Tax free and guaranteed returns has always been a crowed puller with investors. In these uncertain times, it acquires the form of ‘Amrit‘. So, if one tells you that you can get a neat 5% to 6% guaranteed rate of return, tax free, changes are you will salivate.

Well, this is how our today’s product – HDF C Life Sanchay Plus – is pitched.

“Better than a Bank Fixed Deposit.” Seriously!

For the past many years, Bank FDs have faced an onslaught from every corner. The current opportunity looks perfect.

FD returns are now sub 5%. They are taxed too. HDFC Life’s financial consultant, I was talking to, went even further. “The money you put in FD, as you know, is swindled away by big industrialists and is not as safe.”

Beat that!

“In contrast, any contribution you make to HDFC Life Sanchay Plus gets you a tax benefit. It gives you a guaranteed, tax free return. The maturity amount is tax free too.”

Are you salivating?

Some are. I received multiple queries about the product so I decided to find out. I went through the online brochure (it’s a torture), looked at illustrations shared with me and even spoke with the HDFC Life financial advisor.

Frankly, if you were to decide on an investment based on how easy to understand it is, this one should be ignored right away.

Still interested? Go ahead and read.

So, what’s the construct of the HDFC Life Sanchay Plus plan?

You pay a certain amount of premium for a limited no. of years and then you receive either a guaranteed maturity payout or a guaranteed income or a combination of both.

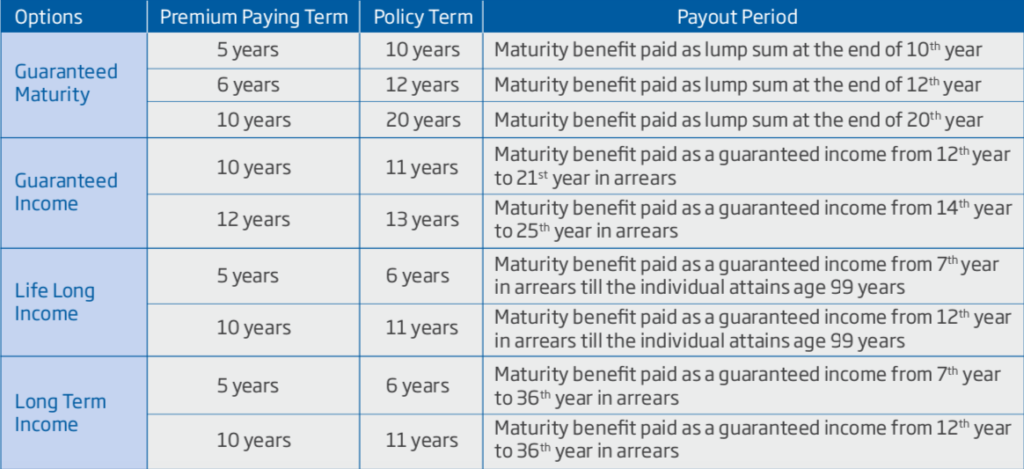

You can choose one of the 4 options:

- Guaranteed maturity plan with 5, 6 and 10 year premium paying terms and a policy term of 10, 12, and 20 years respectively. At the end you will be paid a single maturity amount.

- Guaranteed Income plan with 10 or 12 years of premium paying terms and income payout duration for same number of years.

- Lifelong Income plan with premium paying terms as 5 to 10 years and incomes starting 6th year or 12th year respectively till 99 years age.

- Long Term Income (available only for 50 to 60 years age bracket) with premium paying terms as 5 or 10 years and income payouts starting subsequent till 99 years of age

The 3rd and 4th options are in the nature of whole life plans. They also have a final maturity payout.

All plans have a Death Benefit component, which we also know as Sum Insured. If the Insured dies during the policy tenure, the nominee can choose a lumpsum / income payout. But that is not the reason for which one should consider it.

The death benefit inclusion only makes the payouts tax free. That is not the reason to consider this plan.

As I have maintained, you should keep insurance and investing separate.

How does it fare against other investment options?

The Sanchay Plus plan is pitched as an alternative to Bank FDs. However, annuity and debt funds come close too. Let’s find out the differences.

How is it different from a Bank FD?

Bank FD rates may not remain at the current levels for very long periods. Quite likely, they will go down, over a 30 year period, they could go to 1 to 2% levels. Interest on Fixed Deposits is taxable as well, at your marginal tax rates.

However, Bank FDs offer full liquidity. You can withdraw your investment anytime, sometimes with a marginal loss of interest.

In contrast, you can always surrender the insurance policy but that will lead to shaving off significant value aka penalty. In early years, you are likely to get just a portion of the premium amount.

How is it different from an annuity?

When you take an annuity, you pay a lumpsum amount upfront to an insurance company, which ten pays you a fixed sum of money periodically. You can decide between various options. The best rate of returns is offered in an option, where there is no return of the principal investment.

Annuity income is also taxable as per your income tax bracket. In contrast, all receipts under the Sanchay Plus plan are tax free.

How is it different from a debt fund?

Debt funds come in various options too. If you opt for a long term debt fund today, it may not be as long as what is on offer with the insurance policy.

Additionally, debt funds are market linked and hence subject to interest rate risk and credit risks.

The taxation is not as high as Bank FDs. Assuming you hold a debt fund for long term (3 years plus), you pay long term capital gains tax post indexation. Over 3 years plus, this could mean about 0.5% of the returns eaten away by taxes.

It is quite likely that both the products – debt funds and the HDFC Life Sanchay Plus – may end up yielding the same return, post tax.

So, why should anyone consider it?

Actually, the HDFC Life Sanchay Plus could make sense for those in the highest tax brackets (40% plus).

Preservation of capital and tax free guaranteed payouts are key points.

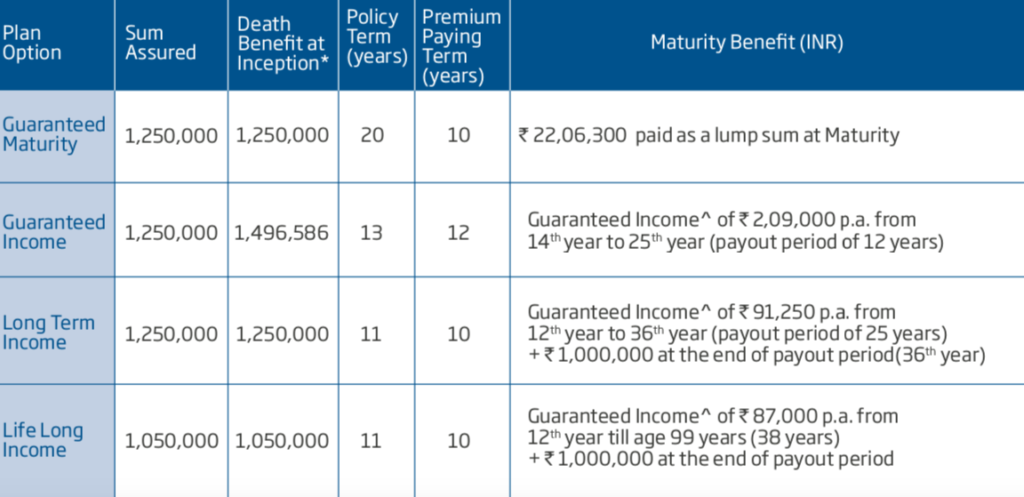

The rate of return is likely to be in the range of 5% to 6%, depending upon the plan. The life long income options end up offering a return closer to the upper bound.

This return calculation incorporates the fact that premium payments over Rs. 1.5 lakhs per annum enjoy a slightly higher return. In our analysis, those paying 5 lakhs and more in premium per year will enjoy an additional 0.1% rate of return.

For those buying online, the payouts go upto 103% of those stated in Benefit illustrations.

All in all, most investors are better off ignoring the Sanchay Plus Plan. Those in the highest tax brackets with extra money outside of goals, looking for a long term guaranteed tax free payout, may consider this after exhausting all other investment options.

Extra Note:

How is it different from HDFC Life Sanchay Par Advantage?

The HDFC Life Sanchay Par Advantage is what they call a participating, market linked plan. About 25% of the corpus of the plan is invested in equities to prepare for a grand maturity payout.

There is flexibility in the way you can structure withdrawals. You can even reinvest cash bonuses back into the plan at the prevailing government rate. You can withdraw money anytime for short term needs.

Actually, if I were to hazard a comparison, this one comes close to Hybrid Debt Fund (earlier misleadingly called a Monthly Income Plans) with upto 25% equity allocation.

An analysis of the plan using just the guaranteed returns (assuming 8% cash bonuses) gets us a lower than 5% annualised return over the lifetime of the policy. The carrot dangled to you is the grand final maturity payout.

If you do decide to buy this policy, work with your investment advisor. If you don’t know one, reach out to us.

One more comment, I would like to make it, direct buying given a big advantage over through HDFC bank or other intermediary. Further, if you are NRI you can save on GST, it gets refunded after filling a form. Lastly, we should keep in mind that our decision making capabilites will not be same at 65 yrs than at 55 yrs. If we take a 10 yrs plan, it is like 12 yrs FD. We get 180 % of origional amount tax free which is like an annuity for same period of time as we had paid in.

So I think a locked in 12 yrs FD compounded at 5.8 % and tax free at maturity is good idea. if one puts in 5K, he will get 40K pm at 12 yrs

Thanks for adding these points.

Can you please elaborate on how if I put 5k will get 40k at 12 years?

Are the yearly payouts tax free irrespective of the income slab of the insured? Also what is the benefit of buying the policy online?

Is the tax benefit applicable only to the final payout? Are the yearly payouts also tax free?

In my understanding, yes, all payouts are currently tax free under Section 10(10D) of the Income Tax Act.

Are the yearly payouts tax free irrespective of the income slab of the insured? Also what is the benefit of buying the policy online?