There will be no income tax payable by individuals whose taxable income is upto Rs. 5 lakhs. This is the announcement made by the Finance Minister as he presented the Interim Budget 2019. Unfortunately, many individuals read this as the income tax slab revision and hence no one pays tax upto Rs. 5 lakhs. Here’s the truth.

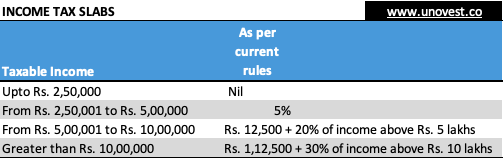

First, there has been no revision in the income tax slabs. They remain just the same.

Here they are again for reference.

Second, the no income tax policy is applicable only to those individuals whose taxable income is upto Rs. 5 lakhs.

It is important to differentiate between Total income and Taxable income. The Total income is your entire salary or business earnings. When you claim some deductions under the Income Tax provisions, the income is reduced further. This balance is known as the taxable income.

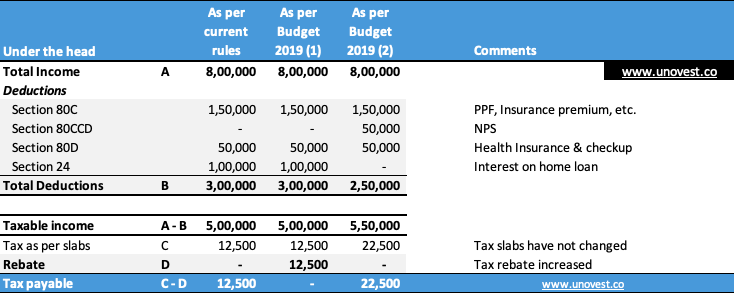

Let’s understand this with an illustration. The image below presents 3 workings.

I assume that you have a total income of Rs. 8 lakhs in the year.

Note: All figures in Rs.; For simplification, cess+surcharge have not been included.

As per the current rules, you take the entire benefit under Section 80C and 80D. You also have a home loan for which you pay about Rs. 1 lakh as interest. All the 3 deductions combined bring down your taxable income to Rs. 5 lakhs.

Now, calculate the tax payable as per tax slabs and in the current year. You have to pay a tax of Rs. 12,500.

The new income tax calculation as per Budget 2019

Come in provisions of Budget 2019. Same scenario as before, hence the same taxable income. You also calculate the tax as per the tax slabs which comes to Rs. 12,500.

However, as per Budget 2019, since your taxable income is upto Rs. 5 lakh, you will get a full tax rebate. This makes your income tax payable zero.

Let’s extend this further.

In the 3rd scenario of the table, total income remains the same. You are not paying any home loan interest. Instead, you have a NPS contribution of Rs. 50,000 under Section 80CCD.

Now your taxable income turns out to be Rs. 5.5 lakhs. The tax payable comes out to Rs. 22,500.

Please pay attention here. Since, your taxable income is above Rs. 5 lakhs, you will get NO tax rebate. You have to pay the entire tax as per the calculation.

Got it!

—

For quick revision, the Budget 2019 has revised the tax rebate for those whose taxable income is upto Rs. 5 lakhs. Hence, there is no tax payable by them.

Having said that, in your tax returns, you still have to make the calculation and claim the rebate.

What should you do?

Well, nothing much. If you happen to be above Rs. 5 lakhs taxable income (NOT total income) category, you can plan your salary structure / taxes smartly to fall under Rs. 5 lakhs.

The new tax calculations are applicable only from April 1, 2019.

Thanks Vipin,You have explained it in simplest possible way.So simply I forwarded to lots of people whats app post…seriously looking fool in mirror.

Glad it helped and thanks for sharing!

Thanks, you have explained and clarified in very simplistic way.

Thanks for reading!