Taxes are always a pain, specially if you have sold a property, where capital gains tax applies. Calculation of capital gains tax on property sale needs a little more effort than usual.

I am sharing with you a quick capital gains tax calculator you can use to estimate your tax liability. We will use a simple case to learn how.

Dinesh has recently sold his property in bought about 5 years ago. He wants to estimate his capital gains so that he knows how much to pay as capital gains tax or invest to saving the tax.

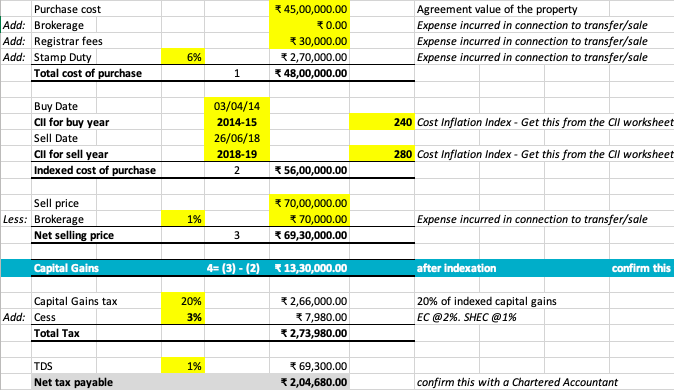

The facts: Dinesh purchased the property in the Financial Year 2014-15 at Rs. 45 lakhs. That’s the transfer agreement value on which stamp duty was paid. He sold it last year at Rs. 70 lakhs, yet again the transfer agreement value.

As per tax laws, you can add expenses incurred in connection to transfer/sale to your original purchase cost. Similarly, you can deduct any such expenses you make at the time of sale to arrive at the net selling price.

At the time of purchase, he paid the registration fees and stamp duty. During the sale, he paid brokerage too.

Here’s how all this comes together.

Estimated calculation of capital gains and tax on property sold by Dinesh.

As you can see, we have input the numbers in the respective cells. Now, here’s the important thing for your benefit and to reduce your tax payout.

Income Tax laws also allow you to inflate your cost of purchase. This is done via use of Cost Inflation Index (CII) provided by the Income Tax Department. The index value is announced at the end of each financial year for that year.

In the case of Dinesh, we take the CII for the year of purchase and sale and input in the calculator. The numbers are 240 and 280 respectively.

Using these values, we now calculate the indexed cost of purchase at Rs. 56 lakhs. This is Rs. 8 lakh higher than the original cost. The formula is:

Purchase cost * CII for Sell Year / CII for Buy Year

As a result, the capital gain on the sale now stands at Rs. 13.3 lakhs.

As per tax laws, you have to pay tax at 20% + Cess/Surcharge on this capital gain. This is the long term capital gains tax, assuming you have held the property for 2 years or more.

But you can save all this tax.

The tax law also provides you with an option to invest the entire gain in a new property or in designated capital gain bonds. This allows you to save on capital gains tax. However, the investment has to happen within 6 months of the sale of the old property.

Capital gain bonds are issued by NHAI, REC and others. Most banks offer these bonds.

Now, make your own calculations. Download the capital gains tax on property sale calculator as an excel workbook.

There are 2 sheets in the workbook. One has the calculator (as you see in the image) and the other has the currently available Cost Inflation Index values as provided by the Income Tax Department.

Note: You should confirm these numbers with your Chartered Accountant before paying taxes or filing your returns.

If you sell your property in less than 2 years of purchase, the cost indexation benefit is not available. The entire gain, in this case, is added to your income and taxed accordingly.

How would you plan for saving capital gains tax? Do let know your views in the comments.

Leave a Reply