Invest in assets that behave differently at a different times and you have a well diversified portfolio.

This dictum is the bedrock of the practice of asset allocation and all the benefits it brings to you.

However, is the choice of your investments really adding to your diversification or just adding more noise?

Let’s find that out.

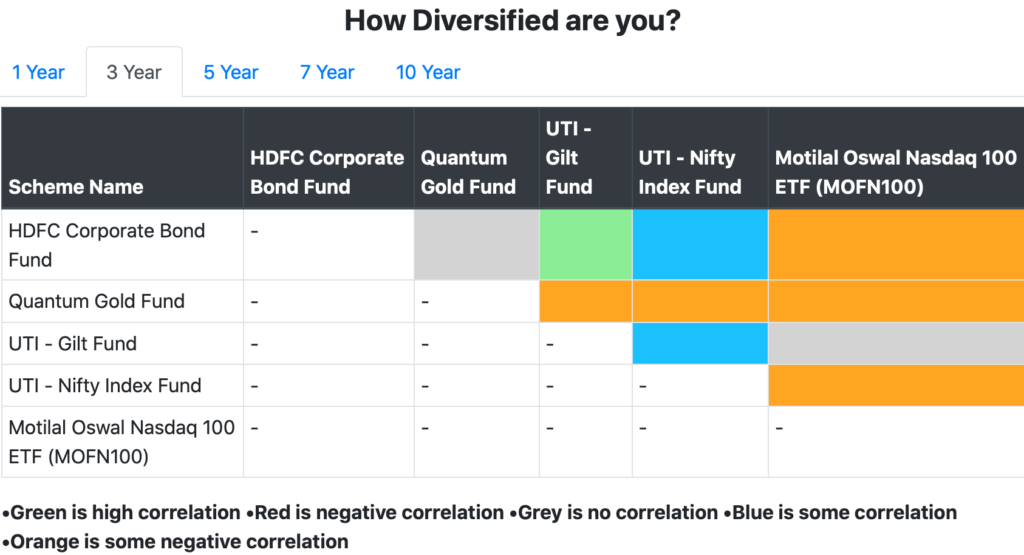

First, a sample portfolio that I use to find out if it really adds to the diversification.

Note: The diversification range is based on the correlation coefficient based on the rolling price changes of the schemes. Every coloured cell represents the relationship between the pair of schemes in the column and the row.

Ideally, the colours that you should see are grey, orange, pink or red.

Based on that, the above set of investments seem to make a perfect portfolio.

So, why don’t you find out the diversification quotient of your own portfolio?

Step 1: Go to Unovest.in and login to your account.

Step 2: Search mutual fund schemes that you have in your portfolio, one by one, and add to the watchlist.

Step 3: Go to the home page and look at the colours of diversification just below the watchlist.

So, how diversified is your portfolio?

—

Note: There will be investments that are within an asset class such as equity or bonds but bring in diversification of style and market opportunities.

While the table may show high correlation between them, this distinction is important.

—

How much should you be in equity now? Click here to see the Unovest Asset Allocation Indicator.

—

Check out The Practice of Asset Allocation – How to Create Wealth between the cycles of fear and greed.

Diversifying assets is an important feature of asset allocation. This protects investors against volatility. This blog serves as a great guide to make a well diversified portfolio. Yoursample portfolio describes how we can check the diversification quotient. The tool provided is really resourceful. It will be of great help to many investors.