If you have been active on Twitter, you have likely come across this post.

The tweet is self explanatory. However, this person is not alone. If you check the thread, there are several others subject to this loan fraud.

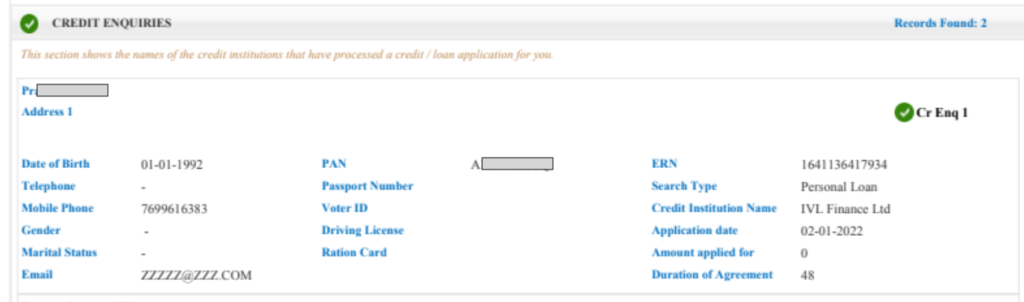

As this scam caught wind, a very close friend checked out his credit report only to find this:

To his non-surprise, IVL Finance (or Dhani) had managed to query his PAN too.

He immediately sent out an email to the all email IDs he could get his hands on with a warning about the fraud.

The company responded with “looking into it”. As you can imagine, in this scenario, it’s hard to trust their word alone.

In the meanwhile, this query has already impacted my friend’s credit score.

Every query on your credit score pushes it down a bit. Not good!

So, what should you do?

#1 Get your Free Credit Score and Report from CIBIL

…and check if there is any entry in the records which you have never authorised.

Here’s my post on how to get your FREE report from CIBIL.

Since then, CIBIL has changed the design of its page and placement of its free report link. It’s somewhere at the bottom of the home page, but you can find it. Also, you can get a free report only once a year.

Remember, your credit report shows up your credit history.

Meaning, if you have tried to apply for a FREE credit card from Flipkart or Amazon or one of the several EMI services providers, that will show up as a query too. And if you have been actually shopping, then the outstanding balances (aka unpaid loans/credit) appear as well.

What you need to find is, if there is something which you never did / ask for? Such as not using DHANI app and yet seeing that query / loan on your report.

If you do find, then you should raise a grievance through the CIBIL portal itself. You may also want to write to the company directly questioning this unauthorised query.

Keep following up.

Now, in the case of DHANI, given the social media uproar, corrective action is likely to happen.

If the company does behave properly, it is likely to send the right information back to the Credit Reporting Agencies such as CIBIL and Experian. This should ‘reverse’ the impact on your credit score and remove this ‘blot’. It could take some time though, at least 3 months.

[A credit card payment that I cleared out months ago still shows as outstanding in my credit report]

But how would you know?

#2 Download your Credit Report and Score again after 3 months

Now, while you can download a CIBIL report again, if you do it within a year of your last free download, you might have to pay. Why? Because only 1 report, in a period of 12 months, is free.

There is another way to get your credit report.

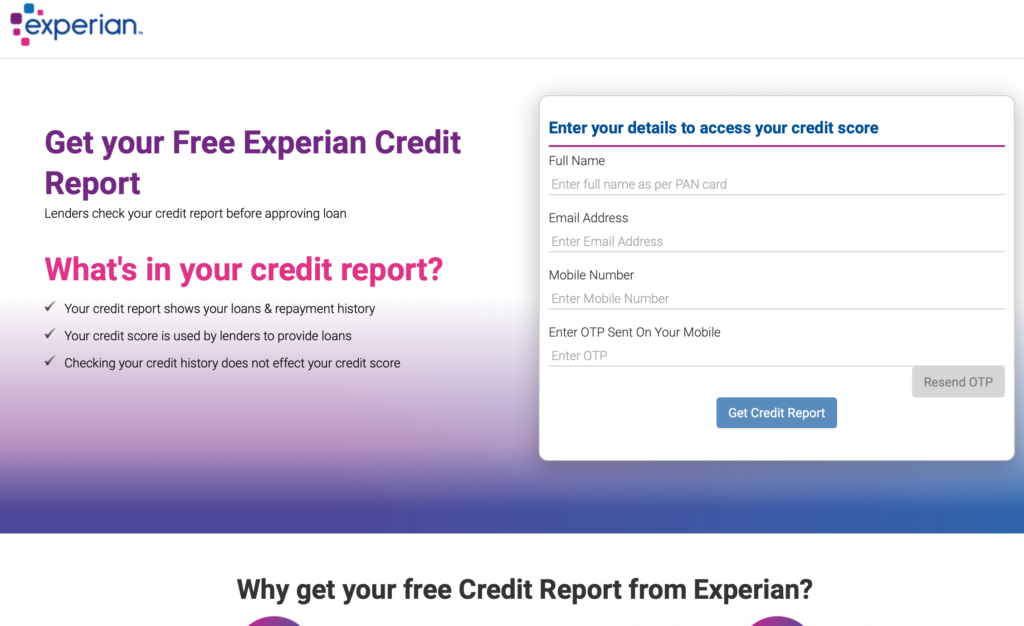

You can now download a free report from Experian.

Just like CIBIL, Experian is another Credit Reporting Agency authorised by RBI. It too keeps a historical record of your credit transactions and generates a score based on your credit behaviour.

Accessing Experian’s credit score and report is much easier than CIBIL. Just go its website www.experian.in.

You will see a button in the top of the page “Free Credit Score”. Click and you will get to this page below.

Follow the steps and you will have the score as well as the report which you can download.

Check for any anomalies and if there, report them.

Just to warn you, a fraudulent loan matter may not go away so easily. You too don’t want it to slide and give your credit score a shock. Hence, you may need to check your reports every 3 months till this is sorted.

So, don’t delay. Check your credit report and score today.

Do share your experience with me.

Leave a Reply