Quick quiz – Would you expect value funds to hold Hindustan Unilever Limited (HUL)?

Here’s the fact. While HUL as a stock is touching mind boggling life time highs, no value fund holds it.

In the past few years, we have reviewed a few funds through the Fundstory feature. The idea was to help you see the other side of mutual fund schemes – beyond the ratings and the performance numbers.

This is a good time to again take a stock of these funds, primarily those from the value category. Mind you, value, as a category, was formalised by SEBI only in 2018. Interestingly, some of the funds we reviewed, opted to be in this category.

Let’s begin.

First off, see the image below for a quick overview of value funds category.

download image for a larger view on open in a separate tab

Let’s take a detailed look at some of the funds that have your attention and money.

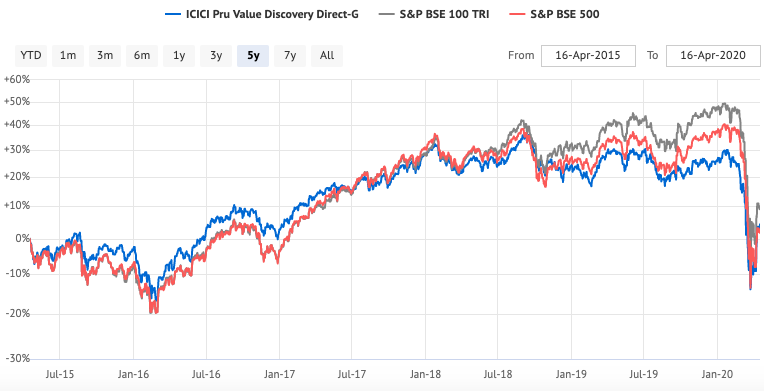

ICICI Pru Value Discovery Fund

The largest fund in this space continues to be the ICICI Prudential Value Discovery Fund. It gained its size as a top performer in the original mid cap avatar. In 2014-15, it started its transition to be a multi cap fund.

Why? Given its size, which at that time was similar to what it is now, the fund found it difficult to get adequate opportunities in the mid and small cap space. It had to include large caps too.

We had warned then that the fund’s performance will become muted and that came out to be true. Since the change, the fund has taken quite a beating. It kept enjoying money coming in due to the recent effect of performance on its numbers and investors’ mind.

Questions regarding its performance started to appear too. It does not carry the same heft as it used too. The AUM adjusted for the recent fall too is down.

The fund was already lagging and it fell another 30%+ in the recent correction of March 2020.

Thanks to the Pharma sector focus, its second largest exposure after financials, the fund recovered quite a bit, currently at – 20% (and probably the best) to show for 1 year performance.

The fund has one of the larger expense ratios at 1.39% for a direct plan and that too at its AUM size. The investors are putting up with a lot.

As a value fund, it continues to reflect a portfolio true to the mandate. The next couple of years should reveal if the fund continues to be a worthy investment proposition. It made a false start (when it changed to multi cap) but it may still redeem itself.

Aditya Birla Sun Life Pure Value Fund

Aditya Birla Sun Life Pure Value Fund is yet another value fund that got inordinate attention after its sky rocketing performance through 2014-15. As a mid and small cap focused fund, it enjoyed the attention and delivered too for quite some time. Investor’s money followed.

Starting 2018, it saw a reversal of fortunes. The mid and small cap space had a tumultuous phase which reflected in the fund’s performance.

In the March 2020 correction, it got its worst 1 year drawdown at -42%.

The fund still has 63% exposure to mid and small caps and the largest exposure is to Healthcare (Pharma & Drugs). The pain for this one may last longer, courtesy the market cap exposures.

The fund has dropped its expense ratio substantially since our last review. It is not clear if it is penance or an effort to create a positive perception.

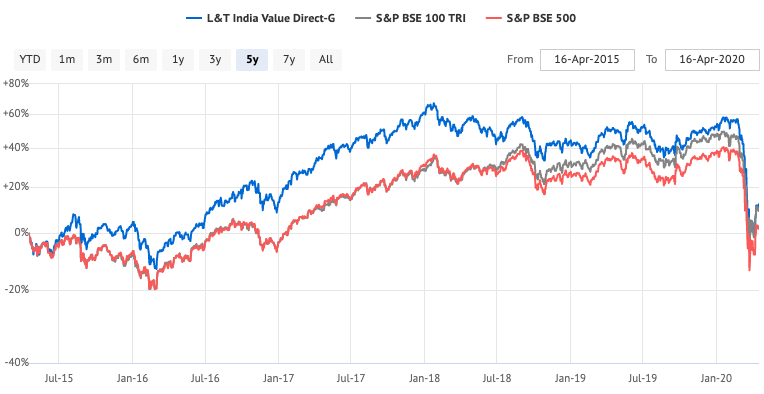

L&T India Value Fund

When we last reviewed L&T India Value Fund, it had undergone a few ownership changes but it did not let it reflect in the way it worked.

The fund has stuck to its mandate and style as a large and mid cap fund with large cap currently at 57% of the portfolio exposure.

It of course benefited from the 2014-15 market upturn but it also managed to stay above water after that, even post 2018.

In the March 2020 correction, it fell 35% (1 year drawdown), but courtesy the exceptional gains it made for itself earlier, it stands marginally taller than other funds.

The fund’s expense ratio is now at 0.91%, substantially down from 1.41% a few years earlier.

The funds top exposures are in Financials, Construction and Energy. This doesn’t look like anything that will help it recover soon.

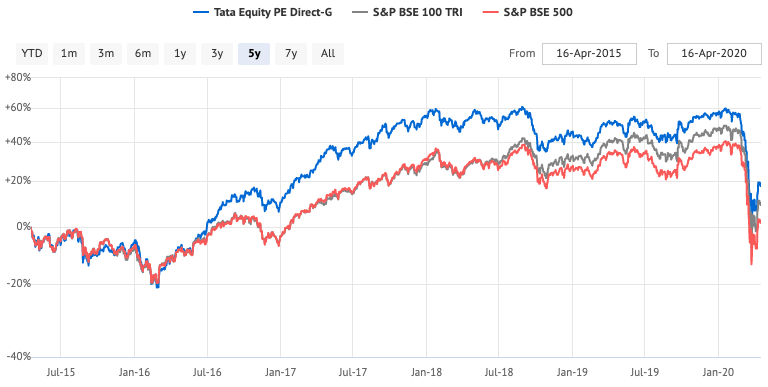

Tata Equity P/E Fund

One of the biggest surprises in this category is the Tata Equity P/E Fund. I have written off the Tata Mutual Fund for the mindless scheme launches and hardly anything to show for performance. But this fund has made itself noticeable.

The fund was a total laggard a few years ago with very little interest from investors. From 2016-17, it showed signs of a pick up. The fund’s bets specially with some large caps and mid caps paid off for it.

This interestingly coincides with the joining of a new fund manager, Sonam Udasi. We are not sure if the star manager effect is playing out here.

The fund drew investors as bees to honey and it grew in size, substantially. The current AUM is close to Rs. 3500 crores, the 3rd largest in the category.

The fund runs a focused portfolio with the current number of stocks at just 36. It is predominantly large caps with some mid cap allocation.

In the recent March 2020 correction, the fund had its worst 1 year drawdown at -33.5%.

The fund’s expense ratio is at 0.44% making it further competitive with respect to peers. With the current top exposures in financials, energy, automobile, FMCG, it appears that the fund is going to sail through the crisis.

Value investing can be treacherous. It ignores stocks that trade way beyond their intrinsic value (such as HUL).

The value fund remains beaten down as the index hurls past without giving the holdings of the fund their due. As this unfolds, investors loose patience and exit only to come back when the holdings have turned around and the new numbers look good. The only difference is that there is a fresh new demand on patience.

The cycle repeats as value funds don’t get valued enough.

Disclaimer: None of the above mentioned value funds are a recommendation to invest. Past performance is no guarantee of future results. Please consult your investment advisor before making any investment decisions.

My take – value funds need a lot of patience which most retail investors lack. Comparing it with a market cap based index isn’t going to help either. Therefore, I avoid.