DSP BlackRock ACE Fund is yet another closed-ended fund (3 year lock-in) launched in recent times. This one is targeted at investors who are interested in stock investments but also want to protect the downside. Does it make sense?

Let’s be honest.

Today, most investors, including you and me, are at crossroads. On the one hand, we see the markets driving up crazy, earnings not catching up, sky high valuations and a constant fear that the markets will correct anytime.

On the other hand, there is some news or the other that pushes the markets further up and makes it further defy gravity. Fear of missing out or FOMO keeps rearing its head.

We are left confused.

Should I be in or out?

Is there a way I can be in stocks and not yet suffer if there is a major fall or correction?

As humans it is quite natural for us to feel like “having it all.” Unfortunately, it doesn’t work that way.

But DSP BlackRock MF thinks it is possible and so here is its new fund offer for DSP BlackRock ACE Fund. ACE is a fancy acronym for Analysts Conviction Equalized.

This fund intends to create a portfolio structure in which if there is continuous rise in the market, the portfolio grows.

However, if the markets succumb to gravity (finally), it protects your portfolio from loss of original investment (I hope I understood it right).

So, how does the fund plan to achieve this magical outcome?

Quite a simple process.

Step 1:

Divide the portfolio in 2 parts. One for growth and one for protection – 94% and 6% – respectively.

Step 2:

Invest the 94% growth portion in a portfolio of stocks with a pre-defined process. Briefly, here is how this investment will happen.

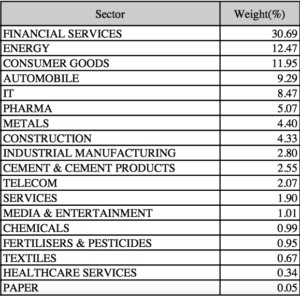

- Take the sector allocation of Nifty 500 index. This sector weightage will be mirrored in the fund too.

- Stock analysts of the fund pick investible stocks from across the market and sectors.

- Filter the stocks by sector. For each sector, invest EQUALLY in the identified stocks.

Source: NSE. As on Oct 31, 2017

Step 3:

Use the second portion of 6% to buy protection against market fall. In investment parlance, this protection comes via a financial instrument called OPTION, more specifically a PUT option. Call it insurance against market fall to protect the original value of your investment.

So, here it is. DSP BlackRock ACE Fund offers you the best of both the worlds. It sounds like quite a deal and you probably feel ready to jump in.

Just that in my view, it isn’t so.

What’s wrong with DSP BlackRock ACE Fund?

Markets don’t care about your plans in 2020.

It’s ironical I am using this line from the fund’s marketing brochure to make a counterpoint.

As you know by now, the fund is a closed-ended multi cap equity fund with a lock-in period of 3 years.

As an investment adviser, for a time horizon of 3 years, I don’t advise my clients to invest in equity or equity mutual funds. The goal for which the money is needed is too sacred to be subjected to the whims of the stock market.

I invest my money for this short a period in a safe FD or a debt mutual fund so that it is available to me when I need it. You see markets don’t care about your plan in 2020. It is our responsibility.

This NFO is asking you to invest in stocks with a horizon of 3 years. And yes, it wants to protect the downside too but at a cost, which is a whopping 6% (remember part 2 of the portfolio).

Not just that it expects you to have a chance to benefit from power of compounding.

The last I looked into compounding, it needs a lot of time to work. 3 years is just a beginning. 30 years is more like it.

The key risk management strategy for my investment portfolio is ‘Asset Allocation’.

ACE stands for A Confused Ensemble

The fund proposition is confused. Is it an actively managed fund or a passively managed fund?

Looks like it is part passive (with sector allocation as per Nifty 500 index) and part active (picks its own stocks in those sectors).

Even within the active part, it is not willing to go the full distance with its stock picks. Within any sector, it will make an equal allocation to each of the stocks identified for investment.

Please note again. It will not give equal allocation to all the stocks it holds in its portfolio. The equal allocation is for stocks within the sector. Let’s say the team identifies 3 stocks in Pharma sector. Overall, Pharma sector has a 6% weightage in the portfolio. Then each of these 3 stocks will get a 2% allocation.

Hello! If the stocks happen to be small or micro caps and the fund size is large, it is going to face problems. In fact, SEBI has caps on how much can be invested in a single company.

To comply with SEBI norms as also maintain its defined ratios/allocations, the fund is likely to make adjustments to ensure that it doesn’t irk the regulator as well as maintain the EQUAL allocation ratio. Isn’t that suboptimal?

I hope it compensates its investors for this self confessed ignorance with a lower expense ratio. Currently, it does not state anywhere the expense structure it plans to operate in.

Funnily, the DSP BlackRock ACE Fund NFO represents the current state of mind of several investors – neither here, nor there.

You too? I suggest you make up your mind.

What’s your take on the NFO of DSP BlackRock ACE Fund?

Hedging strategy is going to have a Basis risk. If you see major exchange traded option, it is for nifty 50 index. But whereas this fund will be replicating Nifty 500. The return of portfolio (i.e Nifty 500) and hedging instrument ( Nifty 50) is not perfectly correlated

True that!