The world is uncertain and you see the proof of it on a daily basis. Yet, a lot of our retirement planning works under the assumption of certainty. Simple example. When it comes to investments affected by uncertainty (think equities), we simply assume one average linear rate of return for a long investment time frame. This is not how it works, right!

An uncertain world means we don’t know if equities will deliver now, later or never. We don’t know if we will face a few years of negative returns early in the investment journey, somewhere in the middle or just when we are about to put our money in the safest possible investments.

We don’t know. So, when this uncertainty is at work, how do you determine if your retirement funding is going to be enough for you?

Can you build several scenarios to see how will you fare in such scenarios?

Can you find out what is the likelihood that if any of those scenarios play out, you will still be living through comfortably, meeting your required expenses?

Can you find out if this uncertainty will eat up everything you have or you will leave behind something as a legacy?

You can.

Let’s accept one fact. There are no certain answers in an uncertain world. At best, you can work to find the probability of something happening. Today, we are going to work out some probabilities of whether you will lead a financial worry free retirement?

If that is not the case, at least you will get a fair idea of what will it take to increase your chances.

Let’s get going.

To begin with, you can download this Retirement Planning under Uncertainty excel workbook.

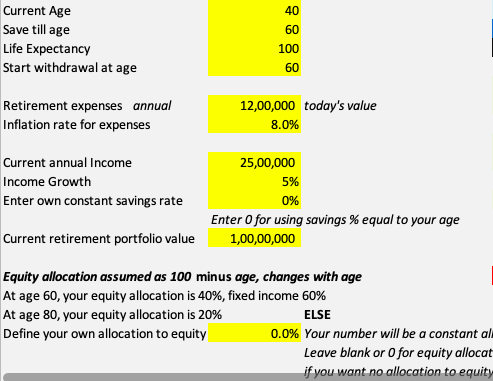

Open the sheet, and you will notice it is pre-filled with certain numbers. See image below.

You have to replace those numbers with what applies to you. (Input in the yellow coloured cells only)

The key input parameters are:

- Your current age

- Till what age do you want save/invest

- Life expectancy (how long should the portfolio serve you, 100 is a good number – PLAN FOR THE WORST)

- At what age do you plan to start withdrawing from your portfolio

- Expenses that you need to plan for (value as of today)

- Inflation rate for such expenses (you may leave this unchanged or increase it)

- What is your current annual income?

- What is the growth in income you expect? (be conservative)

- Your savings rate – Pay attention to this. The model that you are using is programmed to use savings as a % of your age. That is, if you are 35, your savings rate will be 35%, at 45 age, it will be 45%. This is a sound assumption as you are likely to take care of a lot of other things in your early life and more savings are possible in later years. If you want a standard savings rate for yourself, just input it ELSE leave it at ZERO for using savings % equal to age.

- Value of your current retirement portfolio

- Finally the asset allocation. We are keeping it simple with just 2 asset classes – Equity and Fixed Income. Again, the model is configured to use a thumb rule of using Equity as 100 minus your age. That is, at age 35, your equity allocation is 65%. At age 55, the equity allocation will be 45%. The equity allocation reduces progressively. At age 100, the equity allocation will be ZERO. If you wish to enter your own constant equity allocation, input else leave it at ZERO for automatic allocation as per age. If you don’t wish you to use equity, then input 0.00001 in the cell.

The asset allocation is used for your entire portfolio including existing.

The rate of returns are based on past observations. You may not want to change them. However, no one stops you from doing so.

Once you have finished entering these inputs, press Ctrl+S or Command+S to refresh the retirement planning under uncertainty model.

What are the chance I will have retirement, free of money worries?

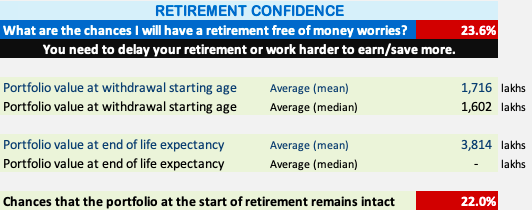

On the right side of the Retirement Planning workbook, you will see a block with the title “RETIREMENT CONFIDENCE”. See image below.

Assuming, you used the same inputs as provided in the earlier image, let’s now answer the key question.

What are the chances of leading a financial worry free retirement?

The answer, as it appears in the above image, is 23.6%. Now, if you keep refreshing the model, you will gett a new number each time. However, as you will observe, most of the numbers fall in a close range.

In this case, we can safely say that the chances are between 20 to 25%.

That is very disappointing. That gives me no comfort.

The message on the sheet too is loud and clear.

“You need to delay your retirement or work harder to earn/save more.”

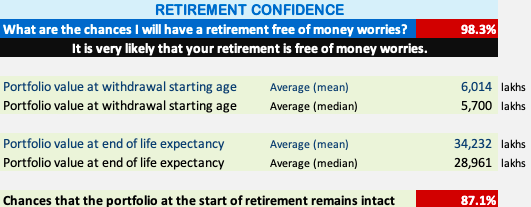

Now, what should I do to enhance my chances? I am now doing the following changes, one by one, and see the effect.

#1 Increase my retirement age to 70 (from 60 earlier) – This results in the chances going up to the range of 70 to 75%.

#2 Decrease my expenses to Rs. 10 lakhs a year (from Rs. 12 lakhs earlier) – This further increases my chances to close to 90%.

#3 Increase my income growth to 7% (from 5% earlier) – This raises my chances handsomely to over 95%.

With the above 3 changes, my model tells me that I have very high chances of living a financially worry free retirement.

You now know what you have to work at to lead up to a successful funding of your retirement. Of course, you can choose to do it differently.

So, what happens behind the scenes in the retirement planning in an uncertain world model?

This model takes into account uncertainty, the fact that markets may not deliver a return that you expect and not in the sequence that you hope. Certainly, not a single linear rate.

To make this possible, we add the volatility factor to the equity returns using standard deviation and then created a random number series, much like what the market would do.

This same process was run for a 1000 times to understand various scenarios. For each scenario, we note the various portfolio numbers and then arrive at a percentage of outcomes that are favourable to you. That is the number you see as your “chance of win”.

Remember, all models help us understand things to an approximation. They are not foolproof and surely cannot stand the test of very extreme, ‘black swan’, events.

Having said that, now, what are your chances of leading a retirement life, free of money worries.

Happy to have your comments and feedback.

[…] a recent simulated retirement plan, while the portfolio faced equity loss years in about 30% of the retirement period (sometimes […]