Continuing with preparing the mind series in Investing 101, let’s look at some additional basic aspects of investing where we tend to behave differently than we should.

Here is a quick overview of 10 basic concepts that you need to commit yourself to. Useful to refresh even if you know them.

#1 Never let your money be idle

What if I say that I would pay you a rupee after 1 year instead of today? I bet you will not be okay with it.

Why? Because there is a potential return on money that you can earn, such as interest. You can take the rupee today and earn that interest for 1 year. Hence a rupee today is clearly preferable.

Based on the concept of ‘time value of money‘, a rupee is more valuable today than it would be 1 year from now.

Not letting your money work and leaving it idle is bad for your financial future. Put it to work. By the way, money lying in your savings account is as good as idle.

#2 Inflation is a hidden tax

A related concept to Time Value is Inflation. Inflation is the rate at which prices increase. So, if you bought vegetables at Rs. 100 per kg 1 year ago and the same set of vegetables now cost Rs. 110 per kg, then the price has gone up by Rs. 10 per kg or 10%.

You see inflation is sort of a hidden tax that eats into your money and reducing its value. Let’s take the same example as above. If your income increases by Rs. 15 to Rs. 115 and the price by Rs. 10 to Rs. 110, then after paying for the extra prices, you are left with just Rs. 5 (Rs. 15 – Rs. 10). That is the real increase in your wealth, net of inflation.

#3 Use the Power of Compounding

Isaac Newton, the eminent scientist, called compounding the ‘eighth wonder of the world’.

Due to the compounding effect, your money works at a faster rate to grow itself. This is how it works.

Suppose you invested Rs. 100 today at 10% interest for 1 year. At the end of 1 year, you will get Rs. 10 as interest. Now, let’s say that you reinvest Rs. 110, that is the original Rs. 100 + Rs. 10 of the interest you received, at the same interest rate of 10% for another 1 year.

So, at the end of year 2, you will receive Rs. 11 (10% of Rs. 110) as interest. So, your total value is now Rs. 110 + Rs 11, that is, Rs. 121.

Keep doing this for 10 years and your original Rs. 100 would become Rs. 259.37.

If you invest Rs. 10,000 today, at the end of 10 years at 10% interest rate, its value would be Rs. 25,937. The same Rs. 10,000 invested at a return of 15% for 30 years would turn into Rs. 6.6 lacs.

Sounds like a wonder, right?

Compounding is the only way you can beat inflation (price rise) to create real wealth for yourself.

But remember that compounding is a slow process and its best happens at the last. It demands your patience and discipline, bit by bit.

#4 Take Risks

Taking risk could result in higher payouts.

Say, for example, investing in stocks. Stock can potentially offer better returns than a Bank Fixed Deposit which carry virtually no risk.

Risk presents itself in various forms. Not just with money but generally. What is the risk that you will suffer from a heart disease?

By definition, risk is the chance that your result/outcome will be different from the expected result/outcome. There is a direct correlation between risk and return. Higher risk could result in higher return and vice versa.

Most risks can be assessed and understood.

You should know, for example, that stock market investments can go to zero value any time. That the land on which your property stands can be grounded by an earthquake. A Bank Deposit almost assures a return and your original investment. That paracetamol will cure your headache is pretty much a given.

The real test of whether you have the appetite for risk is if you can hold on to your investments even if their market prices are moving like a yo-yo. You will know it only when it happens.

I read, “not taking risk is the biggest risk“. You can walk in with your eyes open.

#5 There is an Opportunity Cost to everything

Simply put, it is a trade-off. Choosing one over the other. When you do something, you forego another. The benefit that you miss out because of not doing the other thing is the opportunity cost.

When you opt to go for further studies and give up a job opportunity, you are foregoing all the income that you could have earned while working.

It reflects in almost all our choices: Watching a Movie vs. Reading a Book; Fixed Deposit vs. Stocks; A Job vs. Own Venture; Spend vs. Invest; Reading this blog vs. Not doing anything.

#6 Profit is Vanity, Cash is Sanity

Are you one of those who like to see their investment portfolios almost on a daily basis? I hate it to break it to you but all you are doing is nothing but an exercise in vanity. It does not add any value. It actually wastes your time.

Your paper profits have no value unless you realised them in cash by selling the investment or receive dividends or interest. Based on your goals, you should rebalance your investments from risky to safe and that is what will count as your real wealth.

Nothing happens to your investments because you look at them everyday. In fact, given the way portfolio values can fluctuate, there is a chance you will end up in a hospital due to an emotional breakdown.

#7 Plan

“If you fail to plan, you are planning to fail.”

It is very important to plan. A plan lays out the direction and the goals based on which we can take specific actions and then review the results to understand the impact of those actions. The review then enables us to take appropriate steps to achieve our goals.

Make a plan for your money (and your career too). If you don’t have one today, start with a simple note. Write down your goals, by when do you expect to achieve them and what is the plan of action to get there. Seek help if you need to.

The exercise of making a plan will crystallise your thinking and bring enormous focus to your actions.

#8 Commit to your Goals

Your financial or investment plan reflects the goals that you wish to achieve and the method that you will use. Goals include a vacation abroad, a car, a house, kids education, social service and retirement.

However, once the plan is made, it tends to remain just there, on paper. You swiftly go back to old habits.

You follow the movements of the market, look at the highest return generating ‘snake oil’ investment and buy that big car which will divert resources from your retirement funds. Essentially, you are losing focus. The likely result: a haywire financial life.

Goals First. You got to commit to your goals. You have to own them. Without commitment, you will never be able to take the steps or make difficult choices that will help you achieve them. This very commitment will prevent you from making mistakes, sometimes very costly ones, too.

#9 Irrationality is for real

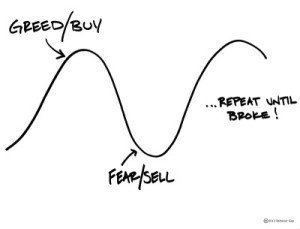

When it comes to money, we often suspend our rational thought and let emotions dictate our behaviour. Unfortunately, this is a universal phenomenon. Two key emotions govern this irrational behaviour: Greed and Fear.

Warren Buffet’s simple rule is noteworthy, “Be greedy when others are fearful, and fearful when others are greedy.”

Controlling your emotions and your irrationality is not an easy job. If you have ever tried to quit smoking, alcohol or drinking tea; you know what I am saying.

You will make several mistakes before you start seeing through this emotional game. I just hope you see through it faster.

#10 Market Timing does not work

One of the often asked questions is “Is this the right time to invest?”

Now, what makes you believe it is not? Most pundits fail at predicting the ‘right time to invest‘. You too can be assured of the outcome of such an exercise.

My 2 cents on this: “The right time to invest is NOW.”

Yes, there are many other factors that you will take into account as a part of your plan. But never let the market or some prediction by a pundit decide when you should invest.

It is good to remember that as an investor, the real difference to your wealth comes from “the time in the market and not timing the market.” Stay the course and ride the rough times and you will be glad about the outcome.

This note is a part of a free course – Investing 101. Want to subscribe to the full course on email?