The sale season is back and the purses are open. “So, have you bought that 49 inch Sony LED TV. The one available at 40% discount plus cash back offer of Rs. 10,000?” I asked my brother-in-law.

“Of course, yesterday. It was a steal. How could I miss it?” he replied with a gleam of excitement.

“OK. But did you need a 49 inch TV?” This got him thinking.

“Well, I can finally see my favourite match on a big TV.” came out the emotional justification of the purchase.

But then we buy because of our emotions and that was his. What’s wrong with that?

I remember last time he had done something similar, that is bought a car. In just a few days, he had nagging doubts. He was wondering if he bought more than he needed. Would just a sedan or maybe even a hatchback have sufficed? Could he have bargained for another Rs. 50,000 or got the insurance free?

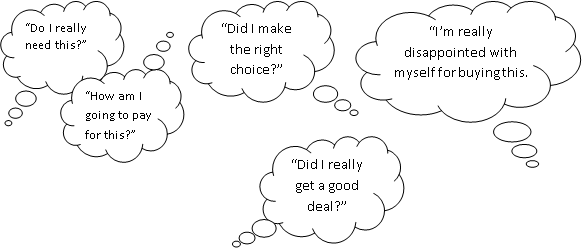

He showed the typical symptoms of buyer’s remorse. I hope it is not coming again.

This is what Wikipedia has on buyer’s remorse.

Buyer’s remorse is the sense of regret after having made a purchase. It is frequently associated with the purchase of an expensive item such as a car or house. It may stem from fear of making the wrong choice, guilt over extravagance, or a suspicion of having been overly influenced by the seller.

How many times have you had buyer’s remorse?

There is something about the ‘Sale’

Our country is currently witnessing a super give away contest by the e-commerce companies such as Amazon, Flipkart, PayTM, etc. etc.

They have really made it difficult. It is not easy to look the other way. The deals almost leave you salivating. How can you miss out? They won’t come back anytime soon.

“See, the price has dropped by 20% since yesterday. I think I should buy this dress.” my friend’s mouth was wide open as she said this.

“Shucks! There is a delivery charge. Why? What’s the point of the discount then?” She waited for a couple of seconds to say “I guess I will still order it.”

“Do you really need it?” I shot my favourite question.

She thought for some time and responded, “Of course, I don’t have this colour in my wardrobe.”

That’s how the conversation in your mind goes on too, probably.

The next day the product arrives and, “Arre, this is not the colour that I selected. This is a tad bright. What do I do now?”

“You can return it.” I offered my advice.

“No, I guess I will keep it. I will order the other one too.”

The two purchases together cost her 25% of her monthly salary.

The deals definitely get us excited. And traditionally the festival season has been the time when we invest in new purchases.

The marketers understand it well. And so, they line up hard to resist offers.

You and I end up buying things we don’t need.

Quick check: How many features of your smart phone have you really used? My guess – not more than 50%.

Buyers’ remorse is not just about clothes, TV or mobiles.

It’s everywhere.

Did you say ‘yes’ to a job offer that ultimately turned out to be the worst you ever had? Thanks to the boss!

Did you buy a stock at its peak price and now don’t see any further growth?

Did you just tuned yourself to the new IPO in the market? Remember IPO stands only for ‘It’s probably overpriced‘.

Did you buy that ULIP or Pension plan because your relationship manager convinced you that it was the best investment you could have?

Did you invest in that pre-launch offer of the property, which is yet to see the light of the day?

At work, you purchased the fancy enterprise software that promised a lot but is yet to become functional. Ah!

Save yourself

If you want to save yourself from buyer’s remorse, it calls for two steps.

One, keep your emotions of fear and greed in check. Ultimately that is what drives most of our decisions. Some honk meditation can come to your help.

Two, a deceptively simple trick you may use to balance the save and spend pendulum.

The bottom line though is to really know what you need. One of 5 road rules for investing and money is look right, then left and then right again. Only if you convinced that it makes sense, should you go for it.

See it is simple.

“If you buy things that you don’t need, you will soon have to sell things that you need.“

Someone really rich said that. You probably know him. 🙂

—

Another sale that you should be looking at right now is in the stock markets. It is time to start loading up on your asset allocation.

Between you and me: Have you had buyer’s remorse? How did you correct it? Or just lived with it. Have you been wiser? Love to read your comments and feedback.

(This post was originally published on vipinkhandelwal.com)

Yes we have been through “buyers remorse”. Honestly, we used to live with it. In fact recently, we were planning to buy a new bigger car (courtesy tax saving EMI option given by my husband’s office) but fortunately spoke with you and changed our mind. For us Trigger point was “do we really need it?” Hopefully we will not have “buyers remorse” this time. Thanks for guiding us!

Glad to know that Aastha. Now save more

Hello Vipin; I do feel that it’s a really common human fallacy and few if any must have not been caught by it. But I have a point to make; under your sub-head of “Buyers’ remorse is not just about clothes, TV or mobiles” you’ve mentioned about IPOs or a new tech software; isn’t there something known as Innovators/Early Adopters who are prepared to risk things for the sake for going in to it; I remember my uncle telling me about the time he decided to buy Infosys shares in early 1990s while others around him were still buying into more traditional options; it was a risk; half of his friends thought that Infosys brochure was a Fake-It-Till-You-Make-It book and felt that it was throwing around words that meant little to most investors. But it paid off handsomely while I’m not denying that there must have been other similar IPOs that mustn’t have fared well and are in oblivion now; the early adopters advantage isn’t just a moot question.

There is another story of a neighbour of mine; the man bought a plot in Ghaziabad worth 5 lac in 2002 expecting the prices to shoot as the area was expected to undergo major haul and when the land prices began climbing; he sold it for 30 lac in 2010. He then spent 5lac into buying a plot of GT Road on the outskirts of Benaras in 2014 June; expecting huge gains since he believed that the area will see exponential growth and possibly industrial development, guess I don’t need to elaborate WHY; but instead in 2018 the land is at 6lac and he would have been better off investing in FDs. I guess it’s not always sunny in Philadelphia.

So, yeah buying a TV or mobile during sales might lead to buyer’s remorse; but clubbing other investments in tech or stock or such others might be an over simplification.

I respect your view and thanks for the comment, Atulesh.

Nice article Vipin, believe today it is good to shop high quality stocks/MFs units than login to Amazon/Flipkart

You bet Girish!