You may have been noticing that the more recent posts have been about how to get a better handle on our portfolio asset allocation. And why not?

Asset Allocation helps us reduce a lot of heartache while ensuring that the portfolio growth does not suffer as well.

You are probably also aware about the Asset Allocation Backtesting tool that I have been showcasing with some findings.

Sample this:

- You want to find out if index / passive investing would have done better?

- What about an international mix?

- Should you have 3 mutual fund schemes or 10?

- Do you need to take a lot of actions to make your portfolio succeed?

You can check it out all this and more with this tool.

Now, I am happy to share that the tool has come a long way.

With the backtesting tool:

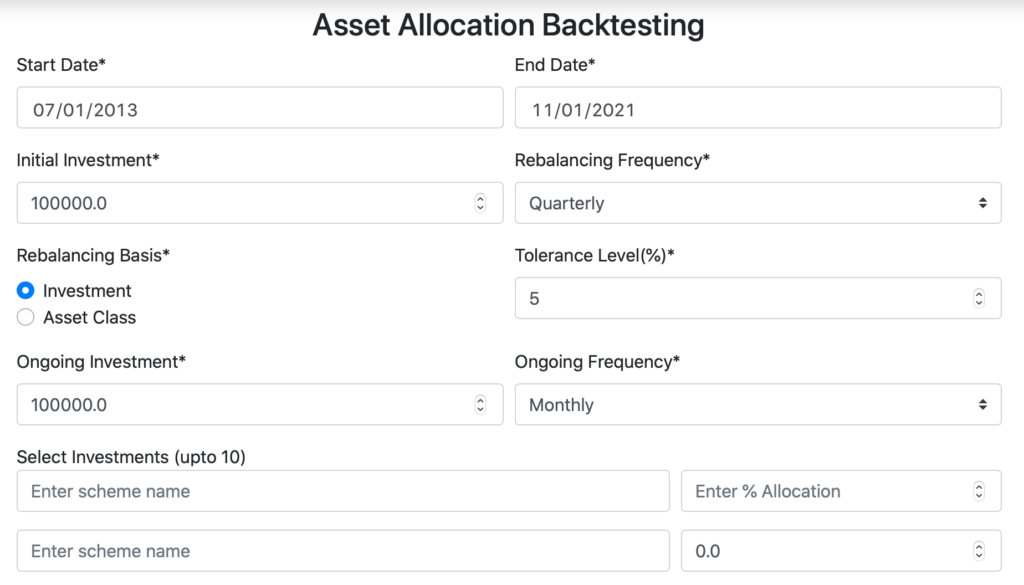

- Define your time period with a start and end date

- Assign an initial asset allocation to a select mutual fund schemes*

- Define tolerance level or a +/- range for this asset allocation, when no action will be taken

- Specify a rebalancing frequency

- Use a lumpsum as well as regular investment (such as SIP)

MF schemes come in several types and variety and can become a good proxy for most investment types.

And, when you run the backtest, this is what it tells you:

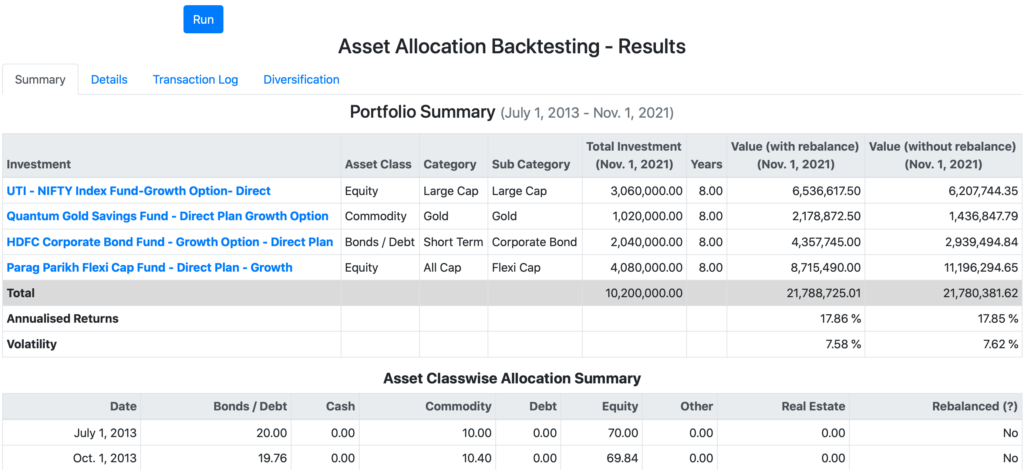

- A summary table with how much was invested in each of the investments and their current value; Also a total with annualised returns as well as how volatile the portfolio was.

- A Details table which gives you a breakdown of the portfolio for every rebalancing date

- A transaction table with all the transactions that happened over this timeline

- Finally, a diversification table, that helps you see if your choice of investment schemes are really make it asset allocation worthy or they are just “more of the same“.

All the above information is also provided for the non-rebalanced portfolio version – that is – if you had not done anything, no rebalancing, how would the portfolio look like.

Gives you a handy comparison and insights on how much action did you really have to take.

All in all, this tool should help you break a lot of myths about managing your investment portfolio.

Now, some parts of the tool are accessible to only premium subscribers.

However, this Deepavali, you can have it at NO cost. Just write to hello@unovest.co and we will be happy to activate the tool’s premium version for you.

It’s time to Light up your portfolio strategy with asset allocation.

Log in to unovest.in and start using the backtesting tool now.

And if it is not too much to ask, do share your findings with the tool.

All the best!

PS: If you creating your account the first time or using forget password, the activation email may land up in the spam box. All you have to do is to mark it as NOT SPAM and push it to the regular inbox. Thanks!

Leave a Reply