If you have been following this blog for several years, you have also read the back stories for most of the popular mutual funds of the time as well as some of the non popular ones.

Be it from the old biggies like HDFC MF, ICICI Pru MF, Aditya Birla SunLife MF or the smaller ones like PPFAS MF, Motilal Oswal MF and Edelweiss MF!

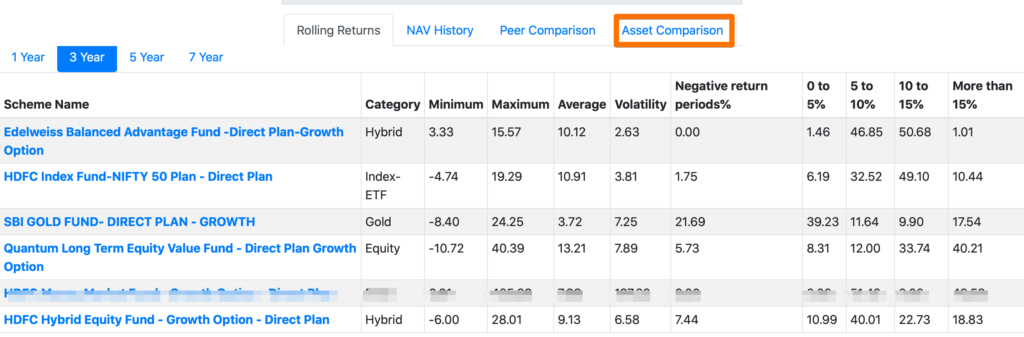

I am sure we all realise now how important it is to look beyond the advertised numbers and see what makes the funds really tick or not.

Advertised – Trailing returns based on current date or best performance.

Reality Check 1– Is the fund performance ‘a stroke of luck’ or it is more consistent?

Reality Check 2 – Does the fund have a defined working strategy or does it have some ‘universal’ luck?

Reality Check 3 – What could be better alternatives compared to a fund? Within its peers?

Reality Check 4 – Did it take on more risk to show the returns it has? Would I be better off with a debt fund instead of an equity fund?

A whole new perspective!

All this and more is now showing up in Unovest 2.0.

Some of you have invited yourself to have an early look. Frankly, that was really early.

Things have progressed in the last few weeks.

When you check in now, you will see a far more comprehensive picture of your funds including some unique categorisation and comparison.

A much better understanding of your funds.

This is not the end. There is more coming along the way.

Things that really matter to your portfolio. Things that will enable you to be a better investor. Things that will get you to your future goals.

Enough of the talk. Let’s go to unovest.in and see it.

As always, I await your feedback.

For peer comparison, it would be better if i can select funds across any category

Yes, that feature will come in too.

for example.. i cannot select axis Bluechip or say canara Robeco large cap when selecting Mirae Asset Large Cap