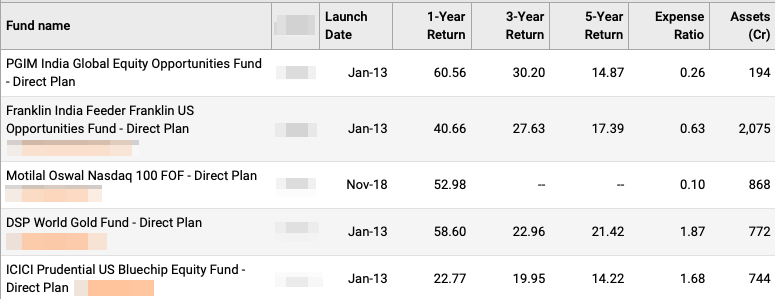

PGIM India Global Equity Opp Fund – Naam to suna hoga! The fund has been hitting the roof with the stupendous returns putting all other international themed funds to shame.

This is how a lay investor sees it.

“Why didn’t I hear much about this fund before?”

That’s where it gets interesting.

As per the Investment Objective stated on the underlying fund’s website:

…seek long-term growth of capital. The Fund will seek to achieve its investment objective by investing primarily in equity and equity-related securities of companies located around the world. The Fund seeks to identify and invest in companies in the early stages of acceleration in their growth. The Fund considers diverse sources of growth for the companies under consideration. Sources of growth could include an innovation in technology, product, or service which disrupts the existing competitive landscape of an industry; a new product cycle or market expansion; acceleration in industry growth; an increase in the market for a company’s product or service; leadership in a market niche; or benefits of a company’s organizational restructuring.

“Low expenses, high returns, 10 year track record and a wonderfully crafted investment strategy. I am in awe“, you say to yourself.

But you know this wasn’t the case always.

When the fund was launched in 2011, it wasn’t the global equity opportunities fund it is known as today. It started life as a Global Agri Business Offshore Fund, under its erstwhile owner DHFL Pramerica Mutual Fund. Agri was a hot theme at the time and several funds were launched in India to capture the momentum.

The investment objective of the fund was :

The scheme seeks to generate long-term capital growth by investing predominantly in units of overseas mutual funds, focusing on agriculture and/or would be direct and indirect beneficiaries of the anticipated growth in the agriculture and/or affiliated/allied sectors. (you can still find it mentioned on the fund’s page on ValueResearch)

Unfortunately, it failed to produce the desired results for the investor. In Oct 2018, the theme was buried and the fund shifted focus and got a new name to go with it – DHFL Pramerica Global Equity Opportunities Fund.

When PGIM bought out DHFL’s stake in the fund house in 2019, it came to be know as PGIM India Global Equity Opp Fund.

Sorry to ruin a fund with pedigree and experience story!

This should set the stage for you to evaluate the fund afresh. Let’s get into what the fund is all about now.

Where does the PGIM India Global Equity Opp Fund invest?

The PGIM India fund is actually a feeder fund. All the money collected here is invested in the PGIM Jennison Global Equity Fund domiciled in Ireland. This PGIM Jennison fund was started in March 2017.

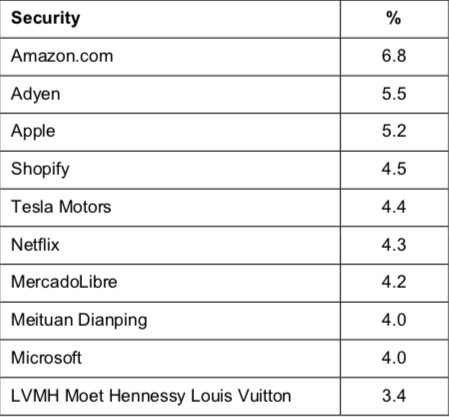

The PGIM Jennison fund then invests the money in a globally themed portfolio with the investment objective mentioned earlier. Note that the PGIM Jennison fund is an actively managed fund.

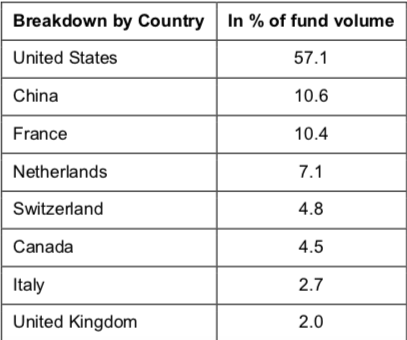

The fund aims to hold about 50 securities from around the world. However, the portfolio suggests that there is a US bias with over 50% of the exposure and is likely to remain so. Yet, a global fund instead of just a specific country is an appealing fact.

Consumer cyclicals, Technology and Communication Services form the 3 largest sectoral exposures of the fund.

What are the fees, expenses and applicable taxes?

There are 2 levels of expenses in the fund. The local India Fund charges 0.26% for the direct plan.

The underlying feeder fund – PGIM Jennison Global fund – expense ratio was 0.87% (source; MorningStar Ireland Website, dated Jan 2020). As per the Scheme Information Document, this was 0.84% as on March 31, 2020.

Note that the returns that you see of the PGIM India Global Equity Opp Fund of Fund are net of all expenses.

Next is taxation. Since this is a fund of fund structure, the applicable taxation is that of debt funds. After 3 years of holding, you get to use Cost Inflation Index and pay flat 20% tax on reduced gains.

What’s the verdict?

PGIM India Global Eq Opp Fund has found itself at the right place at the right time. Technology stocks have had a dream run in the last couple years sweetly coinciding with the point in time when the fund decided to change its skin from Agri to Any Equity.

Imagine, if it was still an Agri Business commodity fund?

The fund is a recent convert. While the global theme is definitely a plus, it need a watch (at least another 3 years) to see where it stands and reveal its true colours.

Between you and me: Are you still pulling out your wallet? Do share your thoughts.

Read more about: Franklin India Feeder US Opp Fund of Fund

Read more: Motilal Oswal S&P 500 Index Fund

Hi Vipin. Liked the narrative. Just adding some information for interested investors who read this page – total expense ratio for the fund now stands at 2.25 (both underlying and FoF combined) as per September update emailed to investors.

Sure. Thanks Manish.Looks like they are making the most of the upside.

Very nice coverage would love to read any updates regarding the same