It is not uncommon for retail investors to chase performance and make it their only criteria to select a fund for investing.

Using the same criteria, one of the funds that makes it as a chart topper is the DSP BlackRock Micro Cap Fund.

I was recently asked my views on this fund. I am sharing them again with you here.

No doubt, DSP BlackRock Micro Cap Fund is a unique fund with a defined investment strategy and execution focus.

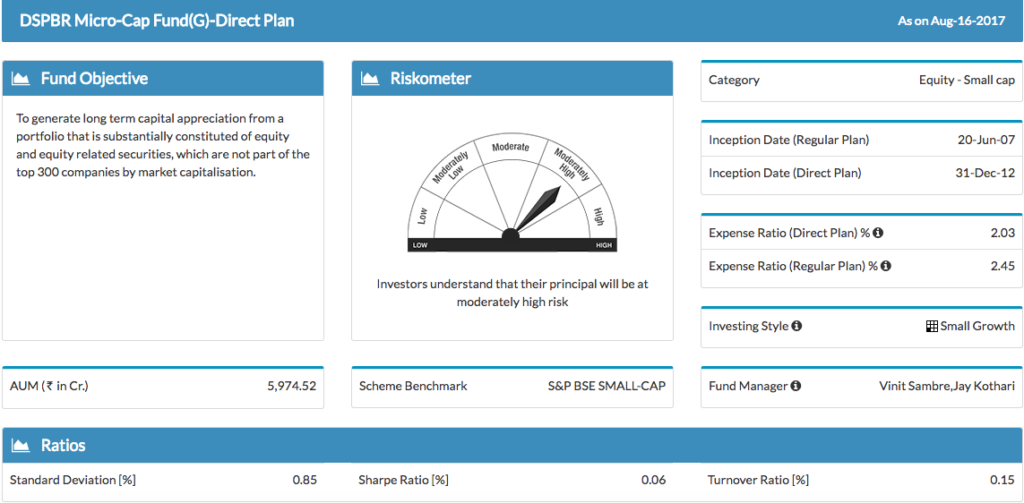

In its investment objective, it clearly mentions that it will NOT invest in the top 300 stocks by market capitalisation. This essentially rules out 90% of the stocks that most other funds invest in. It looks for the less sought, less studied and lesser known companies and businesses that have a potential to provide outsized returns.

Having said that, these stocks are less liquid (the fund may not be able to sell the stock any time). The stocks could also come under the radar of day traders and looking for quick returns and thus make them more volatile.

So, who is this fund suited for?

Given its narrow focus, it is not suited for those who can’t take its volatility in their stride. The fund can lose much more than the so called large and mid cap funds and it can also gain with the same speed.

In fact, the fund has actually lost more than half and also risen more than 100% in a span of around two years.

Given its highly volatile nature, you can make the best of it if you can stay with it.

In other words, don’t even think about investing in this fund if you have a time horizon of less than 10 years, .

But you can’t invest now in DSP Blackrock Micro Cap Fund!

Yes. The fund is closed for subscription as of now. In fact, for a large part of the past few years, it invited only restricted flows. At one point only Rs. 2 lakhs per day maximum investment was allowed, which was later reduced to Rs. 1 lakh per day, before it was completely closed for new investments in mid Feb 2017.

Even when it opens, at least an year away. That too will be a small and limited opening.

Restricting investments from time to time is a good sign.

It serves the fund’s objectives well, as given the limited size of the space it operates in, large inflows are detrimental to its mandate.

The size of its potential investment companies is so small that if it tries to push more investment, it might just end up owning a substantial stake in the company. SEBI rules don’t allow that.

The fund currently is one of the largest in its space and also commands one of the highest expense ratios (2.03% as of July 2017 for its direct plan).

You can read more about DSP Blackrock Micro Cap Fund here: Factsheet.

Disclosure: I am invested in this fund.

Disclaimer: The information provided is only for the purpose of learning. This should not be taken as investment advice. Please consult your investment adviser to understand if this fund suits your investment objectives and risk profile.

Vipin,

Hope this fund was part of the enhancer portfolio earlier , Why you have removed it .

Any specific reason for removal.

One more thing i would to discuss, in the Enhancer we have 3 Flexi and 1 Mid cap, but no Small/Micro cap funds are present.

My understanding is , we can have it for long term goal (14+ years) with aggressive stand.

Hi Vandhi,

Since, the fund is currently not available for investment, it has been removed for now. There is no other fund we like in that space. Once, it opens up for subscription, it will also be added to the list.

Thank you