Have you ever received a call from your bank / broker to take a loan and invest in the recent hot IPO? Well, I have. The promise seems lucrative. It is difficult to let go the offer. Let’s see how leveraged investing works and should you go for it?

So, this big company is launching a big IPO and going by the media news and all the PR, it has been made to appear like the next big blockbuster.

“You can make 50% returns in just a few days. Once the IPO lists and opens for trade you can exit with 50% gains.”

“If it opens at just 30% higher than the issue price, you will double your investment.”

Very enticing. Let’s see how does this work out.

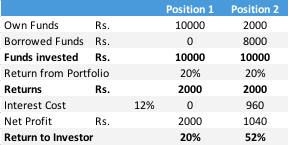

Suppose you are willing to invest Rs. 10,000 in one of the IPOs. You have 2 choices.

In Position 1, you invest all of your own money.

In position 2, you resort to leverage of 1:4. You put only Rs. 2000 of your own capital and borrow Rs. 8000 to invest. The rate of interest is 12% per annum.

See the table below.

Assume on the listing day, the share goes up by 20%. You sell. What did you gain. If you have got 100% allotment of shares and you took the leverage, you are sitting on 52% absolute gains in a matter of a few weeks.

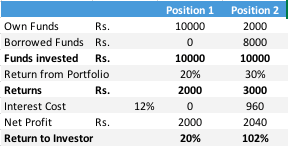

Let’s push the greed pedal. See table below.

Assuming the listing day price is up 30%, you literally doubled your investment in just a few weeks.

Don’t even talk about annualised returns.

I am sure you are now raring to finance your next IPO investment. Wait!

What if?

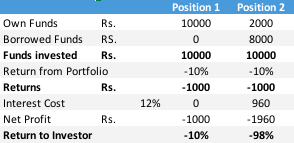

What if instead of the blockbuster listing, the IPO listing is lower by 10% of the issue price.

See table below.

If you had invested your own money, the loss is limited to 10%. But if you had borrowed money to invest, you are sitting on a 98% loss. You have wiped out even your own capital invested.

Let’s not even talk about when there is a higher loss %.

But you see, these are small numbers. If you happen to bet bigger, your existence can be in a crisis.

There are investors / speculators who add a few zeroes into the calculation. Many of them don’t survive to see another day.

So, yes I had got a call too but I refused. I didn’t take the bait, NO! And I live today to tell this to you. 🙂

I believe as a retail investor you should stay away from such methods and focus on building a simpler long term portfolio that takes care of your goals and lets you sleep peacefully at night.

Remember, you don’t lose only the money.

Between you and me: Why will you do such a thing to yourself which puts your existence at risk?

I do not agree with this statement: “Not just that you have to now arrange money to repay the loan of Rs. 8000 that you took to buy the shares in the IPO.” According to the example one should be sitting on Rs. 8040 (10000- (net loss of of 1960)). Am I right?

That’s a good catch. Thanks and glad you read it so closely.