The last date for individuals to file their income tax returns is July 31, 2022.

Frankly, the idea of going through the process does not bring a pleasant feeling. Also, a reason that filing gets delayed to the last date. If you can follow the process step by step, you will find that it takes no time to do.

As you go about the task, you will first need to organise your information. Here are some tips and resources.

- If you salaried, get your Form 16 from the organisation.

- Download your Form 26A from TRACES website of the Income Tax Department. It mentions all the taxes paid already including TDS/TCS or self assessment tax (there are reports that this is not entirely accurate but still one of the sources for information)

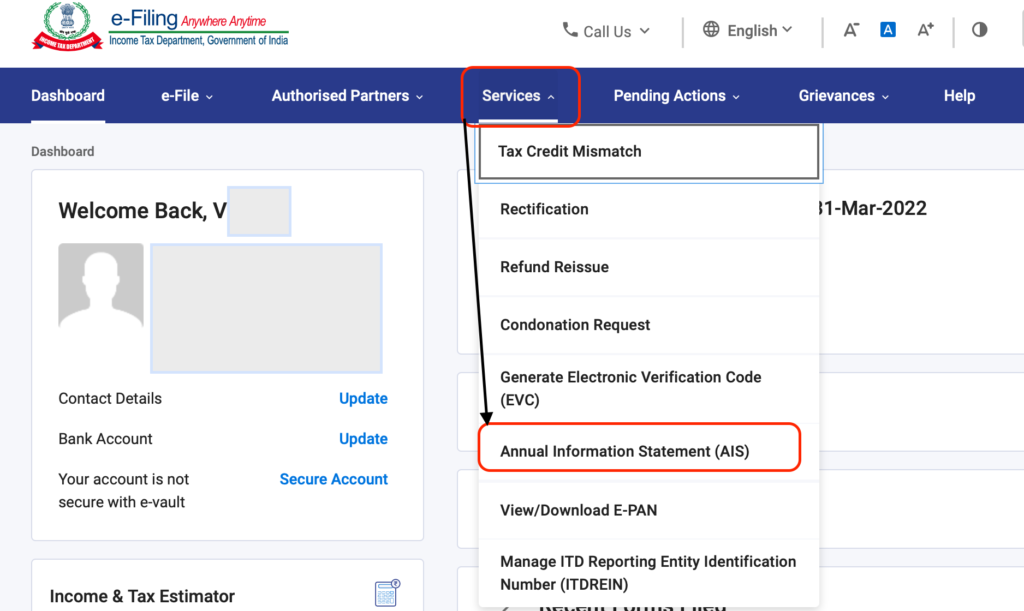

- Update: You can a download the AIS and TIS reports too for a more comprehensive coverage of your all income and asset purchase/sale details. Just login to the https://incometax.gov.in website and under “Services” menu, you will see the Annual Information Statement link. Click on it and it will take you to the portal where you can view the AIS along with the the TIS or the Tax Information Statement. Between the two, you are likely to find all the info you need to file your tax returns.

You can use the AIS to cross verify all the transactions from your respective accounts.

- List down all your bank accounts and download account statements for the financial year.

- List your Fixed Deposits, if any, and interest received on them.

- If you have invested in other alternate fixed income investments (not mutual funds), find out their interest. Some of them may send an annual interest statement automatically, for others, you have to check your bank statements for credits or get them to send one.

- Get capital gain statements for your stocks and mutual fund investments. For mutual funds, you can use this link to know how. For stocks, your trading account provider will have a report.

- Do not forget to set off any capital losses (long term-short term) from the earlier years which have been recorded in past IT returns, from this years capital gains-losses.

- Sold a property? Here’s how you can calculate capital gains and losses on sale of property.

- Any income or receipt that is tax free (such as from insurance policies, tax refunds) will need to be mentioned separately.

- For claiming your deductions, have your investment or expense receipts handy such as PPF, Tax saving mutual funds, rent, school fees, insurance premia (life and mediclaim), donations to recognised entities, etc.

- If you are using a CA or a website to file your taxes, you can send / upload all this information.

- If you are self-filing on the department’s website, select your form based on the components involved. A simple salaried income with income upto Rs. 50 lakhs can use an ITR – 1. With capital gains, it will be ITR -2. Here’s a good reference list

- There might be an additional tax to be paid based on your income, receipts.Have that money available in your account. If there is a tax refund due, great!

All you need to know about capital gains and allowed set offs

Advantages of Filing Income Tax Returns

Filing tax returns has advantages too.

- Most home loan providers ask for your past 3 year tax returns to calculate your loan eligbility

- Visa applications too frequently ask for tax returns

- Not to mention, if you have to claim refunds or carry forward losses into the future for set off, filing income tax returns is the only way to do it.

If this is your first time to file your income tax returns, I wish you all the best.

Tax Trivia: FY stands for Financial Year – it is the year for which you are filing your tax return.

AY stands for Assessment Year – it is usually the year next to your financial year, in which the assessment is done to file the tax returns.

Example: If FY is 2021-22, then AY is 2022-23.

Leave a Reply