Everyone is worried about the way stock market indices are running up – from one high to another. Many are selling their investments. But what are the experts doing?

When I say experts, I refer to the mutual fund schemes which have a stated strategy of lowering allocation to equity when the market valuations are excessive.

Typically, this is the forte of Dynamic Asset Allocation or Balanced Advantage funds.

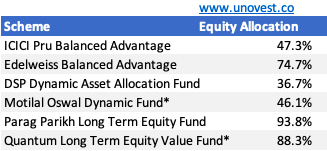

Let’s take a quick look at the table below.

The allocation is only for unhedged, long term equity holding and does not include arbitrage. The allocation % for Motilal Oswal Dynamic Fund and Quantum Long Term Equity Value Fund is as of Oct 31, 2020. All others are as of Nov 30, 2020.

I took some of the schemes across the spectrum to understand how are different fund managers thinking or, in some cases, what is their model suggesting.

You need not be surprised to find Parag Parikh Long Term Equity and Quantum Long Term Equity Value Fund as a part of this list. Both have a known bias for holding cash. In the past, they held as much as 30% of the portfolio in non equity.

As you notice, there is no consensus on the state of the markets or how the models of these funds interpret the markets.

In case of dynamic allocation funds, a pro cyclical, trend following model from Edelweiss MF has over 70% in Equity. In contrast, an aggressive ICICI Pru Balanced Advantage, is at less than 50% equity allocation.

This is definitely lower than the equity allocations these schemes had a few months ago. For example, DSP Dynamic Asset Allocation Funds’ long equity exposure was above 60%.

On the other hand, a known conservative fund such as Quantum Long Term Equity Value Fund is at 88% (as of Oct 31, 2020). Even Parag Parikh Long Term Equity, a valuation conscious fund, has more than 90% allocation to equity in its portfolio (as of Nov 30, 2020).

Now you see dynamic or balanced advantage funds have a role to fulfil for their investors. They need to minimise drawdowns even at the cost of lower returns. That’s the primary expectation any investor has of these funds.

Read more about Dynamic Asset Allocation Funds

Having said that, the allocation in these funds can be a good indicator of how frothy the markets are, if at all.

The other equity funds are, of course, equity funds and they will tend to keep a fuller allocation to equity.

What should you do?

No doubt the experts have left you confused. So, what should you be doing?

Before you can answer that, you have to answer what is the allocation that works for you? If your target portfolio allocation not equities is 50% and the current allocation has become 60% may be time to reduce it a bit and rebalance.

However, if you are still building up your allocation to the desired level, then this may not result in anything substantial.

In most portfolios, I work with, the equity allocation is already less than 50% .

Tactically, it does sound enticing to book some profits and use it to deploy back later, if and when, markets fall. But history has told us that it can’t be done perfectly.

At extreme levels, you will be seized by the then market situation and not take action. If you reinvest only when things normalise, well, then why bear the exit loads, capital gains and the accompanying stress.

Of course, there is a question of seeing the RED in the portfolio. Frankly, if you are not ready for the colour, then you should not be in equities.

Then there is the question of what type of fund you are invested in. If your fund already has provisions to reduce/increase equity allocation based on its own model/mandate, then you needn’t duplicate the action. Let the fund’s model dictate the allocation.

The simple bottomline is that you check your portfolio allocation, decide your comfort level and if things are out of line, then take any action.

Investing success is about managing the mind more than the money.

Between you and me: How have you changed you investment portfolio in recent months? Do you plan to take any action based on the markets?

Read More: Is your portfolio ready for a market crash?

Hey great piece of work

but had one question

As in current market scenario the overall equity portion in the portfolio has almost doubled

so is it time to cut off equity and add to debt and gold

what is your suggestion?

Thank you

What rules have you set for rebalancing? Broadly, if equity has crossed your intended allocation, you should rebalance.