A home loan EMI is a common way to fund the purchase of a dream home. In the last couple of years, as interest rates hit rock bottom, banks offered home loan at rates as low as 6.5% with enough takers.

However, as interest rates go up now the original payment plan is threatened. How?

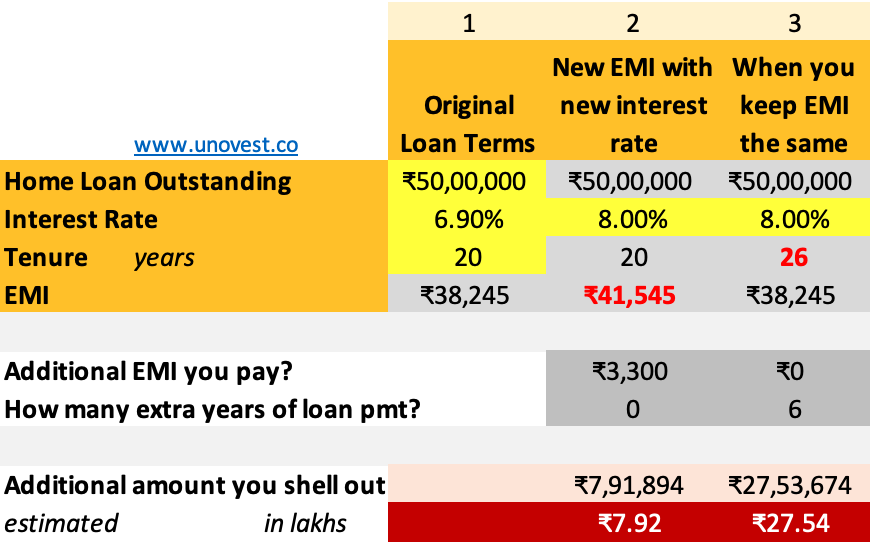

Let’s say, 1 year ago, Mr. Gupta took at loan of Rs. 50 lakhs for their new home and the bank offered it at a 6.9% interest rate for a period of 20 years. The EMI of this loan turned out to be Rs. 38,245. This looks affordable against the salary that Mr Gupta gets.

The bank’s recent communication to Mr Gupta says that the home loan rate is revised to 8% effective Oct 1, 2022.

Mr Gupta sighs! He thinks here is nothing he can do about this and pushes the email to the archives. (The bank’s agreement clearly states that the home loan interest is tied to a benchmark rate and as rates go up, the rate on the loan shall too.)

The bright spot in all this – the EMI stays the same.

How does the unchanged Home Loan EMI impact Mr Gupta?

The question that Mr. Gupta is not asking is what happens to the loan payment terms once the new interest rate goes up.

Well, as you know, EMI of a loan is determined by the amount of loan, the interest rate and the tenure. In MS Excel, you can use the formula PMT = (RATE,NPER,PV,(FV),TYPE).

PMT or short for payment, stands for EMI. RATE is interest rate. NPER is no. of periods and PV is the loan outstanding. To get EMI (monthly basis), you divide the annual RATE by 12 and multiply NPER in years by 12.

Now, the Home Loan EMI is not changing. The loan amount is not changing. But the interest rate has. So, where is the impact?

It is on the tenure or the no. of years for which the EMI has to be paid.

Mr Gupta pays the same EMI but for 26 years and not 20 years. Yes, that’s 6 years of extra loan servicing or a total extra payment of Rs 27.5 lakhs.

See scenario 3 in the image below.

That’s a shocker! Mr Gupta needs to rethink his loan payment terms.

Increase Home Loan EMI

Instead, Mr Gupta can instruct the bank to increase the EMI in a way that the loan tenure does not change. In his case, the EMI will go up by Rs. 3300 per month.

However, the overall extra payout over the loan tenure is much smaller compared to increasing the tenure. (see scenario 2 in the image above)

Now, let us be clear, the above numbers are estimates and over the tenure of the home loan, interest rates may vary several times. However, going by personal experience, banks are quick to increase rates but painfully slow when it comes to bringing them down.

So, all in all, the better strategy is to increase the EMI than the tenure of the loan.

Use this Excel Calculator for Home Loan EMI

Try it out for yourself.

—

Read more – Should you rent or buy a house? Logic vs Emotion

Leave a Reply