“Don’t put all your eggs in one basket” is one of the simplest ways to explain the concept of diversification.

While the above statement puts across the point very beautifully, in 1950s a person by the name of Harry Markowitz went on to build a mathematical model. He even submitted a paper on his research to the Journal of Finance. Finally, he went on to share the Nobel Prize in Economics in 1990.

As a result of his effort emerged the Mean-Variance Analysis, which became the bedrock of the Modern Portfolio Theory. Over the years, the majority of the investment management chaps use the model to select and build portfolios for their clients.

What Harry Markowitz put across was this:

- There are different investment securities with low correlation to each other. They display different behaviour at different times in terms of results or performance as also the timing of such returns.

- One can use the past data on risk and returns and the future expected returns along with user preferences to build an optimised and efficient portfolio that delivers the maximum possible returns at the minimum possible risk.

The simple postulation of the paper was that diversification is good and can be and should be done scientifically. Here is a way to do it.

But did the expert apply the same rule to his portfolio?

Apparently not!

When the time came to apply the rules to himself, Markowitz chickened out.

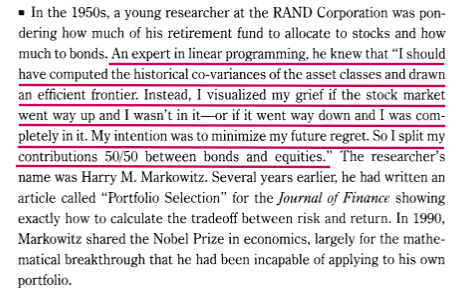

Here’s an excerpt from Jason Zweig’s, a well known financial journalist, book Your Money and Your Brains.

The founder of the Modern Portfolio Theory himself went for an equal weightage allocation.

Why did that happen? Whey couldn’t he apply the same rules to himself for which he even went on to win a Nobel Prize?

Simple trumps Complex.

The mathematical model that won the Nobel Prize was just too complex. It demands inputs of past data (for several years) about risk (or variance) and returns as also expected future returns which can then be plotted in several combinations to identify which of the combinations of various assets are likely to provide the most optimum results.

Phew!

The problem starts with the data and it compounds with the fact that the past can never be equal to the present or the future.

This makes the model impractical.

Our mind fails to accept this complexity.

What we practice and prefer to practice is the simple. Complex freezes us while simple triggers action.

Hence, Markowitz took the simple approach for his own portfolio. A 50:50 allocation to equities and bond, periodically rebalanced.

Is this perfect? No.

Is this easy to understand, implement and monitor? Yes.

At any given point in time, simple will always trump complex in your mind.

Isn’t that true?

The experts don’t have all the answers. Even if they say there is an answer, it may not be practical.

Find what works for you and implement it.

[…] There isn’t any concept procedure on what distinctive technique any fund brings to the portfolio. That qualifies for over^(n) diversification or divorsification, […]