Oh yes! The basics. Too often ignored since they are just basics. We are looking for advanced, exotic, get rich quick. And only when the reality slaps us do we find ourselves thinking again – What went wrong? Money basics are not just about numbers or calculations but about behaviour too.

You have read them before at some or the other place. Useful to refresh now. Here’s the countdown.

#6 There is an Opportunity Cost to everything

Simply put, it is a trade-off. Choosing one over the other. When you do something, you forego another. The benefit that you miss out because of not doing the other thing is the opportunity cost.

When you opt to go for further studies and give up a job opportunity, you are foregoing all the income that you could have earned while working.

It reflects in almost all our choices: Watching a Movie vs. Reading a Book; Fixed Deposit vs. Stocks; A Job vs. Own Venture; Spend vs. Invest;

#5 Profit is Vanity, Cash is Sanity

Are you one of those who like to see their investment portfolios almost on a daily basis? I hate to break it to you but all you are doing is nothing but an exercise in vanity. It does not add any value. It actually wastes your time.

Your paper profits have no value unless you realised them in cash by selling the investment or receive dividends or interest. Based on your goals, you should rebalance your investments from risky to safe and that is what will count as your real wealth.

Nothing happens to your investments because you look at them everyday. In fact, given the way portfolio values can fluctuate, there is a chance you will end up in a hospital due to an emotional breakdown.

Read more: Mutual Fund Basics

#4 Plan

“If you fail to plan, you are planning to fail.”

It is very important to plan. A plan lays out the direction and the goals based on which we can take specific actions and then review the results to understand the impact of those actions. The review then enables us to take appropriate steps to achieve our goals.

Make a plan for your money (and your career too). If you don’t have one today, start with a simple note. Write down your goals, by when do you expect to achieve them and what is the plan of action to get there. Seek help if you need to.

The exercise of making a plan will crystallise your thinking and bring enormous focus to your actions.

Read more: 50 decisions you can make using a financial plan

#3 Commit to your Goals

Your financial or investment plan reflects the goals that you wish to achieve and the method that you will use. Goals include a vacation abroad, a car, a house, kids education, social service and retirement.

However, once the plan is made, it tends to remain just there, on paper. You swiftly go back to old habits.

You follow the movements of the market, look at the highest return generating ‘snake oil’ investment and buy that big car which will divert resources from your retirement funds. Essentially, you are losing focus. The likely result: a haywire financial life.

Goals First. You got to commit to your goals. You have to own them. Without commitment, you will never be able to take the steps or make difficult choices that will help you achieve them. This very commitment will prevent you from making mistakes, sometimes very costly ones, too.

Read more: Mutual Fund basics

#2 Irrationality is for real

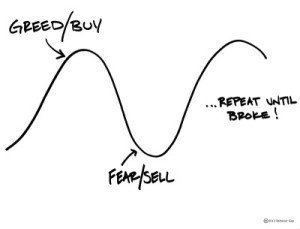

When it comes to money, we often suspend our rational thought and let emotions dictate our behaviour. Unfortunately, this is a universal phenomenon. Two key emotions govern this irrational behaviour: Greed and Fear.

Image source: Behaviorgap.com

Warren Buffet’s simple investing rule is noteworthy, “Be greedy when others are fearful, and fearful when others are greedy.”

Controlling your emotions and your irrationality is not an easy job. If you have ever tried to quit smoking, alcohol or drinking tea; you know what I am saying.

You will make several mistakes before you start seeing through this emotional game. I just hope you see through it faster.

Read more: Money Master

#1 Market Timing does not work

One of the often asked questions is “Is this the right time to invest?”

Now, what makes you believe it is not? Most pundits fail at predicting the ‘right time to invest‘. You too can be assured of the outcome of such an exercise.

My 2 paisa on this: “The right time to invest is NOW.”

Yes, there are many other factors that you will take into account as a part of your plan. But never let the market or some prediction by a pundit decide when you should invest.

It is good to remember that as an investor, the real difference to your wealth comes from “the time in the market and not timing the market.” Stay the course and ride the rough times and you will be glad about the outcome.

Read more: Confused! Should I invest lumpsum now or do STP?

Between you and me: What forms the foundation of your money and investing acumen? Please do share with me in the comments.

[…] will oscillate between greed and fear. The two devil emotions, which if not controlled, can play havoc with your […]