of the fund better.

You can look at for how many of the observed time periods did the fund deliver positive returns as well as negative returns right through the history of the fund.

Let’s look at the rolling returns of the some popular funds. All observations are on daily rolling intervals.

Making sense of it-

- The Maximum return is the one that you get when you are extremely lucky. For each of the time periods, it shows the maximum that one could have got.

- The Minimum return is the one that you got if you were extremely unlucky.

- The Average return is the Median here, that is, what most of us investors are more likely to get.

- The Volatility (as measured by Standard Deviation) helps you understand how near or far the NAVs have moved from the mean average over that period. See the ups and down graphs for reference.

- The Negative return periods or the Loss Periods show in how many times in that rolling return period did an investment in the fund lose money. A 0% means that the fund has never given loss in that rolling period.

With volatility and negative return periods, you can get a sense of the risk associated with the fund.

The next set of rows brings to you the % of times that returns fell in various ranges for that rolling period.

Let’s look at a few more funds.

To me, rolling returns present a comprehensive picture of past performance than trailing returns.

With rolling returns, I can see a range of performance across blocks of time. They thus appropriately capture the fund’s behaviour and help me make a correct assessment about the fund.

So, henceforth, you may want to calculate and use rolling returns when evaluating your mutual funds.

Where should you find rolling returns for mutual funds schemes?

There are several online options today. But I must tell you about Unovest’s own rolling returns calculator too.

As a part of Unovest 2.0, we are putting together mutual fund information in a way that it brings out a comprehensive true picture of any fund scheme.

Interestingly, for the performance section, we will use only Rolling Returns. The above screenshots are all from there.

Now, currently the access to Unovest 2.0 is only by invite.

If you wish to get access to Unovest 2.0 and be a part of the progress we are making, all you have to do is to show your interest.

Use the Google form on this link type in your email ID (only 1) and we will send you an invite.

Between you and me: What’s your own take on rolling returns as a performance measure? Do share in the comments.

If our time horizon is 10 years n can take very aggressive risk , even then we should include large cap mutual fund in portfolio or simply include multicap n mid/small cap mutual funds. What is the ideal mutual fund portfolio for sip of rs 12000/month for 10 yrs n high risk taking capacity

Dear Himanshu,

In my view, it is a personal choice. As long as you understand the associated risk and volatility, it is fine. Though a large allocation to mid and small caps is ideal only for the long term of over 10 years plus.

Multi-caps do invest in large cap too. Currently most multi-caps are positioned mostly towards large caps. But they can make a shift in strategy and move away towards other caps.

Hope this helps. Thanks.

Thanks for prompt .reply.

I am investing 2500 sip in each of the following funds :

Idfc premier equity

Franklin high growth

Franklin small cap

Icici pru value discovery.

My time horizon is 10 yrs.

I want to start additional 2500 sip in another mutual fund . I am wondering whether I should invest in large cap fund such as HDFC 200 (THOUGH IS HAS NOT PERFORMED , BUT MR PRASHANT JAIN IS CONFIDENT OF CYCLICAL REVERSAL) OR DSP BR MICRO fund

Let me add to the information for your decision. On the risk return spectrum, the two funds are on two different sides. What do you want to add to your portfolio?

thanks for prompt reply again. I am asking expert guidance that whether it is advisable to keep large cap fund into the portfolio even if time horizon is 10 yrs . ok let me put up this way . Had it been you , where would you have invested additional 2500 sip into ?

regards

Perhaps its time for Unovest to provide such a calculator to compute rolling monthly returns. Thanks.

Dear Jai

Thanks for the input. Unovest will have it in due course. Thanks again.

Interesting. IMO, the number of data points for each period may also be included. a graphical representation showing each data point vs the return, with average ,min n max return lines will clearly show the volatility and performance . 2 sigma and 3 sigma calculations showing 95% and 99% probability of getting a specified return will aid potential investors to choose between funds.

Note: I am assuming that all returns shown are based on net NAV, net of expense ratios– I am curious, are you accounting for the steep fall in expense ratios based on SEBI’s directive?

how does one decide the frequency ie 1 day/one week/1month/1yr/3yr/5yr?If you are investing with say 10 years holding period in mind your frquency should be 10 years?

over what period of time one should view rolling return–from inception date to the current date? or how does one decide that?

1. can u calculate rolling return of portfolio consisting of several mutual funds?

2 If one is making random lump sum investment several times(not SIP), how rollong returns will be generated and interpreted?

3. Can one compare rolling returns of a fund against a bench mark /category average?

Since I started investing in mutual funds, I have always relied on trailing returns and didn’t know about the rolling returns. After reading this blog I came to know about rolling returns and their advantages of it. Maybe it was a lack of research from my side or the quality and in-depth analysis of both the forms of returns which are in your blog and this blog wasn’t available at the time when I started researching about mutual funds returns on the basis of their return. Looking at all the benefits of relying on rolling returns from now on I will use only it to check the performance of mutual funds not just in the 1, 3, or 5 years period but also in the intervals between this time period. This will help me to get a better understanding of the return that I will earn at the end of the time period I was investing for.