The stock markets are making all time highs. Many think – too fast, too soon!

All those questions are back –

- Should I stop my SIPs?

- Should I pull out money invested in my funds?

- Is this the right time to add more money to stocks?

- Should I buy gold/real estate?

Well, if you are asking these questions, you are only human.

So, what do we do?

First, the basics.

Investing success is about 99% temperament and only 1% about where you invest.

While there is no end to what all you can invest and all the hot ideas that keep floating around, the big question is how do you get yourself to behave in times like these.

As Richard Feynman said, “Your biggest enemy is yourself.”

That’s where mental models come into picture. Think of a mental model as a predefined thinking guide – not a shortcut to cut corners.

It is something that helps take off the cognitive load from your brain and makes action possible. It makes you behave!

As far as investing and wealth is concerned, that mental model is Asset Allocation.

I don’t need to say a lot about it. Just see this.

How is Asset Allocation a Mental Model?

It is.

First, it’s a FOMO antidote.

At any point in time, it is hard to know what is the best investment. Asset Allocation allows us to take a piece of everything that is worth investing in and let the magic of cycles work itself in.

You rebalance over time, to see that you actually were able to benefit from all asset classes. No need to wonder where the markets are, or if something is very expensive to get into or get out of.

Next, it encourages prudence, risk management and good investment practices.

The idea is to allocate to various types of investments. Some highly volatile, some less. Some wealth builders, some wealth protectors. Some active, some passive. There is a place for all things. It helps you diversify.

As you rebalance, you tend to buy low and sell high, booking automatic profits and thus bringing in prudence to your actions.

Next, it acts as a cushion from the impact of unknowns.

We live in a VUCA world. Volatile, Uncertain, Complex and Ambiguous.

Asset Allocation alone can save you a lot of heartburn when things become topsy turvy – COVID, wars, climate change, you name it.

In fact, when you asset allocate, you humbly acknowledge “I don’t know everything”.

With a diversified portfolio, you always know that there is one portion that you can find your comfort as the other ones work towards long term wealth.

Next, it gets you to act.

Since it is driven by rules, the mental load of making decisions goes down dramatically. You have to rebalance periodically based on the rules you have set, without getting mixed up in your emotions.

Finally, Asset Allocation gets you Behavioural Alpha.

Well, individual investments may or may not have alpha. But when you manage your behaviour well, that alpha is more or less assured.

You don’t pull out of markets when they touch all time high. You don’t stop SIPs. You invest when there is blood around. You calmly move from one asset to another, without a fuss.

Now, the specific questions.

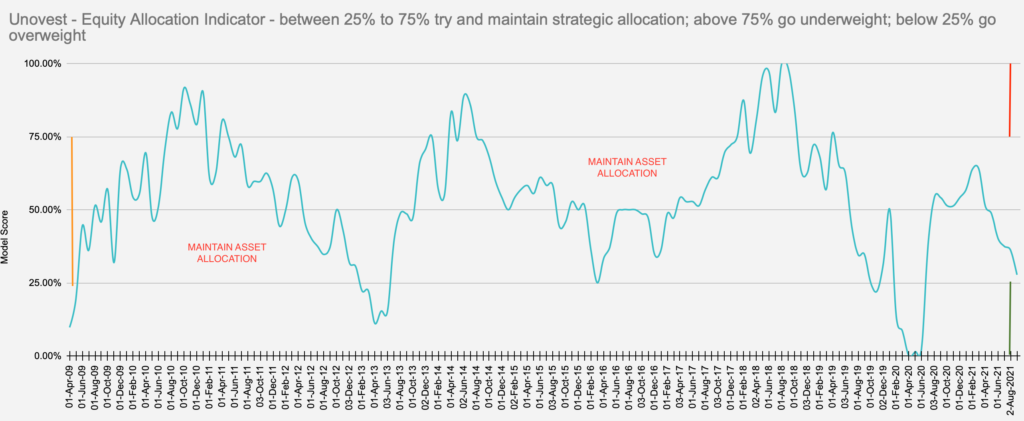

To answer them, let’s bring in some objectivity here with the Unovest model. .

Even thought markets may seem to be at all time highs, our investment model tells us to continue investments as per allocations.

Read more about this model here and here.

Quite simple –

- Do not stop SIPs.

- Sell only the portion of the money that you need or to rebalance to your original asset allocation.

- As far as the lumpsum investing is concerned, it will depend on what kind of a stomach you have!

- If your asset allocation permits, real estate / gold are not ruled out too.

Basically, behave!

What’s your mental model for guiding your investments?

If you don’t have a model for yourself, why don’t you try it out at unovest.in.

Even if you have one, it would be interesting to know the possibilities.

Under the analysis section, you can use various mutual fund schemes (equity, bonds, gold, cash) to backtest several variations and find out, what kind of investment allocation and rebalancing rules may work for you.

Not just that, you will also realise how peaceful investing can be with the only thing to work on is our behaviour.

Do not forget to share your findings.

If you need any help in understanding, please do reach out!

Whatever you do, don’t let it take away your sleep.

Leave a Reply