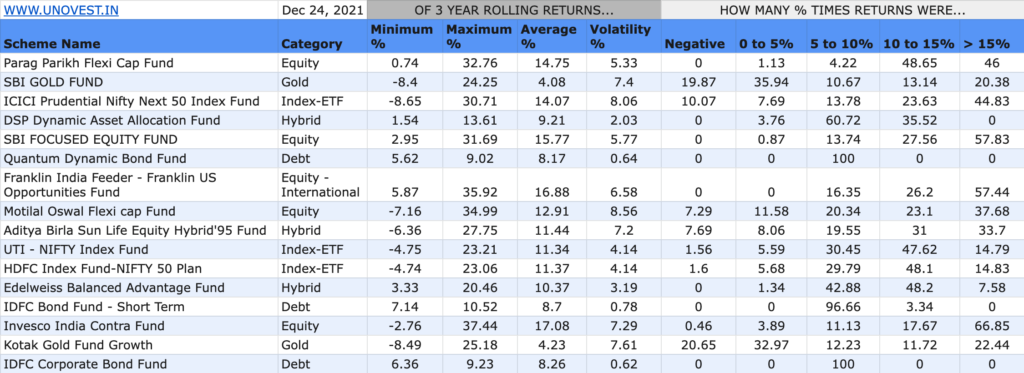

Take a look at the image below.

It lists some of the investment options from across asset classes (equity, bonds, gold, hybrid) with their 3 year rolling return summary.

If you want to see detailed notes and performance comparison for each of these, head to unovest.in. Log in (or create your free account) and check out these and your other favourite schemes.

Questions:

- How many of these are already in your portfolio? (I have just one)

- Which one of these (or others) are you likely to pick for your 2022 portfolio? Why?

- How much will you allocate to your picks?

Confused? Not sure? Want to know more?

Sure. Let me invite you for a free wheeling chat on building your mutual funds portfolio on Saturday, Jan 1, 2022, 4 pm to 6pm.

I will be taking your questions around investment portfolios, how to look at mutual funds, asset allocation, rebalancing and meeting your goals.

I know I am making this tough by choosing the 1st day of the new year. But what better day to make a start and a commitment to make your portfolio work harder.

So, quickly, register your interest here and let’s make a great start to the new year with clear thinking and a focused portfolio.

Plus, break a lot of myths on investments, portfolios and getting behaviour alpha.

This is what Onkar Kanade says after attending the previous virtual session on Financial Planning:

I have been following your blogs for a couple of years & they have helped me make prudent financial decisions. The session on financial planning was equally enlighting. It not only helped in giving a structure to personal finance but also helped in devising a roadmap to achieve our financial goals based on the existing investment data. Please keep up the good work. It always helps to have an unbiased view on your side. Thanks!

The session will not be recorded so it is best to attend it as it happens.

The meeting room link will sent via email at 3PM on Jan 2, 2022.

—

The trouble is most investors do not know how to create a mutual fund portfolio that will help them to achieve their long-term goals. From these points, I have noticed that the concept of SIP has simplified the process to trade in mutual funds, like investing 1000,2000 as well as 5000 rupees as well as keeping a close watch on these schemes and updating you about their performance every month.