Go out on Quora and you will find DIY investors asking – “I want to invest in safe index funds. Can I put all my money there?”

In fact, I recently had a first hand experience. A new investor was speaking with me.

“See I am afraid of the stock markets – stocks or mutual funds. I had a very bad experience in 2008. But you see, the FD rates are plunging too and hurting my expected income.”

OK. So, what do you plan to do about it?

“Well, a friend of mine suggested that I invest in index funds. Apparently, they are safe and can get me a higher income too.” She continued.

I was aghast and concerned at the same time.

But I could not prevent my tongue going to my cheek.

I spoke. “I say you have the perfect idea.

Index funds are safe, absolutely safe because the only one who is a threat to your money is “Mr Market”, I mean the stock market. No fund managers, middleman, even investing platforms, for that matter.

You will sink and swim with the tide “Mr Market” decides to ride on.’

“What do you mean by ‘threat’? Are they not safe?”

“Well, if you are referring to the fact that you can never lose money with them, I say those chances are low but there are.”

‘Index funds ultimately invest in the same universe of stocks as other mutual funds. Why would they act any different?”

“Oh, but my experience with mutual funds has not been good. In 2005 or 2006, a bank RM got me a fund where I had to pay 5 instalments. After the 5 instalments, I would be getting a good sum of money. But I realised that I had put 1 lakh each for 5 years only to get Rs. 4.5 lakhs back at the end of it. It was shocking?”

“Well, you see that was not a mutual fund but a ULIP, the biggest of the scams that existed during those years.”

“Oh, I was told it is a mutual fund.”

(after a pause) “So, why do people say that index funds are safe?”

And that is the big question of the day.

Why, indeed, why would anyone think that “index funds are safe”?

Let me venture out and see if I can understand this.

First, when anyone refers to index funds they are talking of large cap funds, typically the Nifty 50 or Nifty Next 50, which form the top 100 stocks as per market cap, etc.

Now, these large companies do have some inherent advantages to their existence. Large market shares, organisation depth, cash flows, to enable the business to survive ups and downs of the business cycle.

Since, they can survive, the likelihood that you will end up losing all your money by investing in them is low.

It’s not zero, it is just low, specially when you hold a basket of such companies and not 1 or 2 punts. To give you examples, Jet Airways stock continued to fly high, even though there was no real plane flying.

Yes Bank made several investors say “NO” to the stock markets / financial sector investing.

So, large cap index funds are perceived safe.

Second, in contrast to active fund management where a fund manager takes the call to invest in a specific stock (primarily to generate a benchmark beating return and prove the worth of his / her existence), index funds have to simply allocate proportionately to the index they want to track.

As an example, a focused equity fund picks a maximum of 30 stocks from the entire stocks universe of 1000s of stocks. A Nifty 50 index based fund has to simply allocate to the 50 stocks in the same proportion. Job done! No research, no costs of a fund manager. The only costs that matter are the operational ones.

A fund manager can go wrong in building the portfolio and underperform the Nifty 50 index. But the Nifty 50 based index fund has no comparison as such, since it is simply following the index.

This combination of “no fund manager risk” and ‘low cost’ is supposedly considered a ‘safety’ moat for a long term investor, who will be happy with the market returns and not get bedazzled by “alpha” strategies.

By saving on cost, you simply add to your returns and be as close to the market as possible.

—

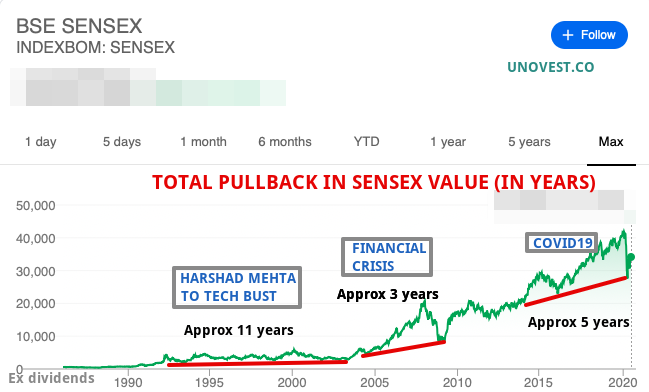

In my mind, these are the 2 key reasons, anyone would think of index funds are safe. And that’s also the reason they are so wrong.

The word is not ‘safe’ but ‘relatively safer’. There is a huge difference between the two.

As much as ” I will never die” and “I will never die due to over-speeding”.

Choose your words and investing style carefully.

All the best!

—

PS: The reason that the notion of “index funds are safe” is taking root is because several self proclaimed investing gurus, YouTube influencers and Financial Twitterati, some of who also post P&L screenshots, have been telling their followers so. To me, that is the most unsafe thing. Beware!

Leave a Reply