Direct Stocks Investing attracts everyone. One of the things I am often asked is, “give me a names of a few stocks that I can hold for long term.”

Typically, the person asking the question already has investments in equity via mutual funds. Yet, it is not satisfying.

There is this deep desire to find something more rewarding, more valuable.

This is not hard to understand. Too many of us are enamoured by how a famous investor turned Rs. 10,000 to Rs. 1000 crore.

It has almost led to a belief that anyone can make it really big with owning stocks. It is easy!

I would not doubt that. The thing is that it is NOT easy. Actually, I will rephrase. It is simple but not easy. Here’s one example to prove my point.

Every one knows that Warren is one of the finest living investors as also one of the richest people on the planet. But how many know about the effort he puts in to his work.

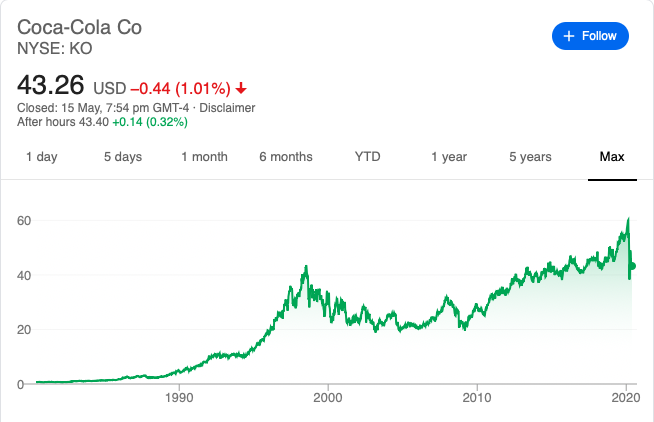

Here’s a sense of what he does. Before making his fabled Coca Cola investment in 1988, Warren Buffet studied 100 years of annual reports of the Company. Read it again – 100 annual reports. That’s what he needed to develop his conviction to invest 1 billion dollars to buy a 6.2% stake in the company, making it the largest holding in his portfolio at that time.

He still owns it, more than 3 decades later.

You may want to ask a question to yourself. As a direct stocks investor, how many annual reports did you read before making that investment?

That pretty much sums up the biggest mistake in direct stocks investing.

We buy the stock but we fail to own the business.

This leads to several related problems.

Confusing the ticker for the business

Most investors look at the stock price as the only input of their investment decision. They believe all relevant information is in the price. ‘Bhaav Bhagvan Che’. (Price is God)

The problem with this ticker based approach is that your views about the business will keep changing based on price movement. You will think you are wrong when price goes down and right when it goes up. The ticker becomes the proxy for actual business.

Some investors even buy into stocks just because they are cheap.

I am sure you are aware of the no. of retail investors buying into Yes Bank and Jet Airways, thinking they had become very attractive. You know what happened next.

While ‘bhaav bhagawan che‘ is certainly true for one set of participants, without putting it into context of the business, its intrinsic value, you are converting it into your poison.

No conviction about the business

The key point to note here is that when you own a stock, you own a part of the business. If you don’t understand the business, you will never have the right reasons of your own to buy/hold the stock. Not just that you will even fail to allocate right.

Position sizing sounds like a jargon but simply put it means you provide enough gun powder to your investment to allow it to make a difference to your portfolio. Yet, it doesn’t have to be large that you lose everything, if your theses turns out to be wrong.

Lack of long term mindset

Wealth creation happens when compounding kicks in. To make compounding work, you have to befriend TIME. That is unlikely to happen because you don’t know why YOU own the stock and hence you will never get time by your side. You actions will be determined on price action. You will sell out quickly for small gains or exit when you see a drop. In any case, you are likely miss out on long term compounding due to business growth.

You are unlikely to hold Coca Cola for over 3 decades. Nor an Asian Paints in India.

It’s the same mindset that made me buy into an IPO in 2004 and selling it immediately on listing. The only positive thing about it was I made enough money to buy a few more books.

At all times, your successes don’t come in one neat line. Notice the bumps in each of the charts.

The bouts of pain, sometimes huge, sometimes small, are an important ingredient of investing success. Unless you are extremely lucky, you can never escape them.

What does it take to succeed with stocks investing?

Let’s invert.

Start buying into businesses rather than just stocks. The day you develop a mindset of a businessperson, your investing success and the riches will be closer to you.

In another follow up post to this, we will note how to go about building your own stocks portfolio.

[…] Best Blog to read: The biggest mistake in Direct Stocks Investing […]