The 60-40 portfolio is one of the most popular portfolio asset allocation for long term investors. Even for those who want to start out with equity investing.

The popular old version of the 60-40 portfolio is that you invest 60% of money into equity for capital appreciation and 40% in fixed income for reducing volatility and creating a bit of certainty.

Over a very long term of 2, 3 or 4 decades, the portfolio is likely to ride out volatility and with profit bookings once in a while can safeguard your portfolio from devastation while also generating a decent amount of growth.

Interest rates have not been favourable over the last many years and equities have outperformed massively, so the 60-40 portfolio investor is wondering.

Several articles from 2021 wrote how it may not be working as before. Some more direct calling it “dead”.

Google “60 – 40 portfolio” and you will know.

Well, I don’t think so.

The 60-40 portfolio is a gradual, low pain approach to build your wealth. It’s not exciting but it keeps your nerves in place.

It is an ideal asset allocation for most investors with moderate expectations. Specially, if it is done right.

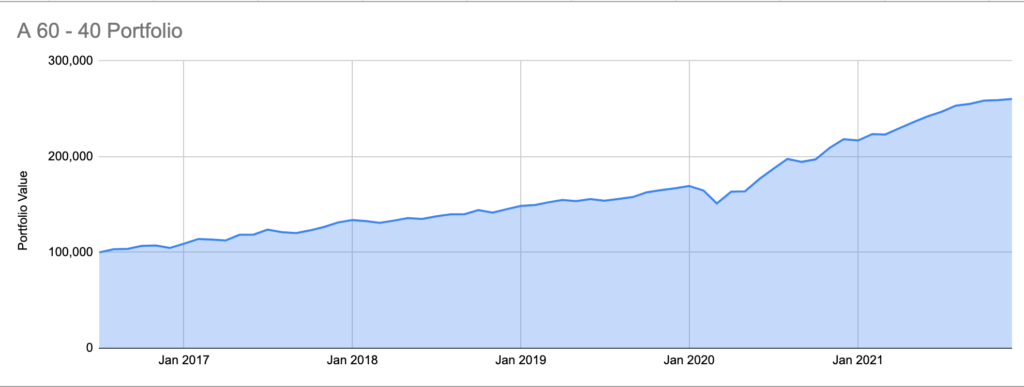

This chart, for example of a simulated Unovest 60-40 portfolio.

How does the 60-40 portfolio fare in the India context?

Well, we did a backtest from July 2016 to Dec 2021. Here are the observations.

- It took a little over 4 years for a lumpsum investment in July 2016 to double itself. That makes it a CAGR of about 16% to 17% year on year. (All earnings such as interest/dividend from the portfolio are reinvested)

- If we take the growth from July 2016 to Dec 2021, it is about 19% CAGR. (Remember, this is fact of the past and not a future prediction)

- That’s not the best part though. The volatility of the portfolio (how much up and down it goes) was almost half of the full equity portfolio. The portfolio fell about 11% in March 2020 compared to 30% or more in the indices.

- One of my recommended balanced advantage funds fell 15% in the same period. The flexicap fund I like fell more.

- Of the 55 rolling 1 year periods, there was only 1 loss year – the one ending in March 2020. The growth chart above kind of says it all.

All this with index ETFs, quarterly rebalancing and some insights of our in house asset allocation model.

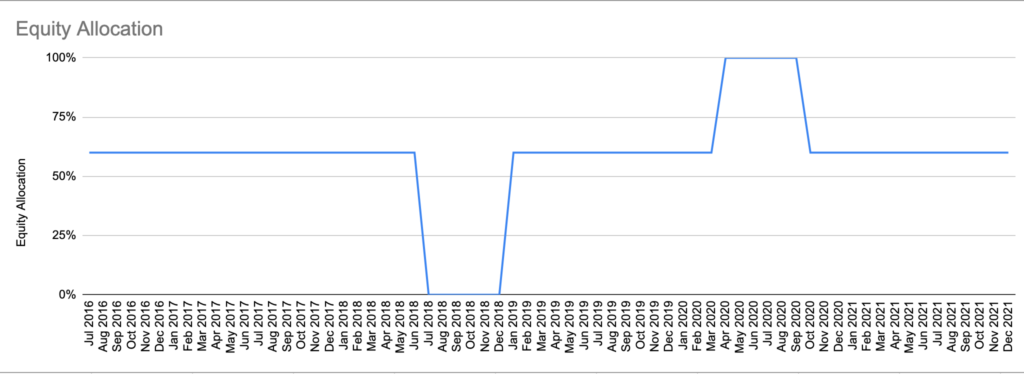

Those insights led to an asset allocation movement as below. Otherwise, it would be a straight line.

The bumps are dictated by the this in house asset allocation model.

It was in a RISK OFF mode in most of 2018 and a RISK ON mode in most of 2020. Rest of the time, just the regular 60-40 allocation with rebalancing.

What if the asset allocation was just 60-40 all the time?

The difference between allowing a 60-40 allocation all the time and the above RISK model is about 3% more (19% vs 16%) in returns, year on year without increasing the volatility.

The past is good but the portfolio is now going into the real world. We will see how it does there, for real.

What does the portfolio consist of?

We are using a slightly different newer version. The portfolio is 60% into equity (including international) and 40% into non-equity. That little change opens up a wide array of options (beyond bonds). We include bonds, Gold, REITs, InvITs, other alternatives, etc. Quite a bit of diversification including some offering decent income opportunities for the portfolio.

The test portfolio (on which the backtest observations are based) includes the following investment options.

- Nifty 50

- Nifty Next 50

- Nifty Midcap 150

- Nasdaq 100

- Gold

- REITs

- InvIT

- Bharat Bonds

There are many more possible but it all depends on how simple or complex you want it to be. I favour the former.

All in all, the 60-40 portfolio is definitely not dead.

It actually rocks with its inherent simplicity and practicality. It is tilted towards growth with equity and yet not in a way that can give you heartburns.

It has a lot to offer with lot less pain associated with a larger equity portfolio. It is a simple and good option for long term goals, such as retirement.

Don’t write it off.

Between you and me: How different is your portfolio allocation? Do share your thoughts.

Leave a Reply