‘Testing times‘ is actually an understatement for the world is going through. I mean who would know that the virus would ultimately mutate into a war!

I am sure we are all concerned about what’s happening out there in the world and sending prayers.

As we look at the changing future possibilities, we have other questions too.

#1 Should I buy or sell?

Firstly, while we may think that the world is coming down crashing on us, that’s not the case. The markets have only corrected by about 12% from the peak, which is fairly normal thing to happen in any given year.

I think since the base changes, there is extra panic. (10% down from 5000 is 500 points, 10% from 18500 is 1850 points)

If we let emotions run sway, you and I will sell everything and go away. But that’s not what we are here for.

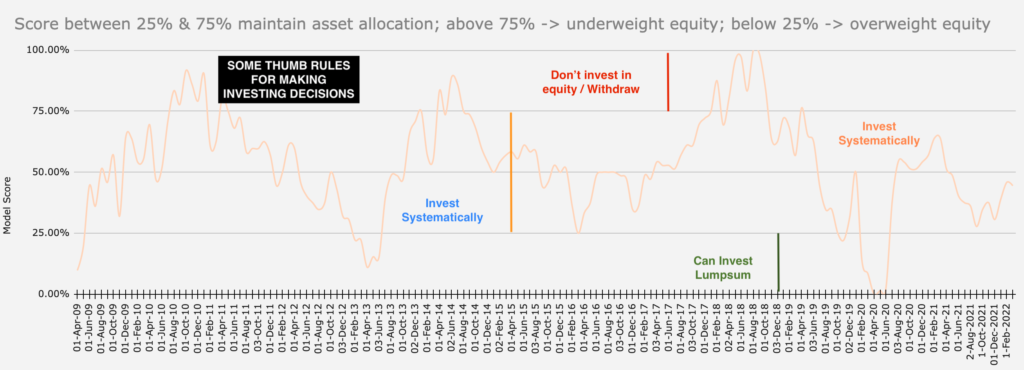

There is a logical way to think. I will depend on a simple indicator/model that we have been using for guidance.

The model suggests that this is not the time to sell but buy (assuming you are investing for at least 5 years). There is your answer.

#2 Should I Invest via SIP/STP or do a lumpsum?

We can look at the model again. SIP or Systematic investment seems to be a better course of action, for now. There is still a lot of uncertainty.

Lumpsum investing is best suited in the RISK ON mode, which is the bottom most part (<25% score) of the model.

If you look at the marked zones, it clearly indicates all possible actions to take in different market scenarios.

So, keep an eye on the indicator here. It is updated monthly.

#3 Should I rebalance the portfolio?

Now, that’s the ultimate question. Always and always, look at your portfolio and the allocations before you make a decision about investing or selling.

Use the opportunity to get the allocation in order – that’s a way to rebalance the portfolio too.

To answer the question, yes please, if your portfolio has breached the defined tolerance zones, go ahead and rebalance it.

We don’t know what the future holds. More specifically, what the pains along the way will be on our march towards our financial goals.

A sensible asset allocation strategy married with periodic rebalancing is likely to yield the best results.

Remember to maintain your emergency funds portfolio (at least 6 months of expenses + EMIs, ideal 12 months)

Hope these reminders help you calm your mind. If you have any other questions, please do send across. I will be happy to answer them.

—

In the background of the market crash, Amey Kulkarni of Candor Investing is organising a virtual session tomorrow, Saturday, Feb 26, 2022 at 11 AM. If you are an investor, more specifically, an equity investor, you can pick up Amey’s mind on investing and portfolio management.

I am joining the session. I urge you to benefit from the session. Here’s the link of the twitter announcement.

Thanks for this article.

YOUR AA Indicator is the most useful graph I came across.

Keep it up Sir Ji.

Thanks for reading and glad the indicator is useful.

This is true, as one needs to be ready to buy when things are low and are not looking great. I can argue that the low points are some of the worst time to exit or sell your holdings.