A mid cap fund is one which invests at least 65% of its monies in 101st to 250th stock by market capitalisation (SEBI’s definition).

The funds are free to invest the balance 35% anywhere else (large, mid or small). Large caps are the 1st 100 stocks and all others are small caps.

We also know that mid and small cap companies by nature are more volatile with bigger pains and gains. Over 7 to 10 years, they usually compensate for the pain they give, but it does test one’s patience.

Most investors bail out when the going gets tough.

Mutual Fund companies understand this behaviour. Now, they don’t want investors to panic based on market movements and retain the money for the long term. Of course, it helps them earn a higher fee too.

To address this issue, some mutual funds in the midcap category use large cap stocks to smoothen the return experience.

For example, just adding the HDFC Bank stock will make the portfolio and fund performance look better than other funds in the same space. Even today, you will see mid cap funds plastered with a Dmart, Bajaj Finance, Infosys or any other such company in their portfolios.

In comparison to such ‘deviant’ funds, the fund which is focused on the true mandate of mid and small cap space will almost always appear like a laggard.

The rating and ranking companies give highest weightage to past returns and that fund ends up appearing like a loser on the charts.

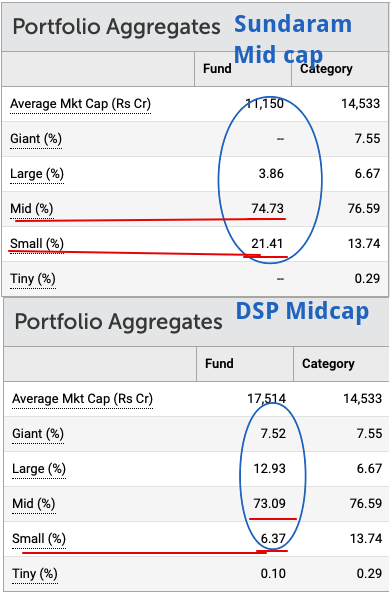

Let’s take the example of Sundaram Midcap fund. It is one of our recommended funds under the midcap category.

The fund has always maintained a focused portfolio. Its initial mandate (when the fund started) was not to invest in the Top 50 companies, basically the largest of the largest 50 as given in Nifty 50.

Even then, it avoided upto 100 companies. The revised SEBI norms made this a requirement for all mid cap funds (of course, upto 65% of the portfolio only).

Sundaram Midcap continues to maintain a portfolio deeper into the mid and small cap space.

See the image below.

For the purpose of understanding, I have compared it with another mid cap category fund – DSP Midcap Fund.

As you notice, Sundaram Midcap sticks to the mandate with regards to its exposures. DSP Mid cap has 20% exposure to large caps. Large caps are less volatile and can provide stability to an otherwise volatile portfolio. DSP Midcap has used the mandate available to hit to make the portfolio less volatile.

That’s good enough for DSP Midcap to stand in a brighter light than Sundaram Midcap.

But does that strictly honour the mandate we want as a part of our portfolio?

No. We want exposure to mid and small caps for outsized returns and we are okay with a time horizon required.

For the same reason of sticking to the mandate, Sundaram Midcap has constantly been seen as a laggard compared to others, specially over the last few years.

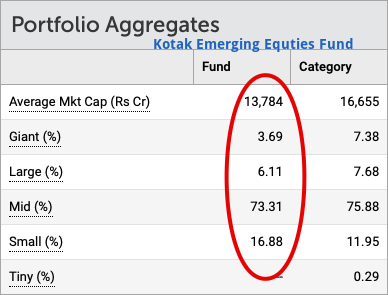

Now, you can probably come back and say – that’s all fine, but why can’t we look at another fund such as Kotak Emerging Equities – it is also ‘quite’ mid cap. It also seems to have done slightly better than Sundaram Midcap.

Of course, every fund has a stock selection and portfolio construction process and basis that they can be better or worse in their performance.

Yet, do I see a big reason to make the switch from Sundaram Midcap?

No. Unless you want that ‘smooth’ experience and a DSP Midcap (also a recommendation) starts making sense.

Should we consider hedging our bets by adding one more mid cap fund?

Probably!

Will that make the final outcome better?

I don’t know.

When we structure a portfolio, we usually want it in a way that gives us exposure to market caps as well as investment styles. Also pay attention to the underlying in the fund.

If you have a large cap fund / large cap oriented multicap fund, then using a midcap fund to add more large cap may only distort the allocations.

Stay safe!

Leave a Reply