In the process of financial planning, protection via insurance is one of the key areas that I look at. In almost all cases, the observation I make is – “You are underinsured.”

I am referring to the life insurance cover here.

Most individuals have a combination of traditional plans – money back, endowment, some guaranteed return product as well as ULIPs, pension plans, etc.

None of these were bought for insurance. The tiny insurance cover that these plans contribute is just a happy accident.

Now, of course, if you have not done your financial planning, it is very likely that you are underinsured too.

Don’t believe me. Believe the numbers.

How much life insurance cover do you need?

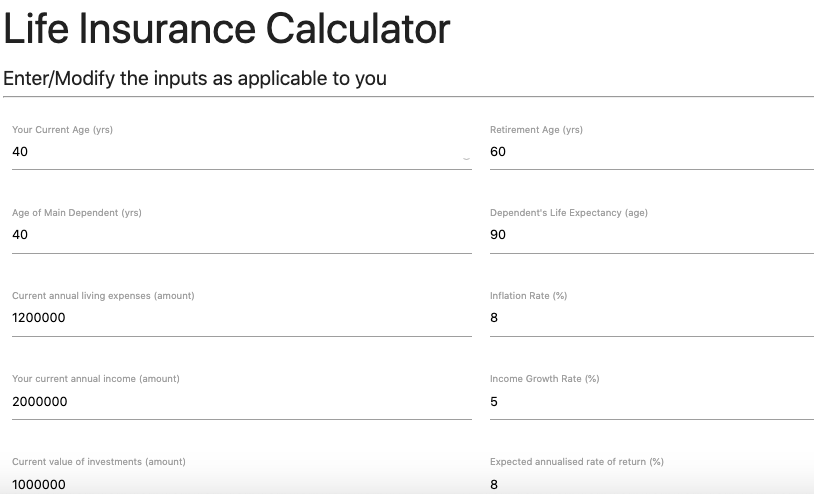

I present to you a comprehensive Life Insurance Calculator 2.0.

The 2.0 refers to the more comprehensive nature of the calculator than the earlier versions. Not just that, it also happens to be my first self coded app. (It feels great to share this with you!).

The calculator uses 2 methods to show you how much is your required insurance cover.

#1 Income replacement – if you were to continue earning till your ‘retirement age’, how much you would have brought home in all. It calculates today’s value of all those future incomes.

#2 Expense replacement – In your absence, your financial dependents still need to take care of living expenses, tuition fees, kid’s higher education, daughter’s wedding, repay loans or any other relevant goals. What is the amount they should get if something were to happen to you today? That’s what this method tells you.

I, personally, find the expense replacement method more relevant.

So, don’t remain underinsured! Remember you have to use a term plan only to buy your life insurance cover. Here’s one term plan product I covered recently.

If you do find it useful or have any other feedback, feel free to send across or post in the comments.

Between you and me: This calculator also happens to be my first self coded application of 2019. I had great fun doing it and I hope it is really useful to you.

Madness. My insurance cover for replacement of expenses comes to 72 Crore. Please tell me calculation is wrong

That’s crazy. What are your assumptions Nithin? Can you share a screenshot of the assumptions you made?