This is the headline of one of the popular newspapers. What’s wrong with it? Not just one, there are other media outlets, which have something similar to say.

Government makes NPS withdrawal 100% tax free.

Entire NPS withdrawal at retirement is tax free now.

Again, what’s wrong with the above?

Simple, none of these is true. Here’s why.

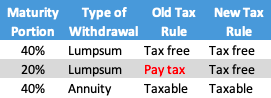

So far, taxation of maturity proceeds on NPS or National Pension Scheme worked as below:

- Withdraw 40% lump sum tax free

- Withdraw another 20% lump sum by paying tax at marginal tax rate

- Convert compulsorily 40% of the maturity amount into an annuity

Of course, you have the choice to convert the entire maturity proceeds into an annuity too.

What’s the hullabaloo about?

In the recent round of changes, taxation for point no. 2 has been modified. An NPS investor will be allowed to withdraw this 20% lump sum too, tax free.

So, in total, 60% (40% earlier + another 20%) will remain tax free if you withdraw it as lump sum on maturity.

The remaining 40% still converts into an annuity, which you receive over the number of years you choose.

See the table below to understand what has changed.

Here’s the big fact.

Annuity income is NOT tax free. It is taxable. You have to add it to your annual income, show it in your tax returns and pay tax as per your marginal tax slab.

If you are in the 30% tax slab post retirement, you pay 30% tax on annuity. As simple as that. And yet, most people are choosing to ignore this tax implication.

On the part of the sellers, they are behaving irresponsibly and telling you that NPS withdrawal is 100% tax free.

Oh yes, that is possible only in one scenario. If you are in the 0% tax bracket during the years you receive annuity, you pay no tax.

How likely is that for you? Very unlikely.

Most investors who are thinking about investing the additional Rs. 50,000 in NPS will likely fall in the 20% to 30% tax slab, even after maturity.

So, stop believing this 100% tax free NPS nonsense.

Yes, the additional 20% tax free amount on maturity does make it more sweet but it doesn’t take away all the other downsides.

By the way, are you still investing only for tax savings?

Vipin,

Why would a retiree fall in 20% or 30% tax bracket necessarily? If he has no salary income and only has the investments to derive his income from as well as annuity, he can always control his taxable income in most years. This is particularly true if he can plan to derive his income from debt funds with tax paid after indexation, if any. This way income from annuity will not go to 20 or 30% bracket.

The senior citizens are offered higher tax benefits on FD too.

Dear Vipin,

Could you update your previous article on comparison of investment options in a mutual fund v/s NPS given the extra 20% taxation benefit now applicable. Another request is that your table talks of 10% , 20% and 30% tax brackets but it may makes sense to see how the numbers change in the 35% tax bracket as well.

With the new change of 60% lump sum withdrawal tax-free, NPS scores over MFs, specially for the higher tax brackets.