Parag Parikh Flexicap fund is highly overrated fund. In fact, one can save on expenses and get similar or better results by using different parts to create their own whole.

“What do you mean?” I asked in disbelief.

—

Parag Parikh Flexicap fund has been a shining example of fund management with its open communication, disciplined execution of its investment strategy and performance delivery.

As you know by now, the fund is a go anywhere fund with flexibility to invest in India as well as International Stocks. However, for the reason of getting equity fund tax benefits, it limits its International exposure to not more than 35% of the AUM. (In most years, this exposure has been around 30%).

You can see a detailed note and the numbers here.

The criticism is that the fund has smartly used the foreign exposure in its portfolio to count as an India equity fund and used it to stand out on the basis of performance. The fund is usually compared with peers who have only a domestic India exposure and hence they feel like laggards.

Even the benchmark of the fund is Nifty 500, which is clearly not a true representative of the fund style. It should be a combination of the Nifty 500 (65%) and S&P 500 – US (35%).

In fact, you can closely replicate the performance of the fund by using the above combination. That is, buy the Nifty 500 index fund in India and the US based S&P 500 index fund in the said proportions.

As you do this, you reduce the fund manager risk. You also reduce your cost.

—

Frankly, it got me thinking.

I went about exploring it further. First off, I got this list of funds available in India to invest, which I can use to recreate the same diversified structure.

Now, in the above list, there are 3 funds which invest internationally – primarily in the US, in fact.

- Franklin India Feeder – Franklin US Opportunities Fund

- ICICI Pru US Bluechip Fund

- Motilal Oswal S&P 500 Fund

The first 2 are actively managed, while the Motilal Oswal is an index fund started in April 2020.

The India based fund are the more popular performing names. There are currently no schemes on offer that invest in the Nifty or BSE 500 index. So, the active schemes or a combination of the respective index funds can be an option. Most of them are new.

—

Well, well! Look at the average – average of 1 year rolling returns.

Only if I had the foresight to pick a combination of the Franklin US Feeder fund and the Mirae Emerging Bluechip fund / Axis Focused 25 fund, I could have done better.

Yes, the expenses may not have been substantially lower and the volatility a tad higher, but who cares! I have got the diversification and more money.

Isn’t that the final goal?

In fact, if I had been a little smarter, I would have bought the Vanguard S&P 500 index fund in the US along with an India Fund and got a much lower expense profile too for the international part.

—

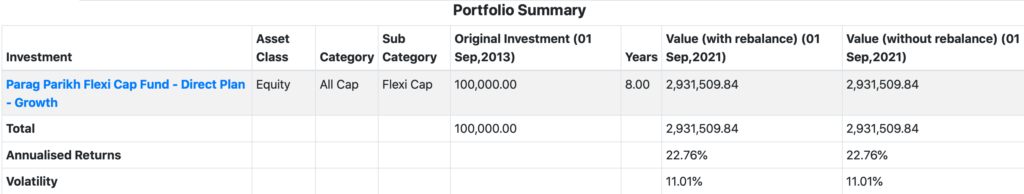

Wait! Let me backtest this assumption with real numbers. With the help of the backtesting tool on Unovest, I played out 1 combination to find out the difference.

My assumptions:

- Investment period – Sept 1, 2013 to Sept 1, 2021

- Initial Investment of Rs. 1 lakh followed by monthly investment of Rs. 10,000

I am using actual funds available in the market to invest in with real NAVs, net of all expenses.

Here are the results.

Assuming I invested only in Parag Parikh FlexiCap Fund, this is the outcome.

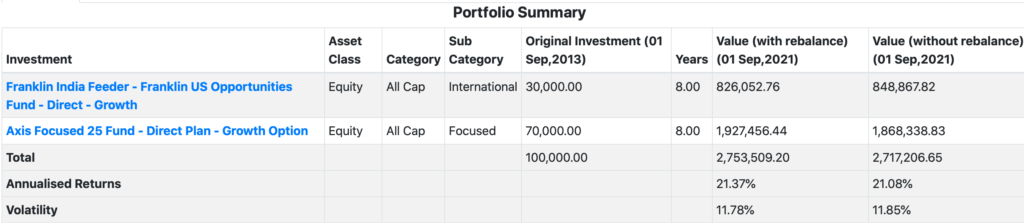

Now, the alternative. Use 2 other funds and build a similar package. Mind you, I am also rebalancing every year to ensure that the proportion remains the same.

Well, now it doesn’t look as rosy, does it?

Not to forget, we are working with past data in a specified period, which also had US equities outshining.

So, how should we approach this?

I think we can all accept that there are no perfect answers when it comes to portfolio construction. I would rather prefer a simple, convenient approach.

Even from a portfolio composition point of view, Parag Parikh Flexicap fund typically holds 25 to 30 stocks, including the international ones. While Axis Focused 25 fund also limits to 30 (as per SEBI mandate), the Franklin US Feeder fund has about 90 stocks, sometimes 100 too.

From an expense ratio standpoint, the Parag Parikh Fund has been consistently reducing its expenses over time, as the size of its AUM grew. In 2015, the expense ratio was close to 2% for its direct plan. As of Aug 2021, the same is at 0.87%.

Even from a taxation point of view, the single fund brings you the diversification with equity taxation.

It doesn’t look as over rated as it is made out to be.

Not to mention, for those preferring a more passive, index based, no fund manager approach, the alternative is index funds.

What do you think? How would you approach this?

I have been investing in PPFAS Flexicap almost since its inception. That is the only actively managed fund in my portfolio now – The rest all are in Index funds. I continue investing in PPFAS because (a) they provide a better risk-adjusted return, (b) I like their investment philosophy and transparency (c) I get some international (US) exposure. WIll continue to hold and invest as the only actively managed fund in my portfolio.

We can form a club!