Can Mutual Fund Performance be the basis of picking your Winners and dropping Laggards?

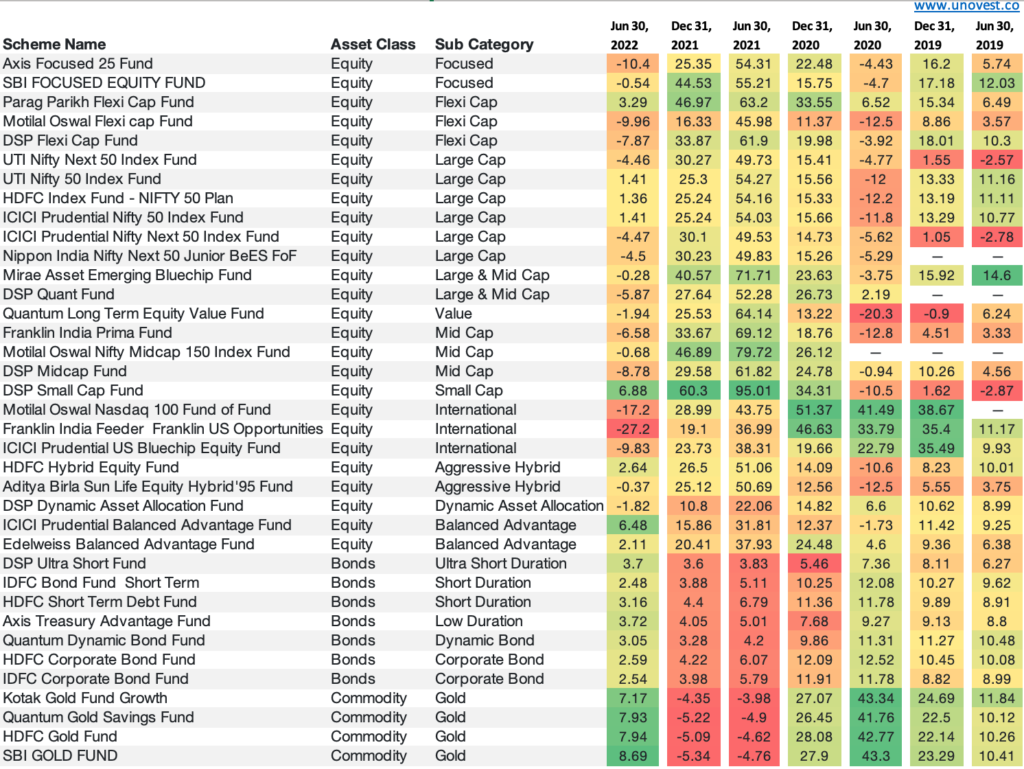

I compiled a chart here with heatmap. Let’s see if this statement holds.

Chart of Mutual Fund Performance – Last 12 months return every half year basis

What appears to me is that on this comparative heatmap basis, if an asset class becomes green, it is time to move to the other side.

Or, should it be bet on the assets that have turned red or a shade of it?

Or, should we just diversify as we don’t know what will work when?

—

Now, how would your investment portfolio change on the basis of this information?

Do you think using “reversion to the mean” basis could be used for picking the asset class / fund? (Winners become laggards and vice versa)

Looking forward to your comments.

Leave a Reply