“Can I invest in a Dynamic Bond fund? They seem to be giving good returns.” my friend asked me.

My friend’s investment thinking starts at returns and ends there. It is time to enlighten a bit.

What are Dynamic Bond Funds?

Dynamic bond funds are a unique category of debt funds, where the intention is to make money in several ways. The primary strategy of course is to understand and anticipate interest rate movements in the market and position the portfolio to benefit from it.

It also includes active trading of holdings so as to capture gains that may be available in a very short window of time.

Apart from that, these funds invest across opportunities and time frames such as Govt. bonds, corporate debt, money market covering the entire interest rate spectrum of long, medium and short term.

However, not everything is rosy. They have their own share of volatility.

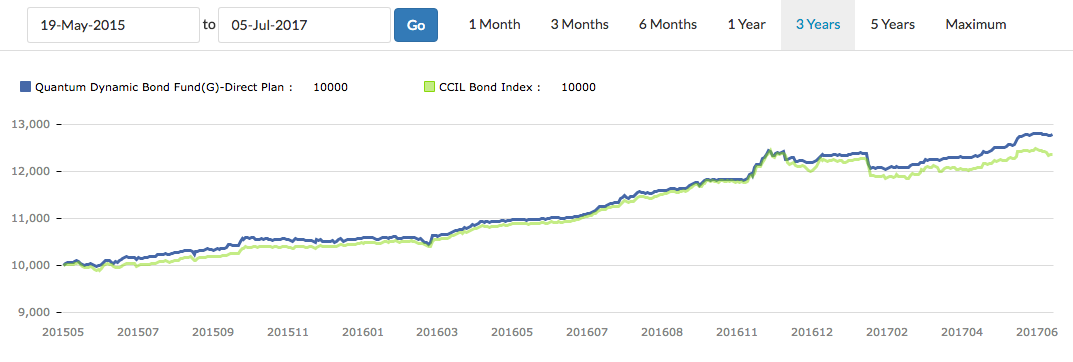

Look at the chart below.

Do you see the ups and downs?

In comparison, the FD or a liquid fund has a linear growth line.

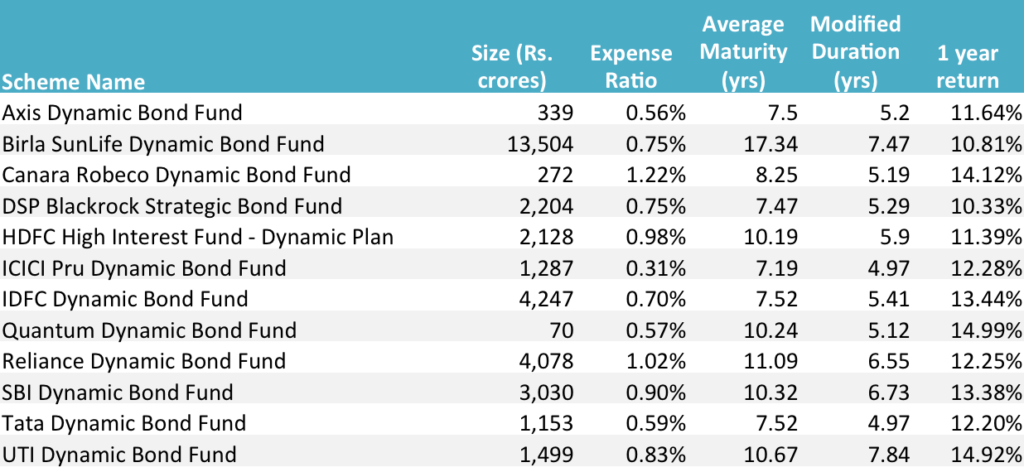

Here’s a further list of 12 dynamic bond funds.

Source: Valueresearch, Unovest, individual factsheets, Data as published on July 6, 2017.

Source: Valueresearch, Unovest, individual factsheets, Data as published on July 6, 2017.

The list is present in alphabetical order and there is no preference to any fund scheme. All are direct plans.

Most of the investment objectives of these funds make a specific mention of generating income as well as capital gains (much like equity funds do). They also make an explicit mention of riding on interest rate movements and make short term trades to benefit from it.

In the above set of funds, we can make a few observations:

- The Expense Ratio is under 1% for most funds. For a debt fund, even a 1% does seem high. However, it is at a premium to produce above average returns.

- If you see the Average Maturity, most of them are 7 years plus, closer to 10 in some cases. These funds typically operate in the long duration zone and buy more of government securities. In fact, most of the funds have over 50% portfolio exposure to sovereign bonds or long term government securities.

- In that sense, they take on no or very little credit risk. Since they are majorly invested in sovereign bonds.

- The column to focus on is the Modified Duration. It indicates the sensitivity of the portfolio to interest rate changes. If, for example, interest rates fall by 1%, the portfolio with a duration of 5% is likely to rise by 5%. The vice versa is also true. If the interest rates rise by 1%, then the portfolio value will fall by 5%.

Does that scare you?

Yes! Then you should probably look at the Ultra Short Bond or the Liquid category of funds.

If you are still going ahead, here are some things to consider:

- These funds can be very volatile and lead to temporary loss in the value of the investment portfolio. (See the chart shown before)

- You need a minimum time horizon of 3 to 5 years with investments like these.

- Don’t allocate all your money to these funds. This is not an alternative to fixed deposits or liquid funds. There is more risk.

- This is not an alternative to equity. Don’t expect equity like returns from the bonds funds.

- The taxation of these funds is similar to other debt funds. Know more here.

I told my friend, “If you want to seek an semi-equity like thrill in a bond investment, then the answer is probably the Dynamic Bond Fund.” Else, forget it.

It is better if you consult your investment adviser and discuss it thoroughly. You may not even need to expose your money to such volatility and still achieve your goals.

That is more prudent a step.

In case you haven’t read a brief primer on debt funds here.

Vipin,

Once again, clear definition of Dynamic bond funds with pros and Cons. Thanks for that.

Can we use this bonds for our long term goal debt allocation like Retirement,kids education which is 14+ years horizon.

Thanks Vandhi.

Of course you can use dynamic bond funds, subject to all the conditions as mentioned in the note. 🙂