What If I told you that there is a portfolio that may have NOT lost anything during the March 2020 fall even when markets fell 30% or more during that time?

That’s a bold statement!

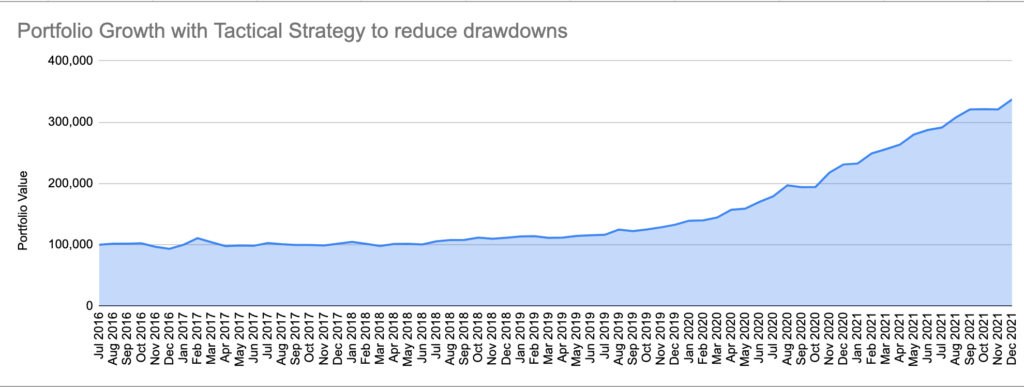

Well, this is what I am talking about. (Notice the period of 2020)

Now, you are smart and would say something like – “Big deal! If I stayed in cash, I would get the same result.”

See!

The only question I ask is “did you?”

A considered decision or a mere coincidence? More importantly, what did you do after?

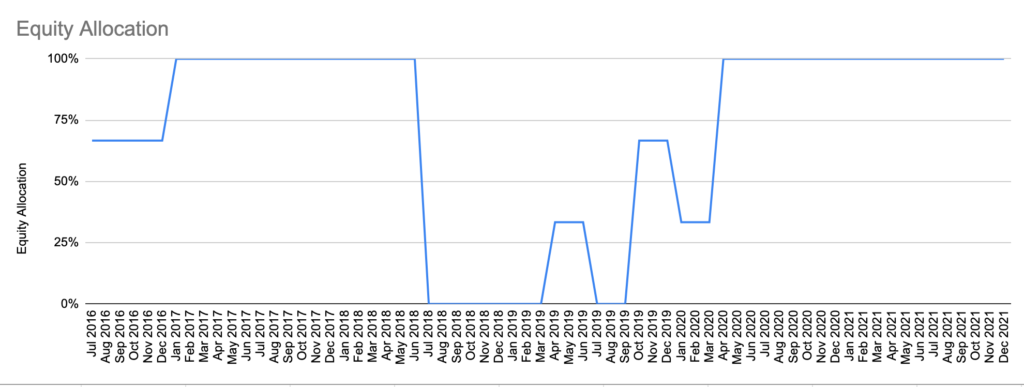

What saved from the March 2020 fall? The allocation.

You are probably saying, “That’s one hell of a call to make. How did you do it? Do you have a Crystal ball?”

No, I don’t.

This is the work of a set of rules bound in a framework.

For our mutual benefit, here’s how I approached this.

- Take a list of broad market ETFs or Exchange Traded Funds (only index, no active) with good trading volumes. Low cost, passive and no need to chase fund managers. These include ETFs in India Large Cap, India Midcap, International, Gold, and Bonds.

- Every quarter, rank them on last 12 month performance. Allocate in a way that leads to less allocation for the recent top performers. As an example, if I am using 4 ETFs – 10% allocation for the top one and 40% to the last one. (This might be the most head scratching thing you will read today)

- Reinvest any receipts of dividends / interest from the portfolio holdings back into the portfolio.

- Rebalance the portfolio on a quarterly basis, without fail.

- RISK ON / RISK OFF – Use Unovest’s Asset Allocation Indicator to tactically determine when to go underweight or overweight equity. This will be done during the quarterly rebalancing.

Should we do a backtest?

I realise that backtests are just that – backtests. They are ‘in the past’ and the reality can be / will be different.

Anyways, let’s still see how did the above framework do.

We will use the period from July 2016 to Dec 2021 which was quite an eventful one with Demonetisation, GST, National Elections, Capital Gains Taxes and finally COVID.

The question that you are now asking is whether this approach only sidestepped the COVID induced fall or did it make any money too?

Let the numbers do the talking.

- Let’s first talk of the drawdowns. Of a total 55 one year rolling periods, 6 had drawdowns. The max drawdown in any one year rolling during this period was about 5.5%. The max drawdown was less than 10%, that too, during the quarter of Jan – Mar 2018.

- As for returns, a lump sum invested from July 2016 till end Dec 2021, delivered an approx. 25% CAGR (before costs).

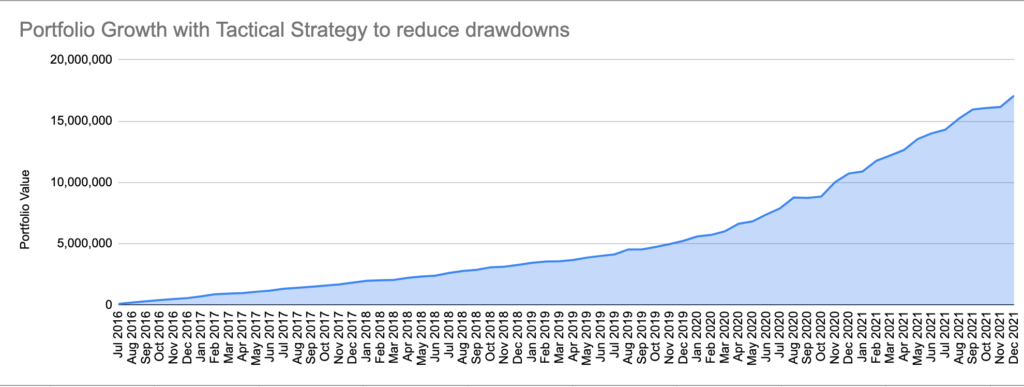

- If we run a SIP during the same period, backtested returns turn out to be much higher, > 30% annualised. (Rupee cost averaging works!)

While the returns seem good for a portfolio that took tactical calls to reduce drawdowns, let’s not get too excited! These are past returns arrived through backtesting. I used end of the month prices for making the allocations.

Live results are bound to be different. There are likely to be slippages due to price of actual trades as well as other costs that can change the result by a few percentage points (up or down).

That brings us to the point of live testing. This framework and portfolio needs to come out of the box into the real world and show what it has got. (More about that in a later post)

What is the takeaway from this exercise?

Investing is more about managing the mind than the money.

While volatility is a friend of the investor, it is a demanding one and not everyone is comfortable with that feature. There are drawdowns that can make your heart sink. By using a reasonable framework based approach, it is possible to reduce the pain of drawdowns.

Smart asset allocation is the way to reduce pains while participating in market linked investments. However, rebalancing is a must to ensure that allocations remain within specified bounds.

If you can further combine it with market insights and go underweight (risk off) or overweight (risk on) on asset classes, you can reduce your risk substantially. As a bonus, it may hopefully add a few percentage points of bonus returns too.

Time is a very important ingredient. In the backtest, as we try to avoid drawdowns, it takes 4 years for the investment to double. Post that it sees a steady increase, courtesy the post March 2020 market rally.

Frankly, this idea cannot work on a whim! You need a framework and a set of rules to make this happen. An Asset Allocation based on IFTTT ( If This Then That).

Question is – do you have one?

Leave a Reply